Bitcoin long-term holders’ activity increases as BTC falls below $20k following the US CPI report

- Bitcoin’s long-term holders are seemingly buying the dips, sticking to accumulating for a while now.

- Long-term holders’ sudden bullishness usually is an indication of an upcoming recovery sooner than later.

- Bitcoin could be seen trading around $19,987 yesterday, with no apparent indication of an immediate change in trend.

The king coin is responsible for the direction the majority of the altcoins take, and every time Bitcoin goes red, it creates an atmosphere of fear that takes time to dissipate. But while that may spook the majority of the investors, one particular cohort of investors seems to not only be unfazed but actually far more active than before.

Bitcoin shot down by the CPI

The long-term holders (LTH) are one of the more interesting bunch of investors since these people chart their own path and are unbothered by market developments mostly.

Earlier this week, the US Consumer Price Index (CPI) report came out, and the same sent shockwaves across the financial markets throughout the world.

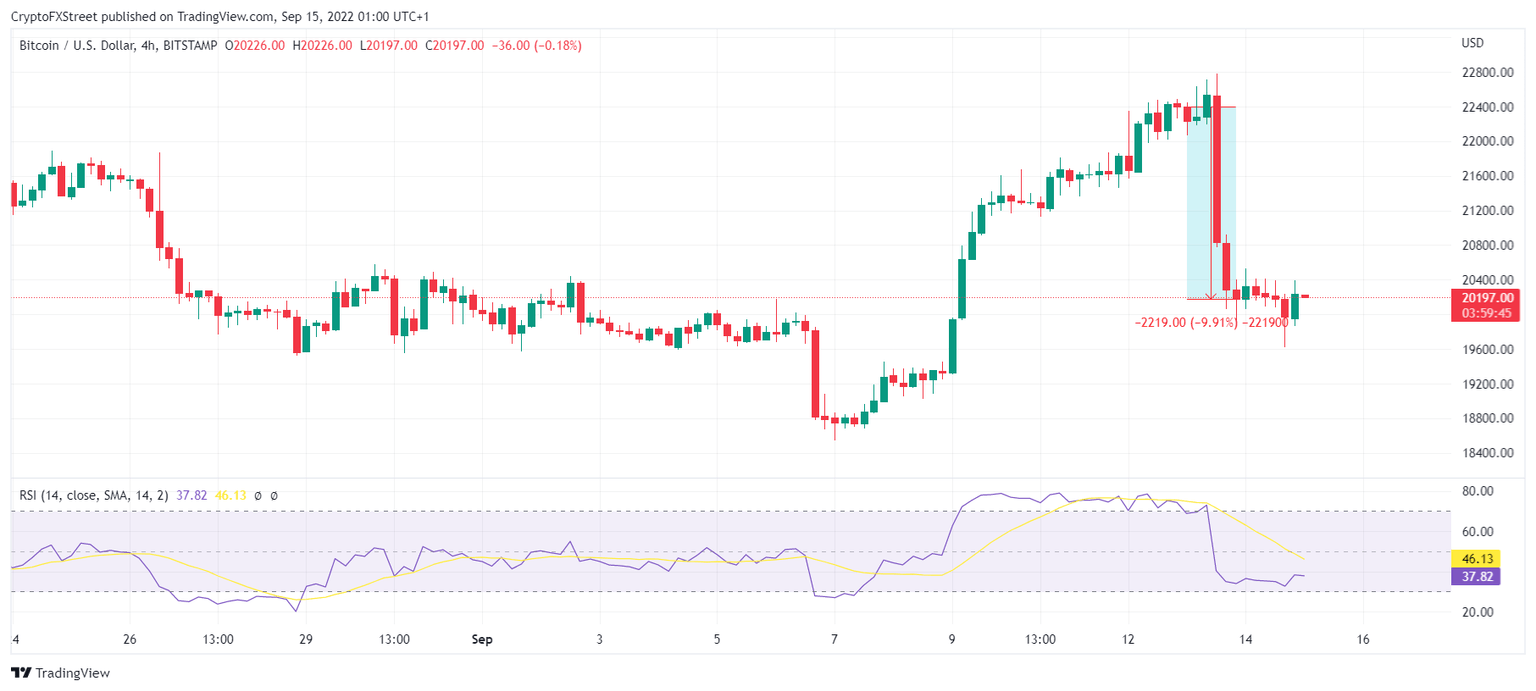

Bitcoin and the crypto market were impacted as well, with the former falling by 9.91% in a single day while the latter almost noted the elimination of $80 billion within 24 hours.

