Bitcoin Price Analysis: Bulls gathering pace for a test of $8,000

- Bitcoin extends recovery gains, $7,500 mark tested.

- Bullish reversal displayed on daily chart, calls for further upside.

- BTC/USD rises for the first time above 50-DMA since Nov. 15.

The BTC buyers are back this Sunday with great pomp and show, after a brief phase of upside consolidation seen on Saturday. Bitcoin (BTC/USD), the most favorite cryptocurrency, attempted to take out the 7,500-handle last hour, having resumed its Friday’s recovery momentum. At the press time, the spot reverses from weekly tops of 7,491.15 to trade near 7,450 region, gaining 2% over the last 24 hours while up nearly 1.50% on a weekly basis. Its market capitalization increases to $136.16 billion vs. $ 133.73 billion seen during Saturday’s mid-European hours.

Markets remain optimistic on the No. 1 coin despite the major US-Iran geopolitical escalation that led to a big wave of a fight to safety across the financial market on Friday.

Technical Overview

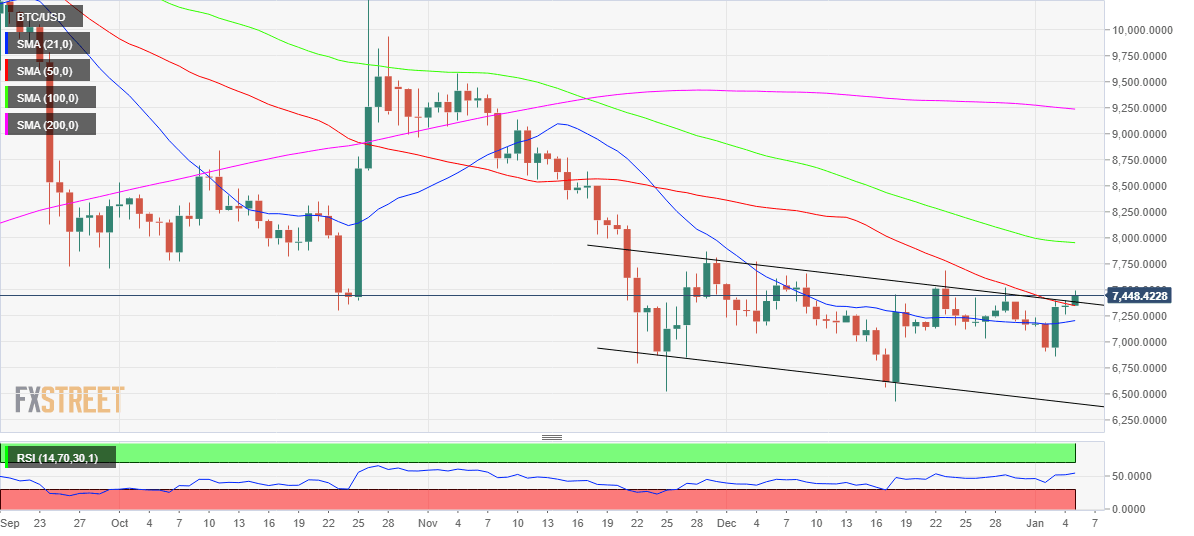

BTC/USD daily chart

As observed in the daily chart, the price witnessed a bullish break out from over a month-long falling channel earlier today. Its also worth noting that the coin regained the 50-day Simple Moving Average (DMA), now at 7,348, for the first time since November, 15th.

Therefore, a bullish reversal can be called for, as the bulls now eye a test of the downward sloping 100-DMA located at 7,953. Buying interest will intensify on a break above the 100-DMA, opening doors towards the pattern target of 8,820. Moreover, the daily Relative Strength Index (RSI) remains above the mid-line, pointing northwards while suggesting further scope for upside.

On the flip side, any retracement is likely to be initially capped by the 50-DMA resistance-turned-support. Should the bulls fail to defend the last, the price could drop further towards the horizontal 21-DMA placed at 7,204.

All in all, the BTC/USD upside looks more compelling in the coming weeks amid bullish technical set up.

BTC/USD key levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.