Bitcoin price eyes $45,000 target ahead of BTC halving in April 2024

- Bitcoin price climbed past $41,000 as BTC holders await green light for Spot Bitcoin ETF.

- BTC price rally to $45,000 is likely prior to the fourth halving event, according to a crypto analyst.

- Analysts at Santiment believe demand for BTC could push the asset towards $50,000 in the ongoing cycle.

Bitcoin price crossed the $41,400 mark on Binance, in its ongoing uptrend, on December 5. BTC price rally is likely driven by the anticipation of Spot Bitcoin ETF approval. There are more catalysts driving BTC price gains in the current cycle.

The rising demand for BTC among institutional investors, ahead of the Spot ETF approval and ordinals, tokens created in accordance with the BRC-20 token standard are other catalysts fueling Bitcoin price uptrend.

Daily Digest Market Movers: Bitcoin price eyes $45,000 amidst rising demand, awaiting Spot Bitcoin ETF approval

- Bitcoin price marked its first weekly close above the $40,000 level, since April 2022, fueling a bullish outlook among BTC holders. It represented the seventh consecutive green weekly close, signaling that bulls are in control of Bitcoin price uptrend.

- On December 5, Bitcoin price climbed to $41,400 on Binance, resuming its uptrend.

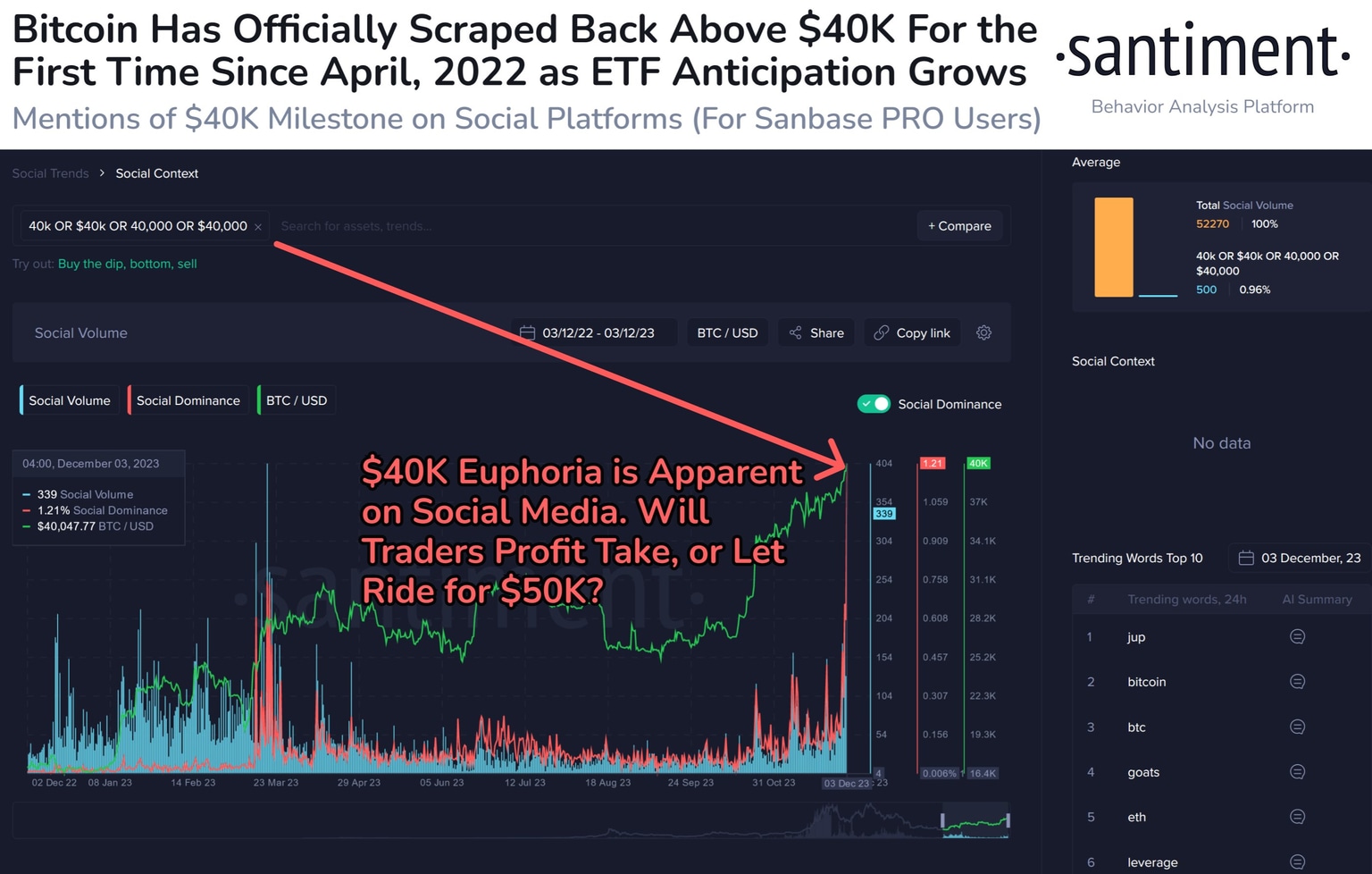

- Analysts at Santiment evaluated the BTC price uptrend and identified a Fear Of Missing Out (FOMO) among market participants. Analysts believe Bitcoin price could revisit $50,000 sooner or later, depending on whether BTC traders engage in profit-taking or demand pushes the asset higher.

