Bitcoin Price Analysis: BTC/USD recovery has come to a standstill, long-term forecasts still bullish

- Bitcoin will become a winner of the current crisis.

- SHort-term recovery has stalled below 50% Fibo retracement.

Bitcoin bulls clawed back some ground and pushed the price above $7,000. While the near-term outlook for the first digital coin is far from rosy, as it stays below critical resistance level, the longer-term forecasts imply that BTC has a good chance to capitalize on the current crisis.

Bitcoin is a bet on deflationary pressures

The current financial crisis revealed that Bitcoin and other digital coins are not correlated with most of the traditional financial assets, which opens up a good investment opportunity, according to Alex Mashinsky, chief executive officer (CEO) of cryptocurrency lending platform Celsius Network. He believes that Bitcoin supporters bet on the idea that deflationary pressures will win over inflation.

He believes that the correlation narrative is one of the reasons, why Bitcoin failed to surge amid the raging pandemic and economic crisis. Many investors preferred to stay away from the market, which used to be highly correlated with stock and demonstrated exceptional volatility.

Five years ago. BTC looked volatile against stocks” but now it “looks more stable than the stock market — it only moves 2% a day, and the stock market moves 5–10%, he said.

BTC/USD: Technical picture

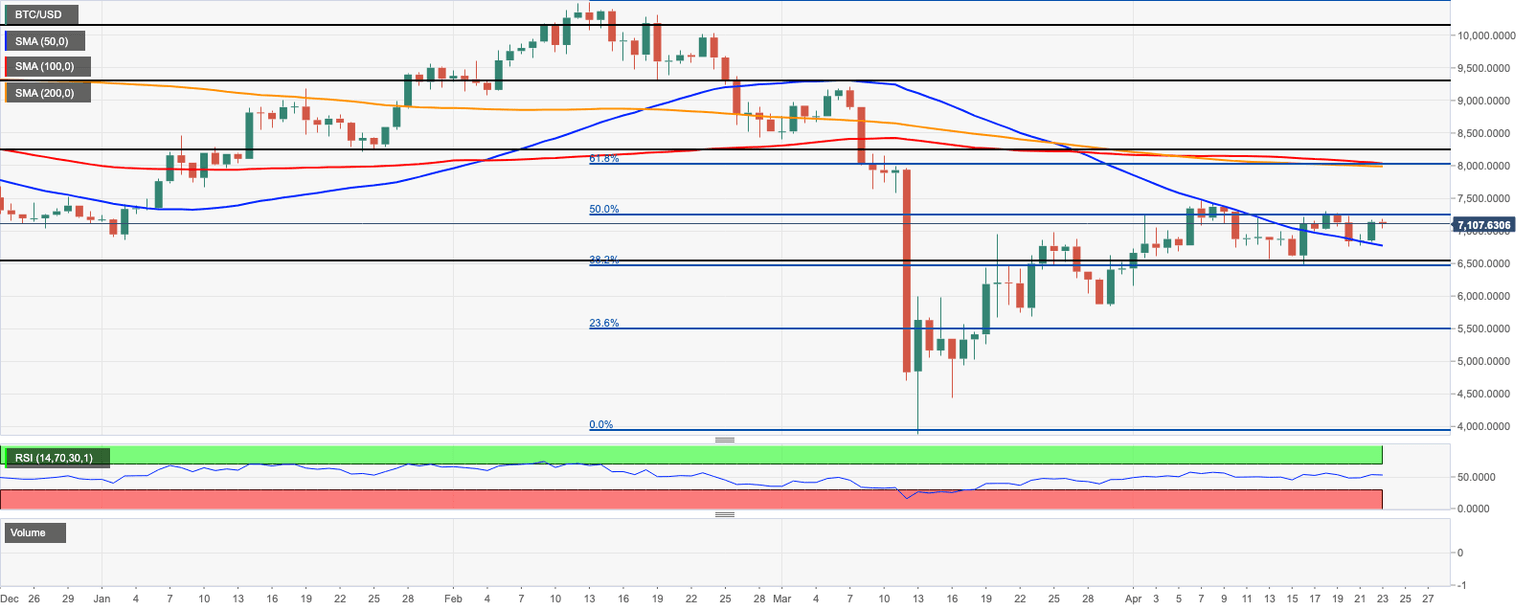

BTC/USD is changing hands at $7,100, in a green zone both on a day-to-day basis and since the beginning of the day. The first digital coin settled above $7,000; however, the further upside is limited so far. The next strong barrier is located on the approach to $7,150 by 50% Fibo retracement for the downside move from February 2020 high. A sustainable move above this area will allow for the recovery to $7,500. This level may slow down the upside move just as it happened at the beginning of April. If this happens, BTC/USD may enter a consolidation mode with a bearish bias.

On the downside, the local support is created by psychological $7,000. Once it is out of the way, the sell-off is likely to gain traction with the next focus on daily SMA50 at $6,770. BTC retains bullish bias as long as it stays above this level. If the price moves lower, the sell-off may continue towards $6,600-$6,500. This area stopped the previous downside correction and served as a jumping-off ground for the recovery. This barrier includes the lows of April 13 and 16 as well as 38.2% Fibo retracement for the downside move from February 2020 high.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst