Bitcoin Price Forecast: BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin price today: $97,400

- Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000.

- BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

- On-chain data shows the current BTC bull market resembles that of 2020.

Bitcoin (BTC) price extends bullish momentum and reaches a new all-time high of $97,852 on Thursday, currently trading above $97,400, just 2.66% from the $100K mark. BTC futures have already surged past the $100,000 price mark on Deribit, indicating confidence among investors while whales still accumulate BTC.

On-chain data shows that the current BTC bull market resembles that of 2020, suggesting that Bitcoin still has room for higher prices.

Bitcoin futures market surges above $100K

Professional-grade cryptocurrency derivatives platform Deribit shows that BTC’s three out of seven futures contracts trade higher than $100,000. Contracts expiring on March 28, 2025, trade at $101,992, a premium of nearly 5% to the average spot price of $97,400. The pricing reflects investors’ confidence that the spot price will remain well above $100,000 through the end of March and beyond.

3/7 above $100K. Only a matter of time before we reach 7/7.$BTC just hit an all-time high and is now sitting comfortably above $97K—how far can this momentum take us? pic.twitter.com/VyJTI9mzda

— Deribit (@DeribitExchange) November 21, 2024

In addition to the futures market, the recent launch of the Bitcoin ETF options supports the ongoing rally. BlackRock launched its BTC spot ETF options (IBIT) on Tuesday, followed by Grayscale introducing its Bitcoin ETF options on Wednesday. This market response will likely attract new investor cohorts and enable diversified trading strategies, which could help reduce volatility and downside risk, solidifying Bitcoin’s place in mainstream markets. Other BTC spot ETFs, such as the Fidelity Wise Origin Bitcoin Fund (FBTC), are expected to have options listed soon, according to digital assets firm QCP Capital.

The ongoing rally is further fueled by whale accumulation. Lookonchain data shows that a whale wallet has accumulated 3,289 BTC worth $302 million from Binance in the past two days and currently holds 25,010 BTC, valuing $2.37 billion. Additionally, the Data Nerd also shows another whale accumulated a total of 1,109 BTC worth $104.39 million from Binance and Coinbase exchanges on Wednesday and currently holds 2,219 BTC worth $212.41 million.

Whales continue to accumulate $BTC!

— Lookonchain (@lookonchain) November 21, 2024

This whale has accumulated 3,289 $BTC($302M) from #Binance in the past 2 days and currently holds 25,010 $BTC($2.37B).https://t.co/8mNHj6aKqY pic.twitter.com/bn2HelylWC

Optimism in crypto markets is widespread after the victory of crypto-friendly candidate Donald Trump in the US presidential election and his supporting stance for cryptocurrencies has fueled the ongoing rally.

“Trump’s Cabinet picks are turning heads, especially with crypto-friendly names like Elon Musk, chosen to lead the newly created Department of Government Efficiency (DOGE), and Pete Hegseth, nominated for Secretary of Defense. Hegseth, a vocal advocate for Bitcoin’s decentralized value, has even pledged to hold, not sell, his Bitcoin holdings.”, says QCP’s report on Wednesday.

QCP’s analyst continued, “With Republicans securing control of the Senate, most nominees are expected to sail through confirmation. Trump aims to finalize his Cabinet picks by Thanksgiving, just a week away. These selections highlight an alignment between the new administration and the growing influence of digital assets in policy and finance.”