Bitcoin price could rise to $50,000

- Bitcoin Open Interest (OI) on the Chicago Mercantile Exchange topped $4 billion for the first time since October 2021, when BTC price rallied past the $60,000 level. BTC OI has crossed an important milestone, supporting a bullish thesis for Bitcoin price.

- BTC holders are anticipating a green signal from the US financial regulator for Bitcoin Spot ETF, between January 5 and 10, 2024, according to Bloomberg ETF analyst Jeff Seyffart.

Technical Analysis: Bitcoin price gears up to revisit $45,000

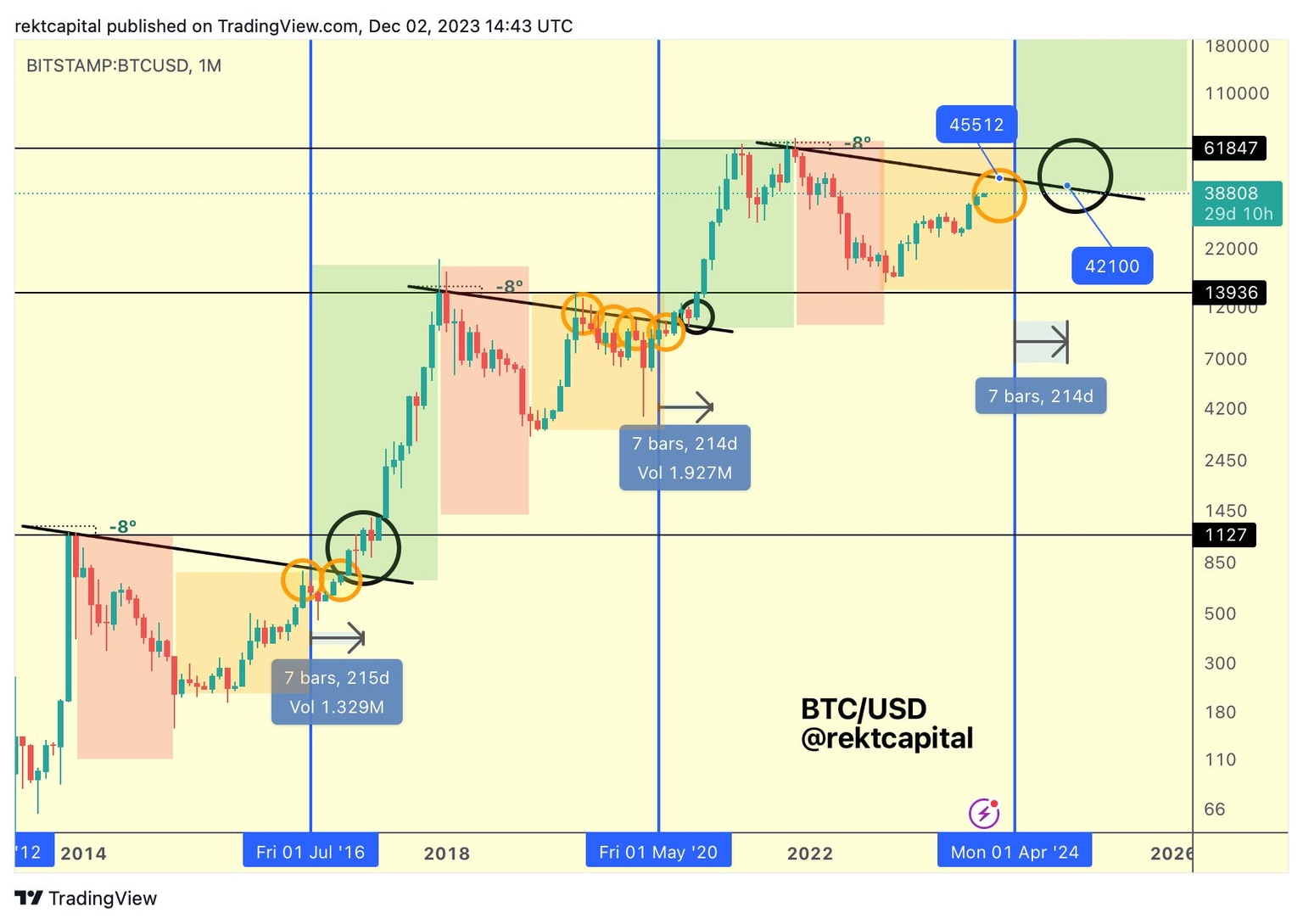

Crypto analyst behind the X handle @rektcapital evaluated the Bitcoin price trend and predicted that BTC price could revisit the $45,000 level prior to the fourth halving event, scheduled for April 2024. The analyst notes the trend that repeated in the past three cycles and predicted a pullback to the $42,000 level after BTC touches $45,000.

BTC/USD 1-month price chart

Crypto analyst @Pentosh1’s prediction supports @rektcapital. The analyst has identified the $40,000 to $42,000 level as the most important one for Bitcoin, marking it as range highs in the ongoing cycle. The analyst believes $36,300 is the mid resistance level and BTC price could find support between $31,000 and $32,500.

BTC/USDT 3-day chart

Bitcoin price is $41,323 on Binance, at the time of writing. BTC price rallied 10% in the past week and yielded nearly 4% daily gains for holders.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.