Bitcoin (BTC) has a “possibility” of winning back more lost ground this month, but a retest of $40,000 may test bulls beforehand.

In its latest market update on Feb. 11, trading suite Decentrader voiced cautious optimism over BTC price action.

Derivatives turn complementary

After rallying above $45,500 on the back of United States economic data, BTC/USD has since dropped back into the range that has defined it this week.

For Decentrader, the chances of a low-timeframe decline are there, even if on-chain metrics are putting in rare bull signals.

“Bitcoin is at a relatively neutral level with clear zones of resistance and support above and below,” the update summarized.

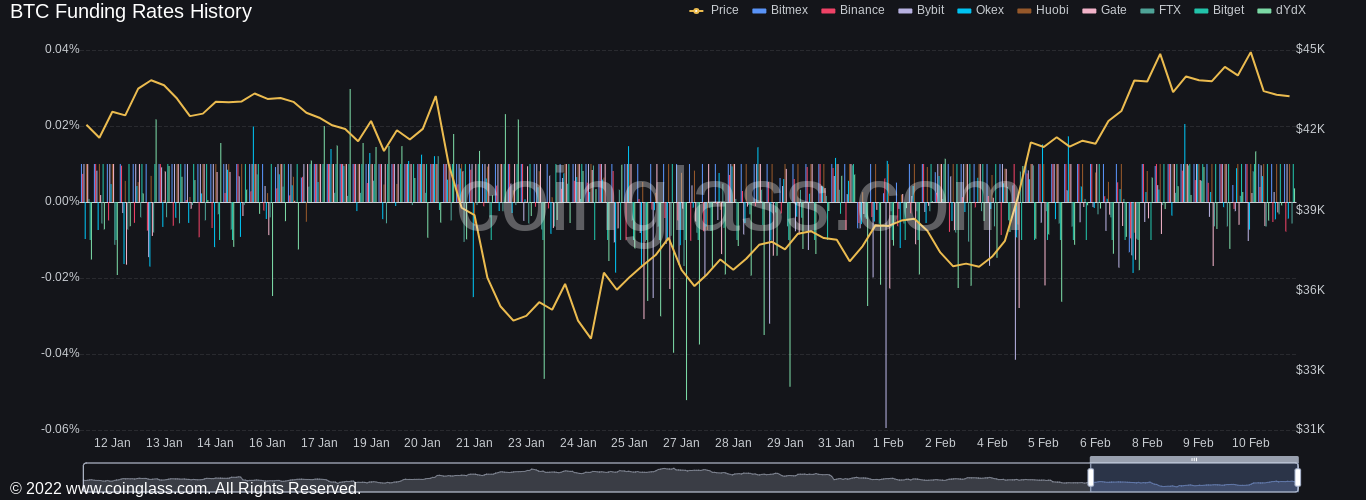

Acting in bulls’ favor is sentiment, now in “neutral” rather than “fear” territory, and encouraging signs from derivatives markets — low funding rates and a negative long/short ratio.

“We have now finally had a sustained period of negative funding rates, seen OI [open interest] drop over time, and importantly, saw Long/Shorts ratio go negative,” Decentrader continued.

An accompanying chart showed that under such rare circumstances, BTC/USD has gone on to rally three times since late 2020.

Funding rates are still overall negative as of Friday, data from monitoring resource Coinglass shows.

BTC funding rates chart. Source: Coinglass

“Nothing changed” on short-term outlook

Moving to the forecast, a downturn could produce a rebound at $39,000 should bulls not be too shaken by the $40,000 mark being broken.

“To the upside, there are resistance levels on either side of the important point of breakdown from the summer crash at $47,950 and $52,660,” the update added.

For the meantime, however, it is yet another case of “wait and see.”

“Nothing changed,” popular trader and analyst Crypto Ed argued in his latest social media update.

“Expecting a move towards $40k. Bullish scenario indicates a bounce to 48k. Bearish comes in play when we break 40k.”

BTC/USD chart with expected trajectories. Source: Crypto Ed/Twitter

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?