Bitcoin Price Forecast: BTC edges below $96,000, wiping over leveraged traders

Bitcoin price today: $95,700

- Bitcoin continues to edge down, trading below the $96,000 level on Wednesday.

- The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

- CryptoQuant BTC’s Net Taker Volume on Binance has turned sharply negative, signaling increased selling pressure.

Bitcoin's (BTC) price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours. Moreover, CryptoQuant BTC’s Net Taker Volume on Binance has turned sharply negative, signaling increased selling pressure and hinting at further decline ahead.

Bitcoin falls below $96,000, wiping over $694 million from the market

Bitcoin price continues to trade in red, falling below $96,000 on Wednesday after declining more than 5% the previous day. This price correction triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours, almost $125 million specifically in BTC, according to data from CoinGlass.

Liquidation chart. Source: Coinglass

CryptoQuant Bitcoin’s hourly Net Taker Volume on Binance has turned sharply negative on Tuesday, signaling increased selling pressure. This metric reached a peak of -$325 million, the highest value in 2025, during the release of the Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) and Job Openings and Labor Turnover Survey (JOLTs) data on Tuesday, which revealed unfavorable results for risky assets.

Traders should watch this indicator as it will be essential to determine whether fear is starting to dominate the markets over the long term or is temporary.

Bitcoin Net Taker Volume (Hourly) Binance chart. Source: CryptoQuant

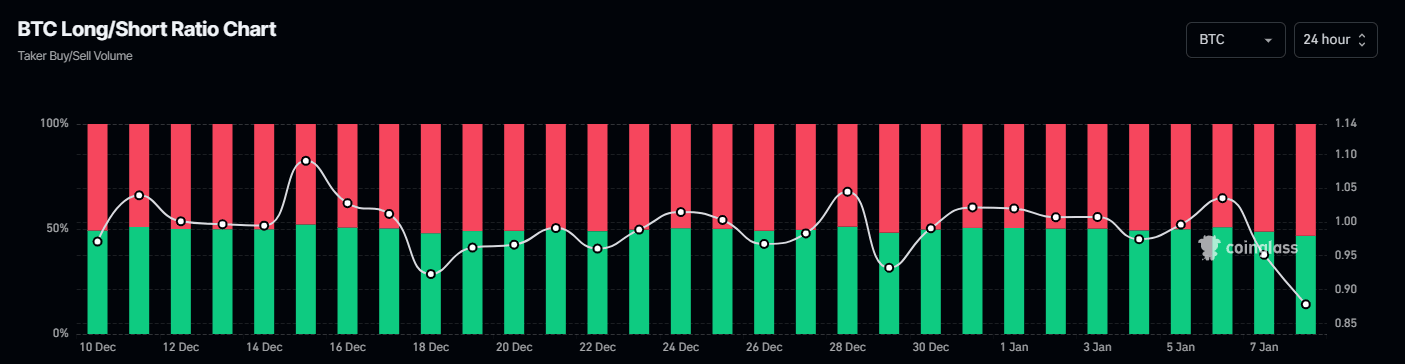

Another sign of weakness is Coinglass’s Bitcoin long-to-short ratio, which reads 0.89, the lowest level in over a month. This ratio below one reflects bearish sentiment in the markets as more traders are betting for the BTC price to fall.

Bitcoin Long to Short Ratio Chart. Source: Coinglass

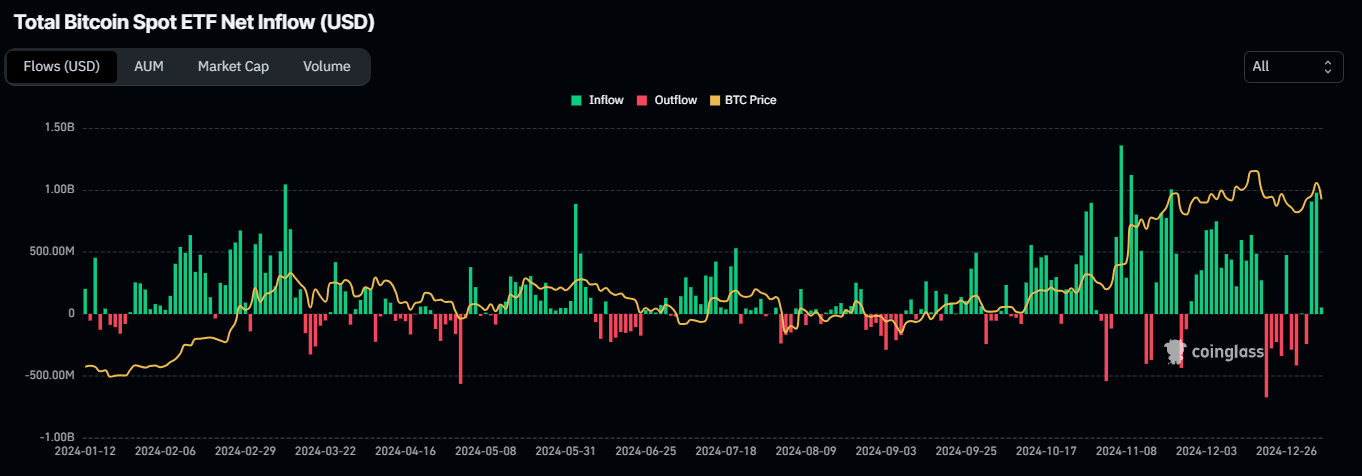

Moreover, institutional demand also shows signs of decreasing demand. According to Coinglass, Bitcoin spot Exchange Traded Funds (ETFs) recorded a mild inflow of $52.40 million on Tuesday, compared to $978.60 million on Monday. If the flow data decreases or records a strong outflow, Bitcoin price could decline further.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Bitcoin Price Forecast: BTC shows signs of weakness

Bitcoin price declined 5.17% and closed below the $100,000 support level on Tuesday. At the time of writing on Wednesday, it hovers around $95,800.

If BTC continues its pullback, it could extend the decline to test its 38.2% Fibonacci retracement level at $92,493 (drawn from the November 4 low of $66,835 to the December 17 high of $108,353).

The Relative Strength Index on the daily chart read 47, below its neutral level of 50 and pointing downwards, indicating bearish momentum.

BTC/USDT daily chart

However, if BTC recovers and closes above the $100,000 level, it could extend the rally to retest its December 17, 2024, all-time high of $108,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.