Bitcoin Price Forecast: BTC falls below $94,000 as over $568 million outflows from ETFs

Bitcoin price today: $93,500

- Bitcoin continues to edge down and trades below the $94,000 level on Thursday after falling more than 5% this week.

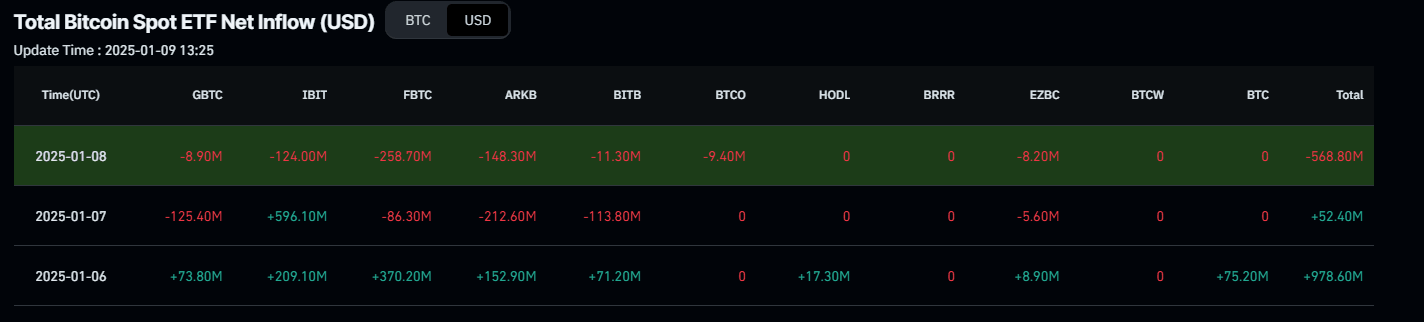

- Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday.

- CryptoQuant data shows that reducing stablecoin inflows signals a weakening buying pressure.

Bitcoin (BTC) continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds (ETFs) recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand. Moreover, CryptoQuant data shows that reducing stablecoin inflows weakens buying pressure and hints at further decline in Bitcoin price.

Bitcoin price falls below $94,000 amid weakening institutional demand

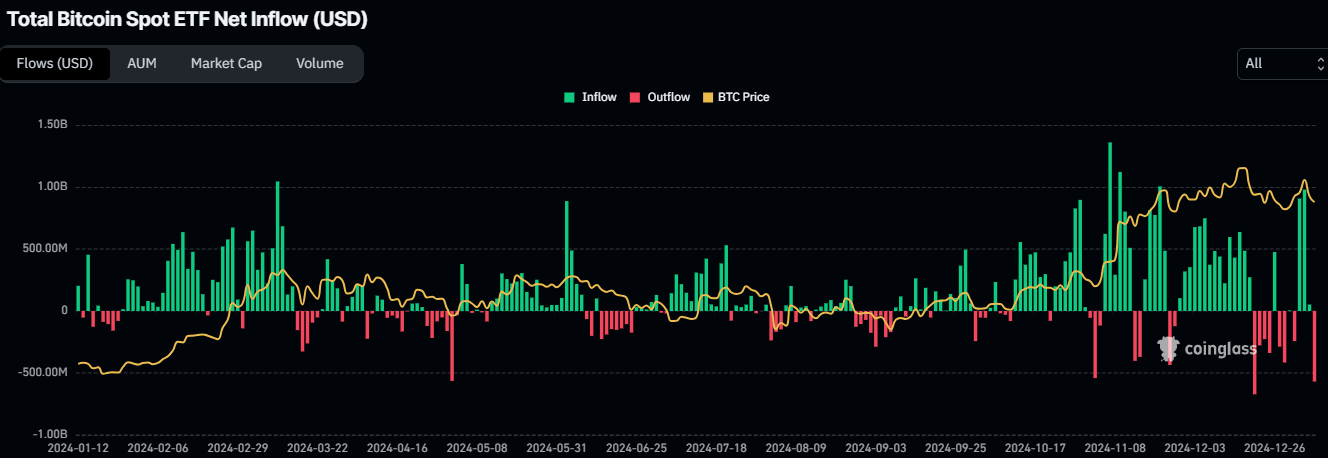

Bitcoin price continues to trade in the red for the third consecutive day, trading below $94,000 on Thursday. This recent correction in Bitcoin price could be seen as institutional demand shows signs of weakness. According to Coinglass, Bitcoin spot ETFs recorded an outflow of $568.80 million on Wednesday, the highest single-day outflow since December 19. If the magnitude of the outflow continues or intensifies, Bitcoin’s price could decline further.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

