Bitcoin Price Prediction: BTC gears up for fresh record top, bulls await clear break of $52,650

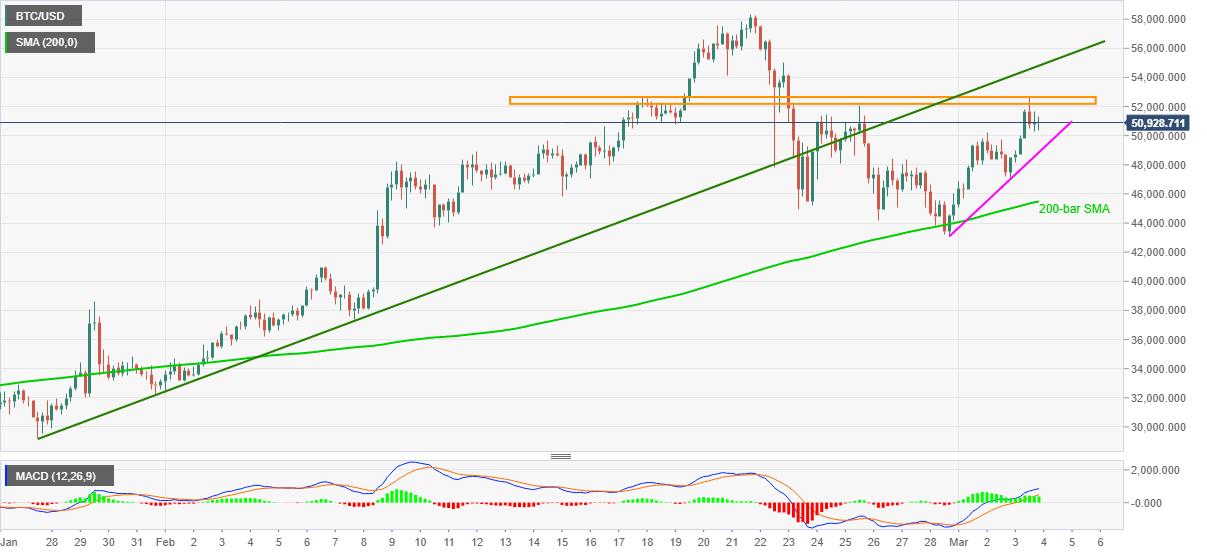

- BTC/USD stays range-bound between $50,300 and $51,650 off-late.

- Sustained trading above weekly support line, 200-bar SMA favor bulls amid upbeat MACD.

- Ascending trend line from late-January adds to the upside barriers.

Bitcoin buyers can ignore the recent choppy moves around $51,000, currently near $50,900, while looking at the cryptocurrency pair’s ability to stay beyond the key supports during early Thursday. The BTC/USD optimism can also take clues from the bullish MACD signals to direct bulls towards a fresh high above $58,355.

However, a two-week-old horizontal area guards the quote’s immediate upside below $52,650.

Hence, BTC/USD bulls need to cross the immediate hurdle to justify their hold on the e-currency.

In doing so, an upward sloping resistance line from January 27, currently around $54,800, can offer a breathing space during the quote’s upside.

Meanwhile, pullback moves shouldn’t be considered serious if staying above the immediate support line, at $48,860 now, a break of which will recall the BTC/USD sellers targeting a 200-bar SMA level of $45,480.

In a case where the BTC/USD bears dominate past-$45,480, tops marked during the early February and late January, respectively around $41,000 and $38,650, will be the key to watch.

BTC/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.