Bitcoin bull market signals emerge as on-chain data mirrors 2020 trends

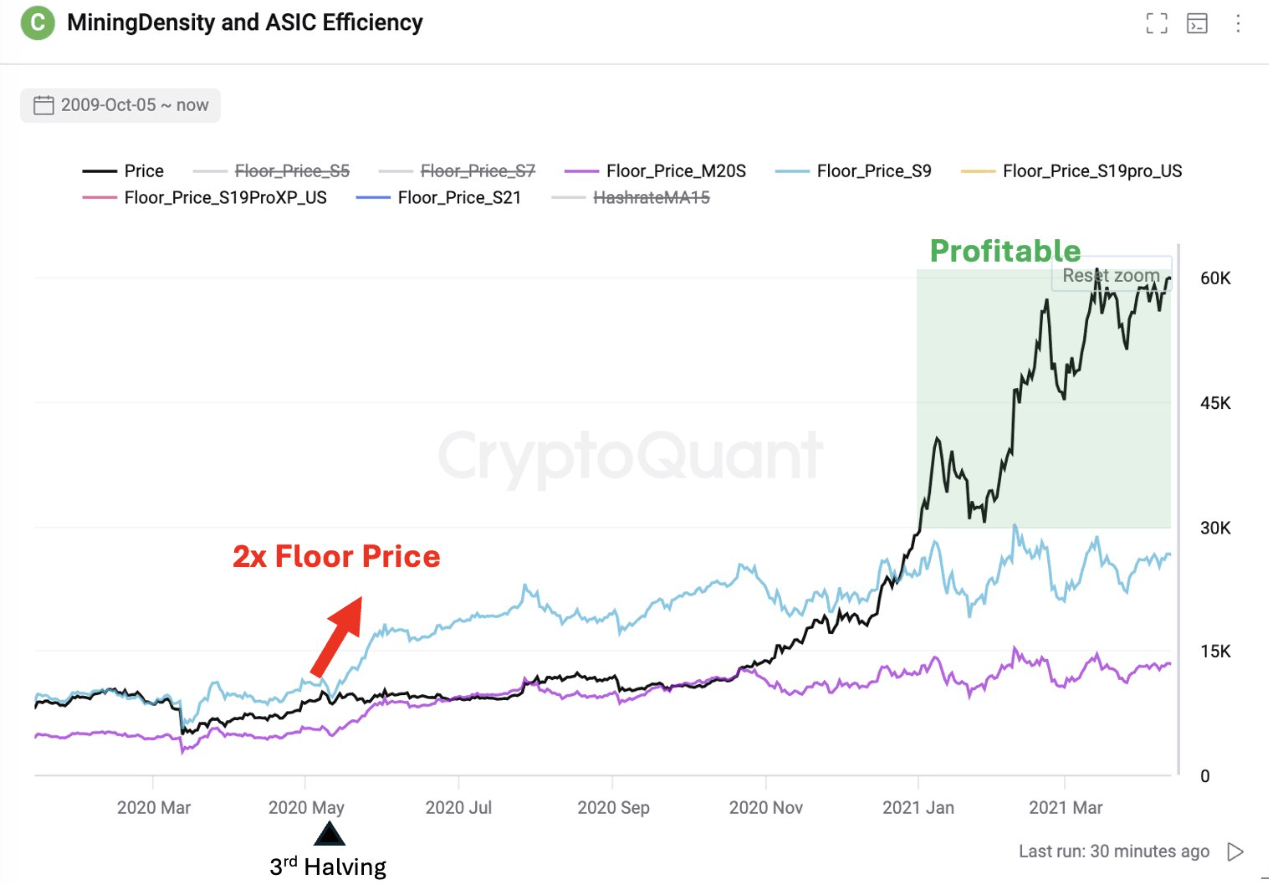

Crypto analytics company CryptoQuant data shows that the current bull market is starting, with on-chain data resembling 2020.

The graph below shows that the bull rally in the last Bitcoin halving cycle in 2020 began in Q4; if history repeats, whales won’t let Q4 be boring.

-638677813486814443.png&w=1536&q=95)

Bitcoin Cumulative Return index on halving years chart. Source: CryptoQuant.

Mining costs doubled after the halving, and the price needs to increase to maintain mining profitability. Since the May 2020 halving, mining costs doubled, yet a parabolic bull run ensued, covering these costs and achieving profitability; a similar move could be expected in the current cycle.

