Bitcoin Price Can Hit $8.8K But BitMEX Signals Warning — Tone Vays

Bitcoin (BTC) clinched a third day trading above $8,000 on Jan. 13 as weekend trading failed to take away bullish momentum.

Cryptocurrency market daily overview. Source: Coin360

BTC: major resistance only at $8,800

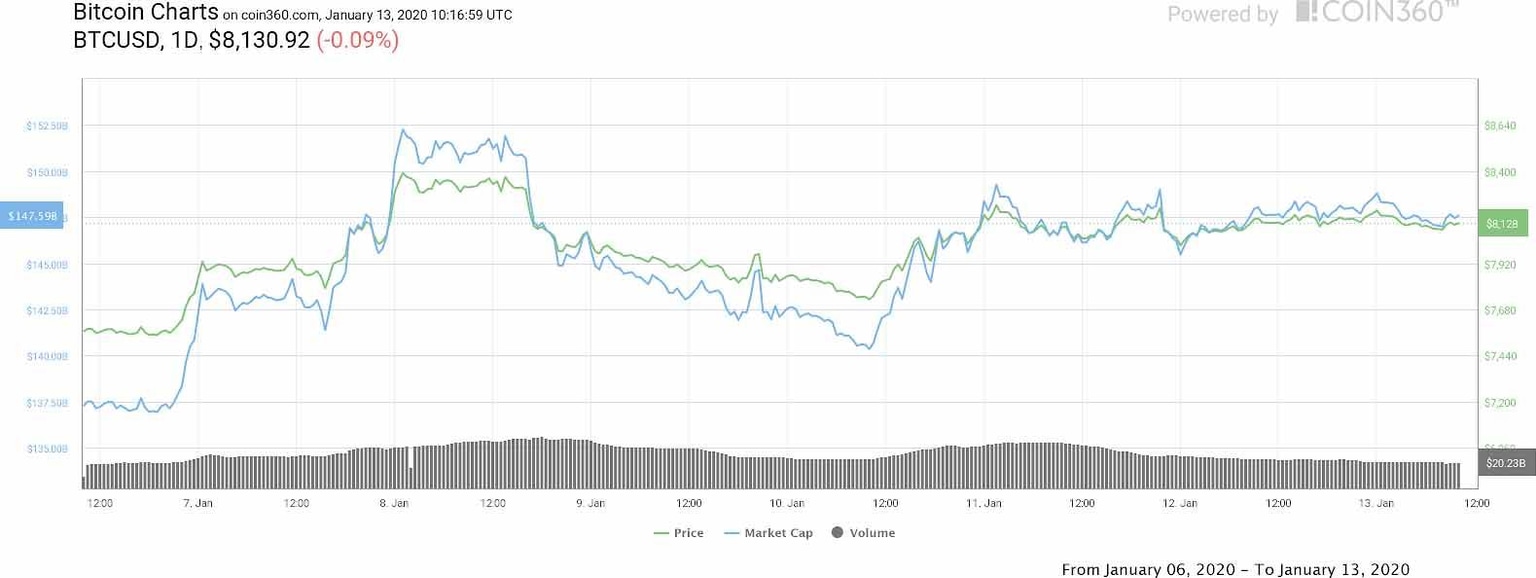

Data from Coin360 and Cointelegraph Markets showed BTC/USD begin the week at just over $8,100. After exiting the $7,000 range on Friday, Bitcoin managed to retain higher levels, with only one brief trip below $8,000 late Sunday.

Bitcoin 7-day price chart. Source: Coin360

Volatility was notably absent over the weekend, with BTC/USD staying within a corridor of around $250.

With further upside a possibility, traders were attempting to discern the likelihood of Bitcoin either cementing its gains or abandoning its upward trajectory.

For Tone Vays, despite a multitude of bullish signals, it was the funding rate on derivatives giant BitMEX failing to react which gave cause for concern. The rate is currently slightly positive at 0.01%, which is generally seen as a bearish sign by traders.

“The oscillators on the daily chart are pretty much all bullish except the BitMEX funding rate — the BitMEX funding rate is actually very, very important, and it’s usually the opposite of what everyone’s been doing,” he summarized in the latest episode of his Trading Bitcoin YouTube series on Sunday.

