Bitcoin price might crash to $30,000 if this bearish divergence stands true

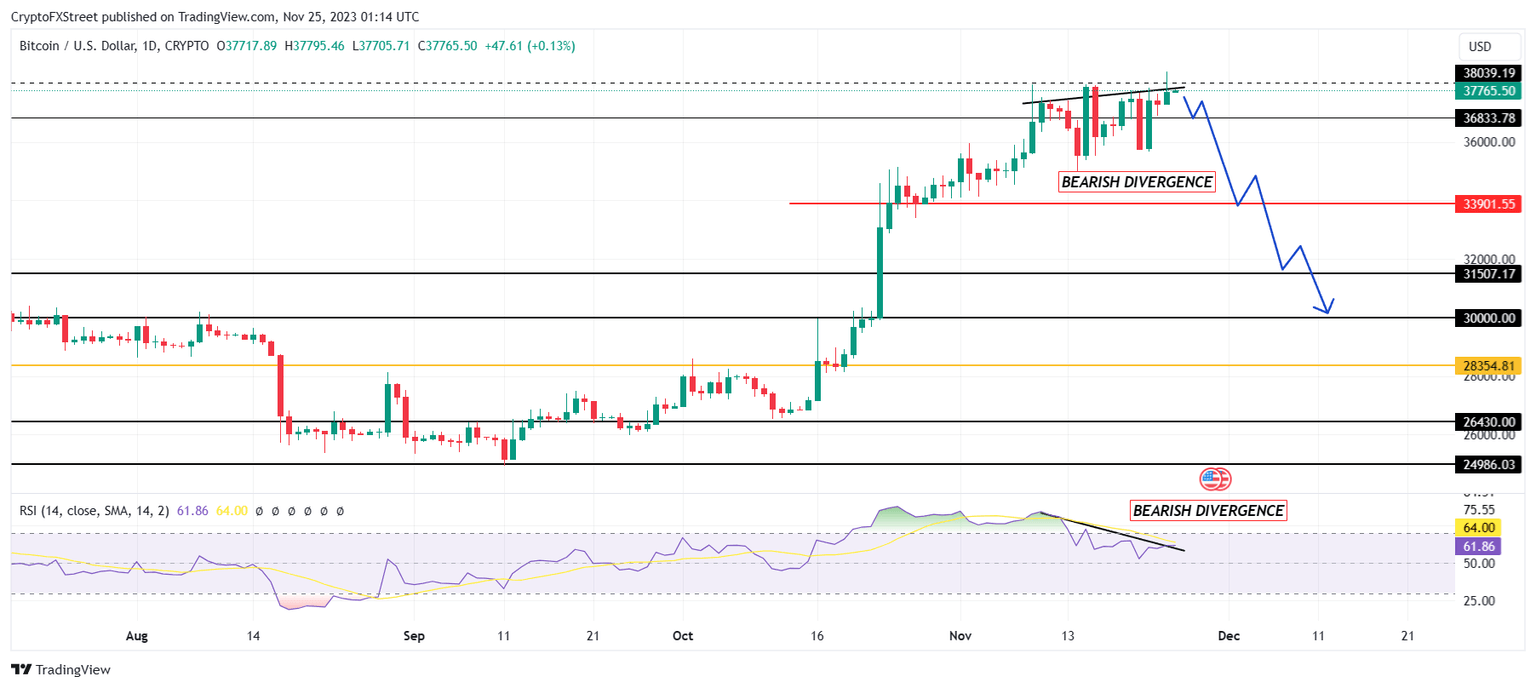

- Bitcoin price is presently trading at $37,765, marking higher highs for the past two weeks.

- The bearish divergence visible on the chart suggests that BTC might witness a steep dropoff soon.

- Whales are still accumulating as their profits have not grown enough to induce a sell-off yet, giving Bitcoin a price a while before it crashes.

Bitcoin price banked on the hype surrounding the potential approval of spot Bitcoin ETFs earlier this month. The cryptocurrency increased, but as the Securities and Exchange Commission (SEC) delayed the approval, the bullish momentum lost strength. However, with some support from whales, BTC still rallied; however, looking at the signs, this rally is about to be heavily reversed.

Bitcoin price to see red

Bitcoin price trading at $37,765 increased considerably over the past month. The biggest driving factor was the potential of spot BTC ETFs being approved, which has now been delayed. Looking at the price, it may seem like the consistent rise might continue regardless, and BTC could breach $40,000, but the truth is a bit different.

While Bitcoin price is forming higher highs, the Relative Strength Index (RSI) is observing lower lows. Generally, the divergence formed by this movement is known as bearish divergence since the bullish momentum that was supporting the price rise is now gone.

Consequently, the empty rally will eventually halt, and to compensate for the lack of bullishness, BTC will correct it, authenticating the bearish divergence.

This could result in Bitcoin price crashing to test the support lines at $36,833 and $33,901. The chances of a fall to $31,507 are high, but losing this line would result in BTC falling to the crucial psychological support level of $30,000. This could restart BTC accumulation and push the price back up.

BTC/USD 1-day chart

However, if the bullishness does not wane and investors attempt to pump the price again, BTC could rise further and invalidate the bearish thesis by charting a rise to $38,000 and beyond.

Bitcoin still has some time before a crash

The bearish divergence would be confirmed once the price falls, but the chances of that happening immediately are not very high. Looking at the Market Value to Realized Value (MVRV) ratio, one can note that, at the moment, the indicator is at 3.4%.

Since the indicator is used to assess the average profit/loss of investors who purchase an asset, the 30-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past month.

This means that investors who purchased BTC in the past month are sitting at 3.4% profit. This amount is not enough to induce profit booking, which would cause a sell-off at the hands of the investors.

Investors are likely to sell their holdings to realize profits when MVRV hits 6.7% to 16.8%. BTC has undergone major corrections when this happened; hence, this area is termed a danger zone.

Bitcoin MVRV ratio

Furthermore, the whale addresses holding 1,000 to 10,000 BTC are still accumulating, adding nearly 60,000 BTC in the past week. This $2.26 billion worth of purchase has brought their total holding to 4.73 million BTC.

Bitcoin whale holding

Thus until the profits hit the saturation level and investors are convinced selling for profit is the better option, Bitcoin price has time. After that, a decline is inevitable.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B07.03.35%2C%252025%2520Nov%2C%25202023%5D-638364743412685507.png&w=1536&q=95)

%2520%5B07.03.38%2C%252025%2520Nov%2C%25202023%5D-638364743642614508.png&w=1536&q=95)