Bitcoin Mining Density chart. Source: CryptoQuant

Bitcoin Price Forecast: Inches away from the $100K mark

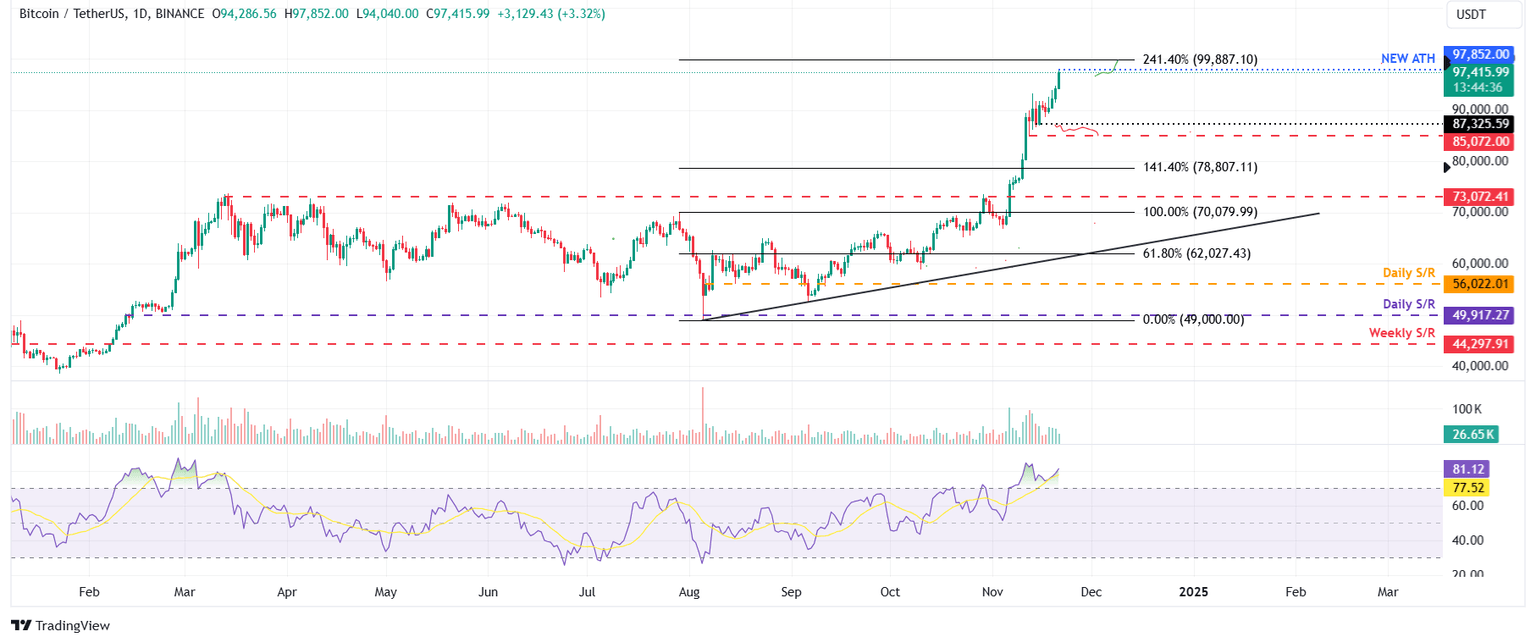

Bitcoin price hit a new all-time of $97,852 on Thursday and is currently trading above $97,400. If BTC continues its upward momentum, it could extend the rally to retest the significant psychological level of $100,000.

However, the Relative Strength Index (RSI) momentum indicator stands at 80, signaling overbought conditions and suggesting an increasing risk of a correction. Traders should exercise caution when adding to their long positions, as the RSI’s move out of the overbought territory could provide a clear sign of a pullback.

BTC/USDT daily chart

If Bitcoin faces a pullback, it could decline to retest its key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.