Vays added that historically, it was nonetheless the BitMEX funding rate which was “usually right” as a prediction tool.

Going forward, he identified the next serious area of resistance at $8,800, but beneath that, there was relatively little standing in the way for Bitcoin.

Others meanwhile noted the apparent lack of buying appetite at current levels. For the Twitter user Joe007, who regularly tops the list of traders on exchange Bitfinex’s leaderboard, history also provided cause for skepticism about the broader cryptocurrency market.

He noted:

“At 12K+, there was clearly a lot of buying interest. At the latest ‘breakout’, it really seems that barely anyone is buying 8K+.”

Cointelegraph contributor Keith Wareing additionally stated that Bitcoin could dip as low as $4,000 by April.

Altcoin boost fails to impress punters

Joe007 was unfazed by upticks in certain altcoins last week, such as Bitcoin SV (BSV), Dash (DASH) and Dogecoin (DOGE).

“For me, alts leading the PA is a clear indication that the rally is driven by stupid money rather than smart one, and therefore is not sustainable,” he added.

As the week began, progress had become more muted among the top twenty cryptocurrencies by market cap.

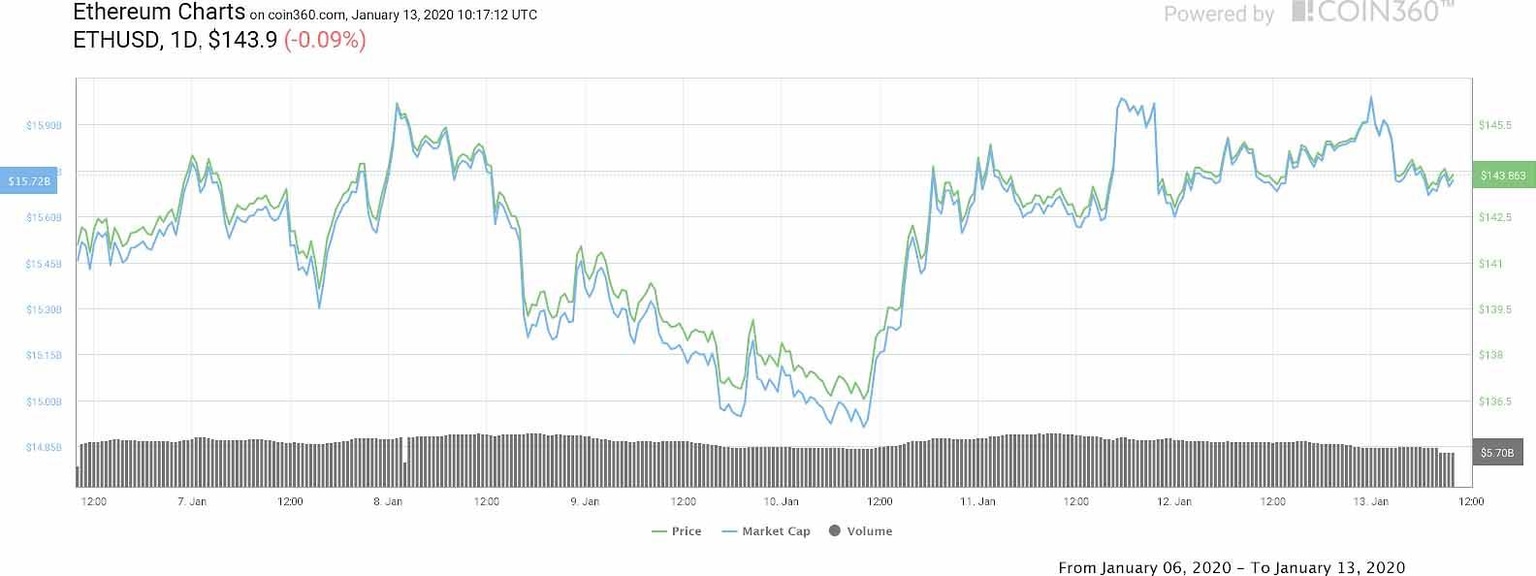

Ether (ETH), stayed practically static, continuing to circle $144, while 1-2% movements in either direction characterized the remaining tokens.

Ether 7-day price chart. Source: Coin360

The overall cryptocurrency market cap was $216.9 billion, with Bitcoin’s share at 68.1%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.