Bitcoin price nearly drop below $35,000 as stock markets add $739 billion in a few hours

- Bitcoin price, trading at $35,530 at the moment, is at the cusp of losing a critical support level.

- The rally that took place after the recent release of US CPI data resulted in the correction of the crypto market.

- At the same time, the stock markets managed to add over $700 billion in the span of a few hours.

Bitcoin price, at the time of writing, is witnessing an uptrend flip for the first time in a month on the daily chart. The credit for this goes to the US Bureau of Labor Statistics (BLS), which released the Consumer Price Index (CPI) data for the month of October. The crypto market, however, did not see eye to eye.

The US stock market firms up

In the span of just a couple of hours, the stock markets in the United States noted inflows exceeding $700 billion. The inflation data noted the CPI for the month of October rising by 3.2% from year to year against the market forecast of 3.3%, changing from 3.7% in the last month.

Heatmap shows that nearly all the major stocks saw growth in the last couple of hours, including the likes of Microsoft, Apple, Tesla, Meta, Amazon and more. The consequent inflows exceeded $739 billion.

Stock markets’ heatmap

Interestingly, the stock markets presently share a rather positive correlation with Bitcoin. The S&P 500 Index and the Nasdaq 100 indices, at the time of writing, have a correlation of 0.25 and 0.33, respectively.

Bitcoin correlation to stock markets

While this does not ascertain an increase, it suggests that the impact of the broader market on the crypto space may not be as intense as expected. Most of the inflows in the stock market were irrespective of the crypto space, but that did not prevent investors from likely selling every now and then.

Nevertheless, Bitcoin price is barely recovering at the time of writing, suggesting a potential flip in the trend.

Bitcoin price correction could begin

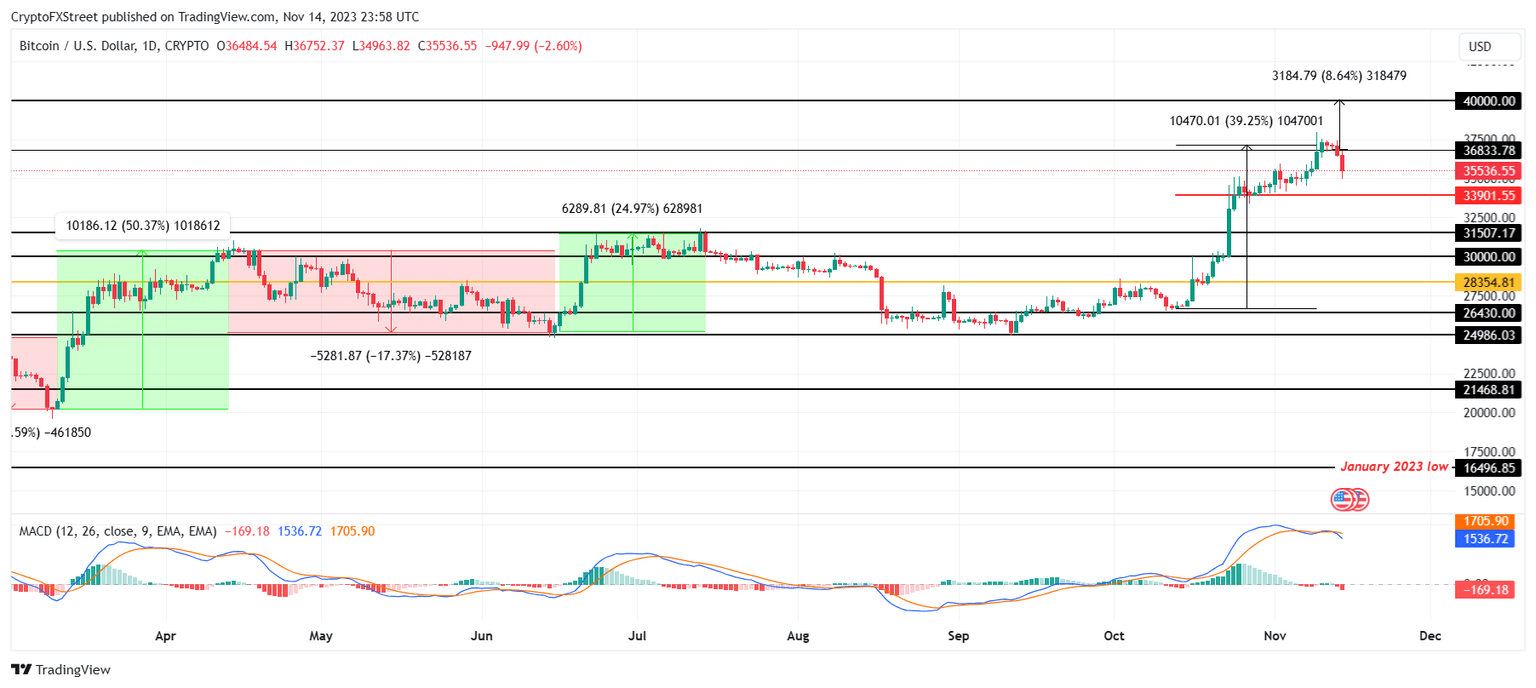

Bitcoin price is trading at $35,536 at the moment, officially confirming a correction in the trend from upwards to downwards. The Moving Average Convergence Divergence (MACD) noted the bars on the histogram extending below the zero line as well as the MACD line moving below the signal line to mark a bearish crossover officially. The rising bearishness resulted in the altcoin nearly falling below $35,500 before recovering back above the crucial support level.

This recovery, however, may not be sustained in the coming trading sessions, which could see BTC falling in value. The next major support level is the local support line at $33,901, which would result in the Bitcoin price falling to $31,507.

BTC/USD 1-day chart

But if the broader market cues manage to flush the crypto space with optimism, BTC could bounce off the $33,901 support level to prevent a crash. Reclaiming $35,000 as support would further invalidate the bearish thesis, pushing the cryptocurrency above $35,500 and towards $40,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.