Bitcoin Price Analysis: Acceptance above $10,820 critical for BTC bulls

- BTC re-attempts $10,800 following Saturday’s rebound.

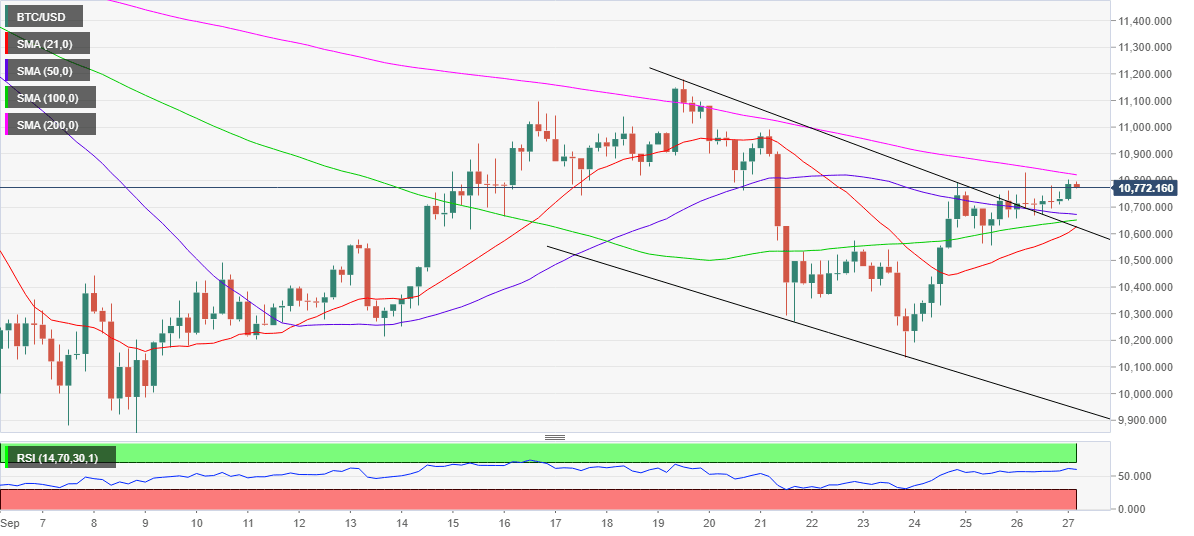

- A falling wedge breakout charted on the four-hour chart.

- Acceptance above 200-SMA is critical to extending the bullish break.

Bitcoin (BTC/USD) is looking to build onto the previous bounce this Sunday, as the bulls challenge the $10,800 level once again. The most dominantly traded crypto found support just above 10,650 and recaptured the $10,700 mark at the closing on Saturday, keeping the buyers hopeful. At the press time, Bitcoin trades with modest gains around $10,795, down nearly 2% on a weekly basis. The market capitalization of the No.1 crypto coin increased to $199.65 billion.

Technical Outlook

BTC/USD: Four-hour chart

Having charted a falling wedge breakout on the four-hour (4H) sticks on Saturday, the BTC bulls entered a phase of upside consolidation, now extending into Sunday’s trading so far.

The price remains trapped between key Simple Moving Averages (SMA), with the upside attempts capped by the upward-sloping 200-SMA at $10,820 while a dense cluster of support levels continues to guard the downside.

That support zone is the confluence of the 50 and 100-SMAs between $10,670/50 levels. A break below which the next cushion at $10,625 (bullish 21-SMA and pattern resistance now support) could be put to test.

A sharp sell-off towards the 10,500 level could be in the offing should the $10,625 support give way.

Alternatively, a sustained break above the 200-SMA barrier could open doors towards a test of the 11K threshold. Further north, the September 19 high of $11,180 will be on the buyers’ radars.

The Relative Strength Index (RSI) has turned south while ranging within the bullish region, suggesting that the bulls are likely to face a hard time holding onto the upside.

BTC/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.