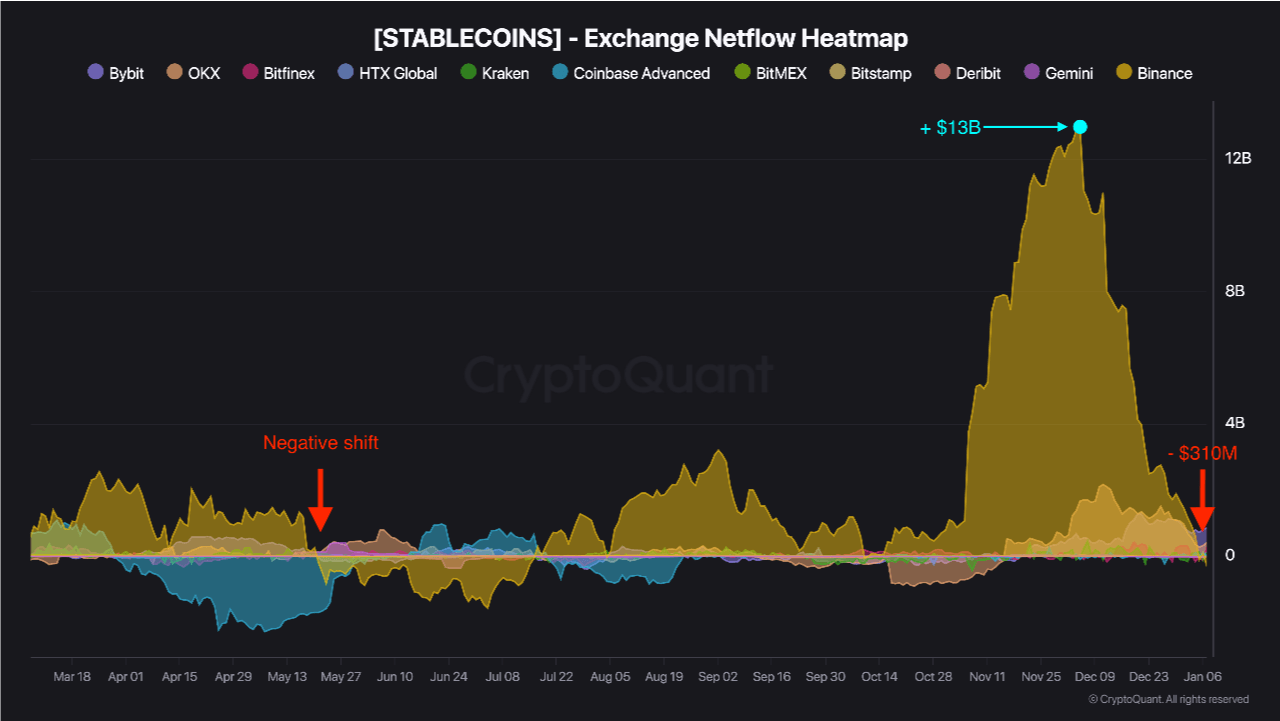

Another sign of weakness is the reversal in stablecoin flow dynamics on Binance. According to CryptoQuant’s stablecoin data, Binance’s stablecoin reserves (ERC-20) have steadily decreased since mid-December, from a $13 billion inflow on December 5 to a $310 million outflow on Tuesday. This suggests that investors may be securing their capital or locking in profits.

A similar trend reversal was last observed in May 2024, before Bitcoin’s sharp price decline from $71,900 to $64,300 in one month. If history repeats, BTC could experience a similar crash in the upcoming days.

Stablecoins-Exchange Netflow Heatmap chart. Source: CryptoQuant

Despite the bearish outlook discussed above, traders in short positions should be cautious as the upcoming Donald Trump presidential inauguration on January 20 could cause a bullish reversal for Bitcoin.

In an exclusive interview, Dr. Sean Dawson, Head of Research at Derive.xyz, told FXStreet, “The upcoming inauguration could serve as a significant market catalyst, potentially driving volatility in Bitcoin and Ethereum. Historically, political events of this magnitude have led to increased market activity, and given the current bullish sentiment reflected in the options market, there’s potential for a positive price movement.”

Dawson further explained that the option markets are experiencing a significant skew toward calls. Derive.xyz shows 300% more calls than puts in open interest, suggesting traders are leveraging for potential upside in anticipation of a post-inauguration run-up.

Bitcoin Price Forecast: Bears eye for $90K mark

Bitcoin price declined 7% from Tuesday to Wednesday, closing below $95,060. At the time of writing on Thursday, it trades in the red for the third consecutive day at around $93,500.

In case BTC continues its pullback and closes below the 38.2% Fibonacci retracement level at $92,493 (drawn from the November 4 low of $66,835 to the December 17 high of $108,353), it could extend the decline to test the psychological level of $90,000.

The Relative Strength Index on the daily chart read 43, below its neutral level of 50 and pointing downwards, indicating bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator also shows a bearish crossover on Wednesday, suggesting a sell signal and a downtrend.

BTC/USDT daily chart

However, if BTC recovers and closes above the $100,000 level, it could extend the rally to retest the December 17, 2024, all-time high of $108,353.Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.