Bitcoin price could retrace to $42,000 if US Nonfarm Payroll comes in at 180,000

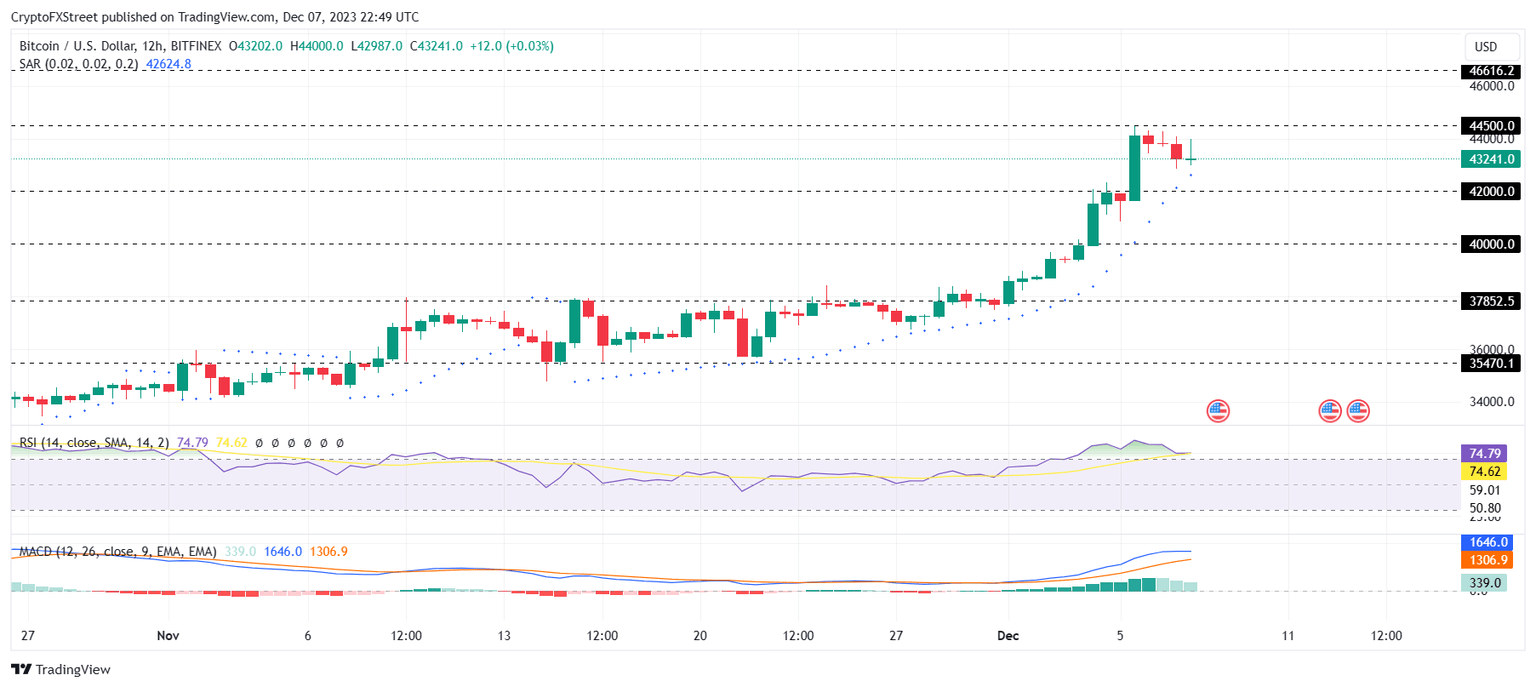

- Bitcoin price is exhibiting waning bullish momentum on the 12-hour chart, trading at $43,241.

- The consensus forecast suggests a 180,000 increase in Nonfarm Payrolls in November.

- A strong labor market is likely to motivate the US Fed to maintain its 'higher for longer' interest rate policy narrative.

Bitcoin price just like other assets, is highly impacted by the macro-financial developments. This includes the Nonfarm Payrolls (NFP) report released by the Bureau of Labor Statistics (BLS) of the United States. This time around, the NFP data is expected to cause a dip in the value of BTC.

US NFP: Forecasting an increase

The forecasts regarding the November figures of the Nonfarm Payrolls are currently at 180,000, marking an increase from October’s 150,000. This would mean that the unemployment rate would remain unchanged at 3.9%.

The NFP report has proven to have a considerable impact on the crypto prices, just as it has on other investment classes. Strong jobs reports, i.e. increase in jobs, tend to strengthen the dollar as the increase is a sign of a stronger economy. This has a negative impact on stocks, commodities, etc, and since crypto happens to share a positive correlation with the share market, particularly BTC, it faces correction.

Conversely, a weak NFP report proves to provide a bullish outlook for crypto since a lower-than-expected increase in jobs weakens the US Dollar, causing a rally for stock and other markets.

Furthermore, in the event the NFP figures are stronger than expected, the Federal Reserve tends to keep the interest rates high. This is done in order to tighten the monetary policy to control inflation. Thus, even if the Fed doesn't increase the rates in the next meeting, they might keep it stable at 5.25% to 5.50%.

Consequently, Bitcoin price will most likely face correction; however, given the bullish developments in the stock markets, including the potential spot BTC ETF approvals coming soon, the decline may not be excessive.

Bitcoin price to note a dip

Bitcoin price is presently trading at $43,241 after failing to breach $44,500, resulting in minor corrections. While at the time of writing, the broader market outlook is bullish, the short-term picture is slightly leaning toward bearish.

This is evinced by the Moving Average Convergence Divergence (MACD) indicator. The receding green bars suggest waning bullishness, which means that Bitcoin price is susceptible to a decline.

However, BTC will, at most, fall back to $42,000 or $40,000 if the former support level is lost. This is the short-term scenario considering a stronger-than-expected NFP report.

BTC/USD 12-hour chart

But if the report is weaker or the broader market cues switch to bullish, a bounce back from $42,000 is likely. This would boost the price rise, pushing Bitcoin price beyond $44,500 and invalidating the bearish thesis.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.