Bitcoin price faces further depreciation as stock market rally repeats history

- Bitcoin price lost the support of $25,000 and is slipping lower, with the crypto market's valuation declining below $1 trillion.

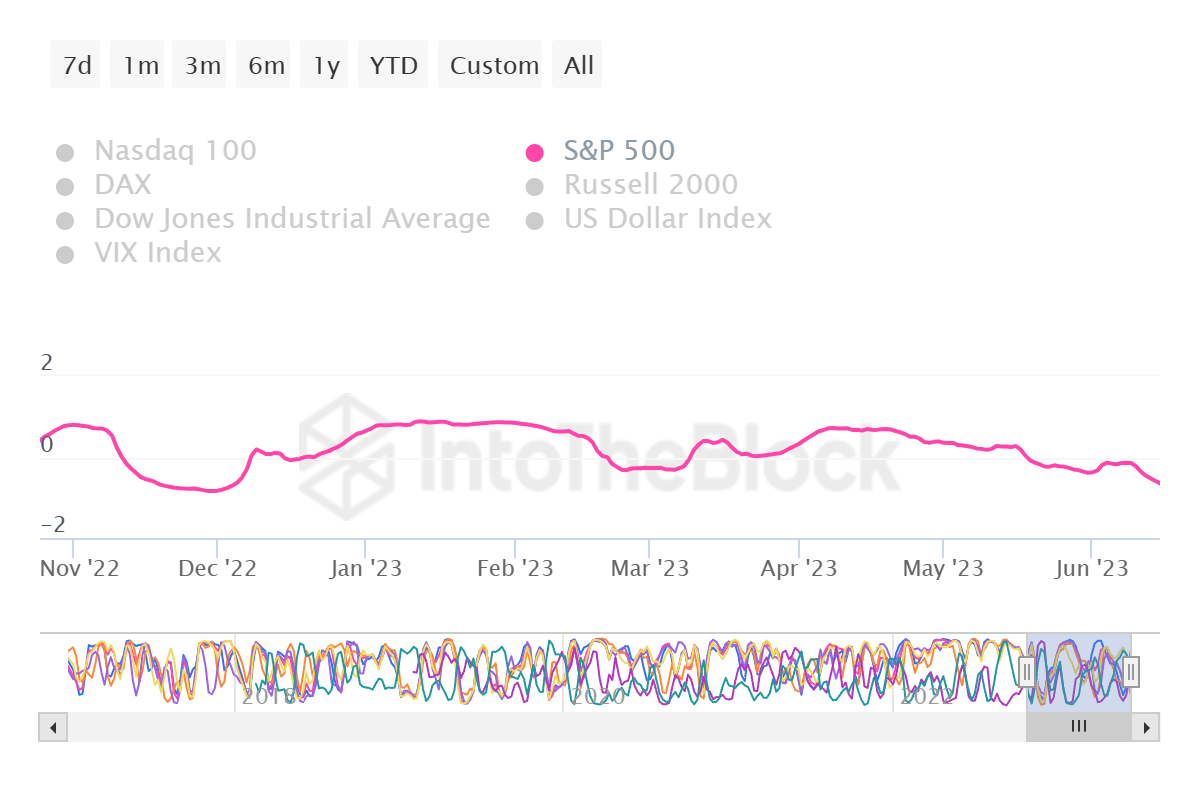

- The correlation between BTC and stock markets is now negative at -0.55.

- BTC is still vulnerable to further decline unless broader market cues turn positive.

The crypto market is losing its value, rapidly falling below $1 trillion in market capitalization following the recent crash. On the other hand, the S&P 500 index has observed a more than 15% rally since the last time it bottomed in March. BTC still faces the possibility of a decline.

Bitcoin price and stock market repeat history

Bitcoin price has been observing a downtrend for weeks now while the stock markets are enjoying growth. Earlier this year, the situation was reversed when the banking failure in the United States depreciated the S&P 500 Index, during which BTC performed well.

Since then, the stock market has evolved to be negatively correlated to the crypto market and Bitcoin, with the correlation falling to the lowest point since December 2022.

Bitcoin and stock market’s correlation

The traditional market is still doing well after allaying the "Sell in May" fears, while Bitcoin price has dropped below $25,000, marking a three-month low. The negative correlation of -0.55 will stay relevant until either of the two entities' momentum changes.

Such an instance was observed back in 2019 when Bitcoin price fell by nearly 34% while the stock market rallied, as noted by analyst Dan Gambardello. However, the cryptocurrency market recovered, which refuted the claims that the crypto market was "left in stock market's dust".

HEARTBREAKING: The stock market has completely left crypto in its dust! It must be completely over...

— Dan Gambardello (@cryptorecruitr) June 15, 2023

Or is it?

Look at #Bitcoin in 2019 falling -34% while #SP500 rallied.

Go with the data...not emotion. pic.twitter.com/kmyu7bvYUr

Thus the "Fear" present in the crypto market is only momentary as once the market stabilizes, recovery could be back on track. Earlier this week, the Crypto Greed and Fear index slipped from neutral owing to the crashes noted.

Furthermore, the recent regulatory crackdown and concerns surrounding the two upcoming rate hikes in the policies in 2023 seem to have spooked the investors.

Crypto Fear and Greed Index

If this bearishness does not subside, Bitcoin price might end up falling further. This is backed by the fact that its Relative Strength Index (RSI) is still far above the oversold zone, sitting in the bearish area.

BTC/USD 1-day chart

If the cryptocurrency manages to climb back and reclaim the neutral line at 50.0, chances of a recovery will shoot up, but a dip into the oversold zone is more likely, looking at the market conditions. This also generally acts as a trigger for a bounce back for any cryptocurrency and might push BTC back above $25,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.