Bitcoin price could be undergoing Smart Money repositioning

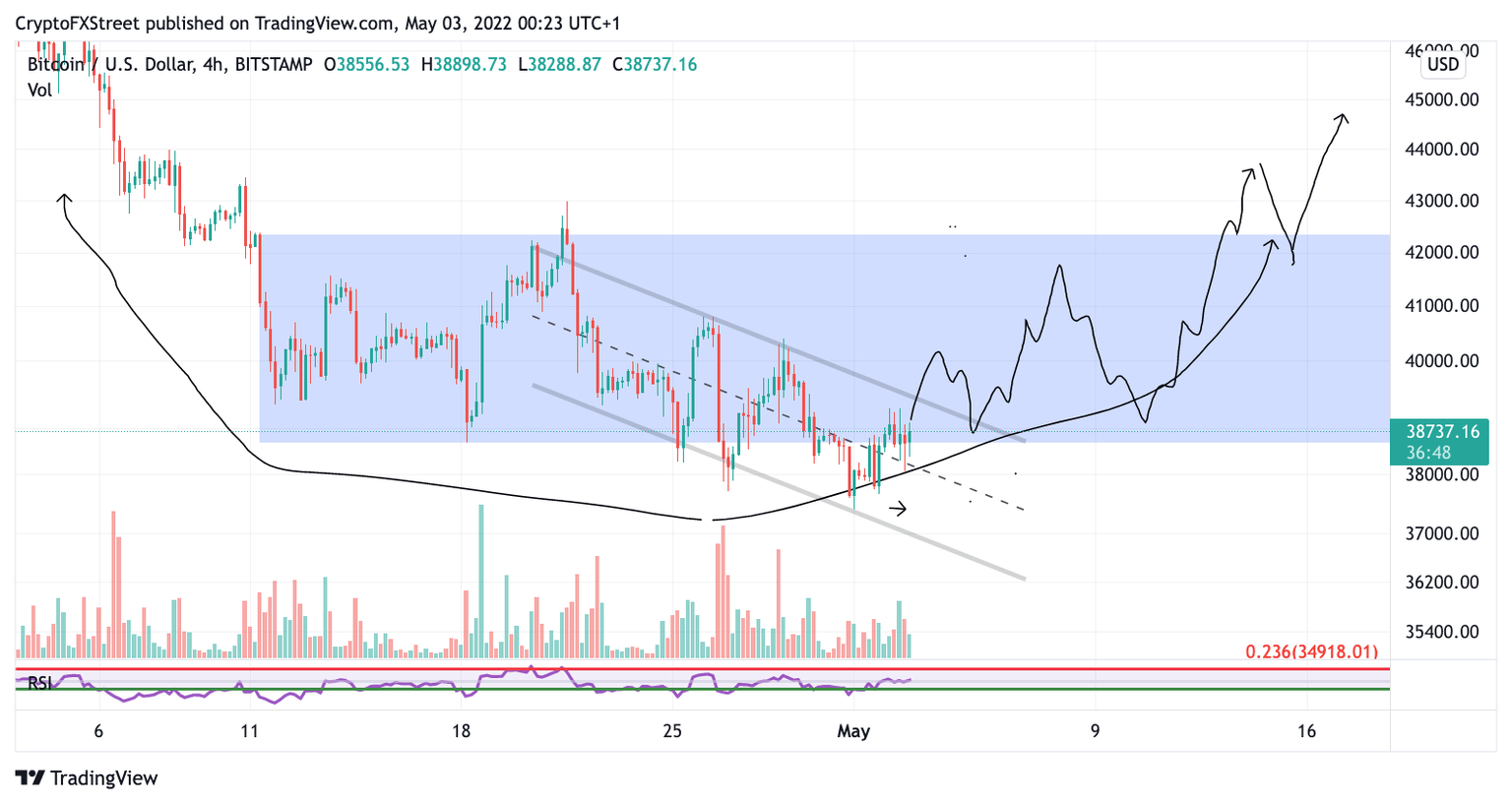

- Bitcoin price still consolidates within a range.

- BTC price volume is dropping.

- Invalidation of the bullish scenario is a breach below $37,650.

Bitcoin price presents a hopeful scenario of a Wyckoff Accumulation phase. Traders should expect low momentum trading before the next directional trend is established.

“Bitcoin Wyckoff Accumulation”

Bitcoin price currently trades at $38,600. Last month, this level was forecasted to be a significant price level for smart money. The bears are losing momentum as the price action is printing multiple dojis and indecision candles. The nature of this zone still portrays a Wyckoff accumulation event underway which is very optimistic for cryptocurrencies despite the harsh sell-offs experienced this weekend for altcoins.

BTC/USDT 4-hour chart

The bullish target for the Bitcoin price is between $44,000 and $51,000 to complete the Wave D of the widely prophesied Bitcoin triangle. The volume profile indicates the current downtrend is in jeopardy as the tapering could mean sellers have left the market. Additionally, the BTC price is hovering above a parallel channel median trend line, which adds bullish confluence.

Invalidation of the bullish thesis is now close below the swing low at $37,340. If the bears can suppress the Bitcoin price back to this level, the $34,500 zone would be their next target, resulting in a 15% dip from the current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.