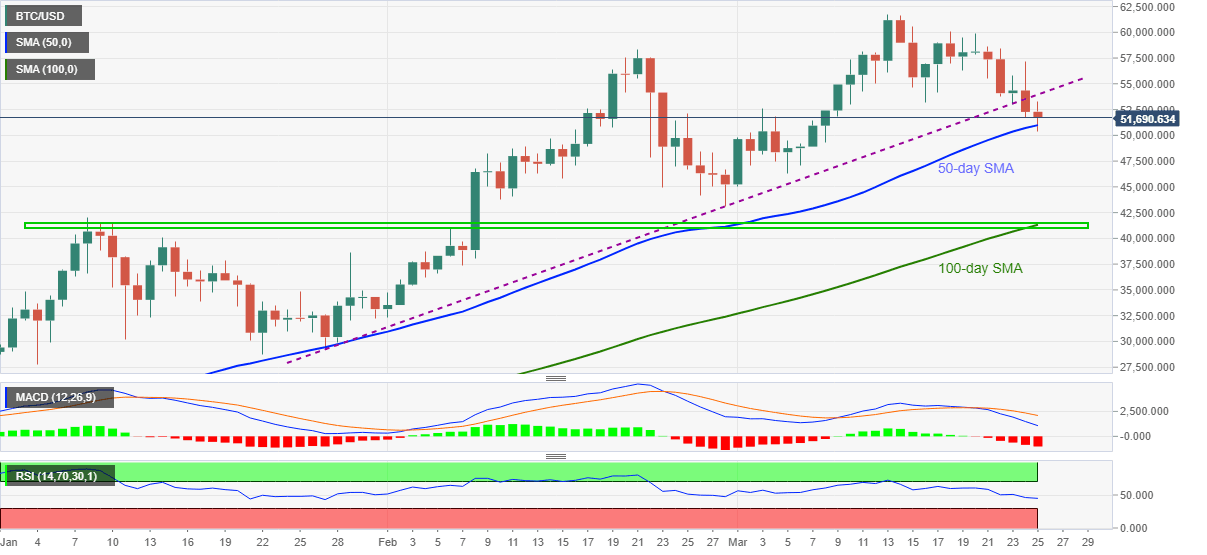

Bitcoin Price Analysis: BTC on the cusp of heavy losses, $51,000 probes bears

- BTC/USD bears battle 50-day SMA following a downside break of two-month-old support line.

- Late-February low lures sellers ahead of $41,300-450 key support-zone.

- Bulls need to cross February top for re-entry.

Bitcoin fades recent corrective pullback while dropping back to $51,700 during early Friday. In doing so, the cryptocurrency major battles 50-day SMA while keeping Wednesday’s downside break of an ascending trend line from January 27.

Given the bearish MACD and downward sloping RSI, not overbought, favoring the key support break, now resistance, BTC/USD is up for further losses. However, a clear break below the $51,000 threshold, around 50-day SMA, becomes necessary for the sellers’ conviction.

Following that, the quote’s slump towards lows marked on February 10 and 28, respectively around $43,700 and $43,050, can’t be ruled out.

However, any further losses will be challenged by an area comprising 100-day SMA and early 2021 tops, near $41,450-300.

On the flip side, a corrective pullback beyond the previous support line, at $53,850 by the press time, will have to piece February top near $58,350 to convince the BTC/USD bulls.

BTC/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.