Bitcoin loses 4% in challenge to bulls’ push for $50K

$47,000 resistance serves as a timely reminder that the only way is not always up for Bitcoin bull runs.

Bitcoin (BTC) lost its appetite for further gains on Thursday as BTC price action targeted levels below $45,000.

BTC price heads toward $44,000

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD testing $44,200 during Thursday, down over 4% in 24 hours.

The pair had spent the previous day seeking new local highs near $47,000, but major resistance at that level ultimately won out, and volume failed to sustain bulls’ cause.

“Slight weakness on the recent breakout implying potential exhaustion on the run,” Cointelegraph contributor Michaël van de Poppe warned at the time.

In his latest YouTube update, van de Poppe assessed the chances of a more fundamental correction setting in for Bitcoin.

“Right now, I think the majority’s expecting $48,000 to be hit before we reverse,” he said, echoing predictions from Wednesday.

“Either we’re going to smack through it, and we’re running towards $55,000, or we’re going to not hit it and just reverse from here towards the low $40,000s, maybe high $30,000s.”

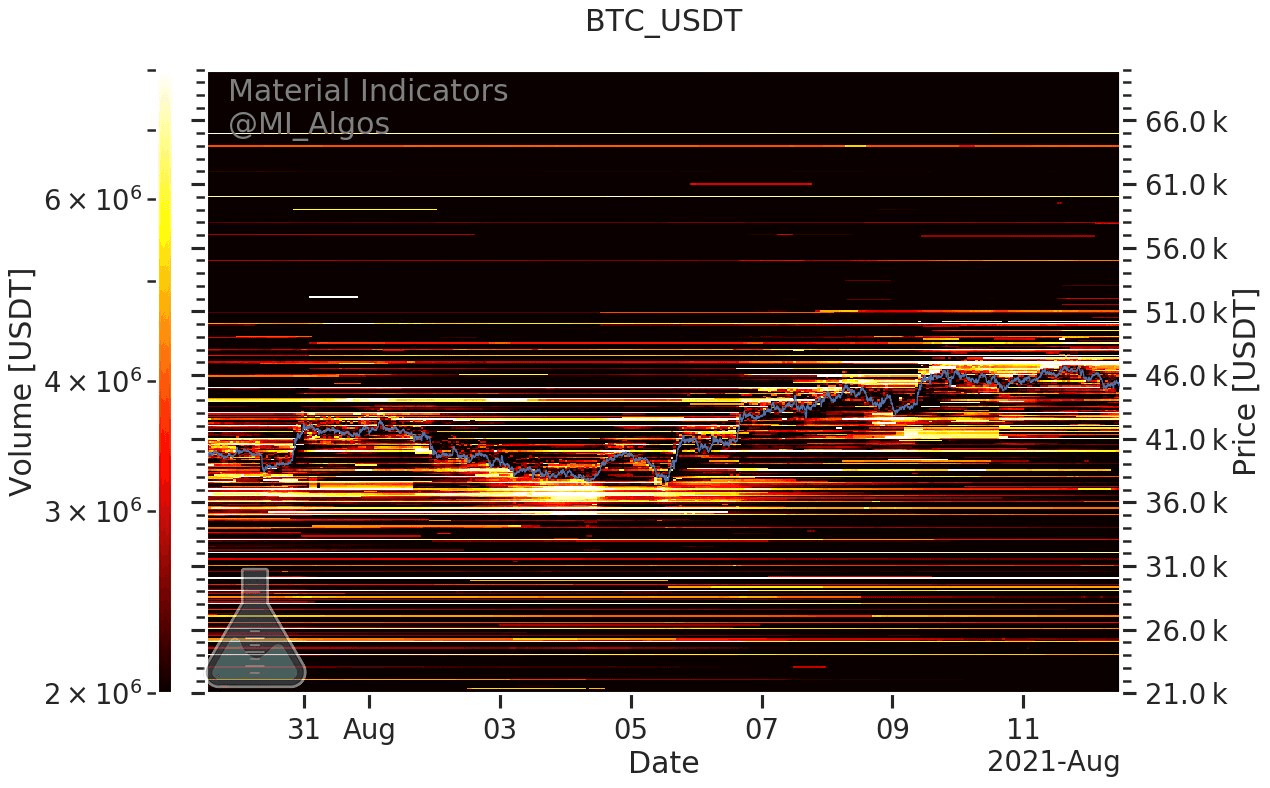

On major exchange Binance, buyer support was thin much above $42,000, with the considerable sell wall still in place at $47,000.

BTC/USD buy and sell levels (Binance) as of Aug. 12. Source: Material Indicators/Twitter

Golden cross still on track

Meanwhile, even Thursday’s modest dip would not be enough to avert a potentially bullish event on the daily chart for Friday: the golden cross.

As noted by analyst and trader Rekt Capital, the traditionally positive golden cross was still on track to hit Friday. It involves the 50-day moving average crossing over the 200-day moving average.

“This BTC dip isn’t enough to sidetrack the upcoming Golden Cross,” he tweeted, adding that BTC/USD should still sustain $45,200 as support to continue its “bullish bias.”

Some golden crosses, by contrast, have seen subsequent price corrections.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.