This incident acted as a huge blow to Bitcoin’s price since the buying pressure that was being generated for a while now subsided.

The Relative Strength Index (RSI) highlights that the immediate selling pressure from yesterday will make a recovery slightly slower.

Long-term holders still don’t care

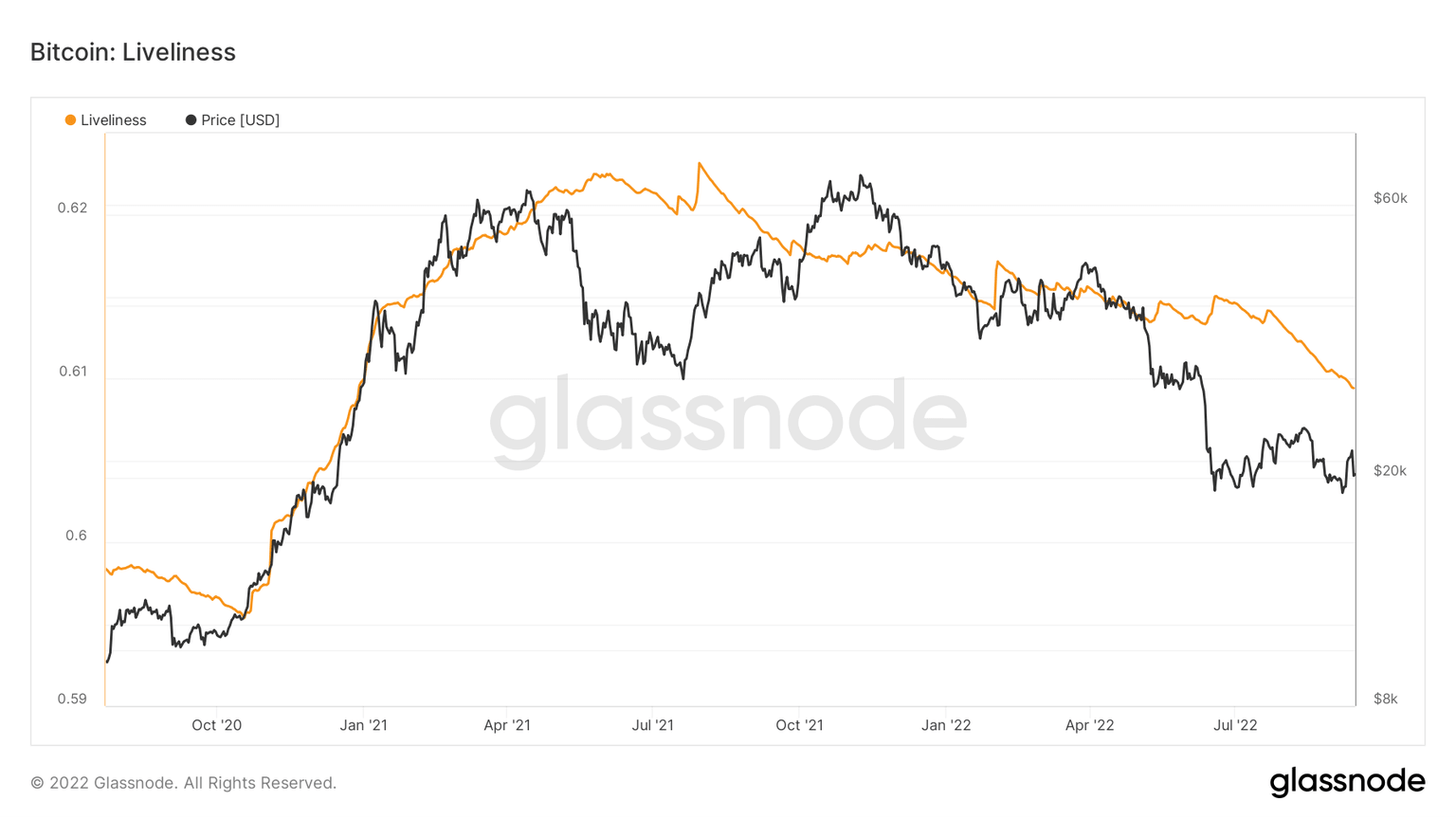

While other investors held back during periods of price falls, LTHs dove in and kept accumulating. The Liveliness of the asset has been declining since the end of July and is continuing to do so. This means that LTHs are accumulating to HODL.

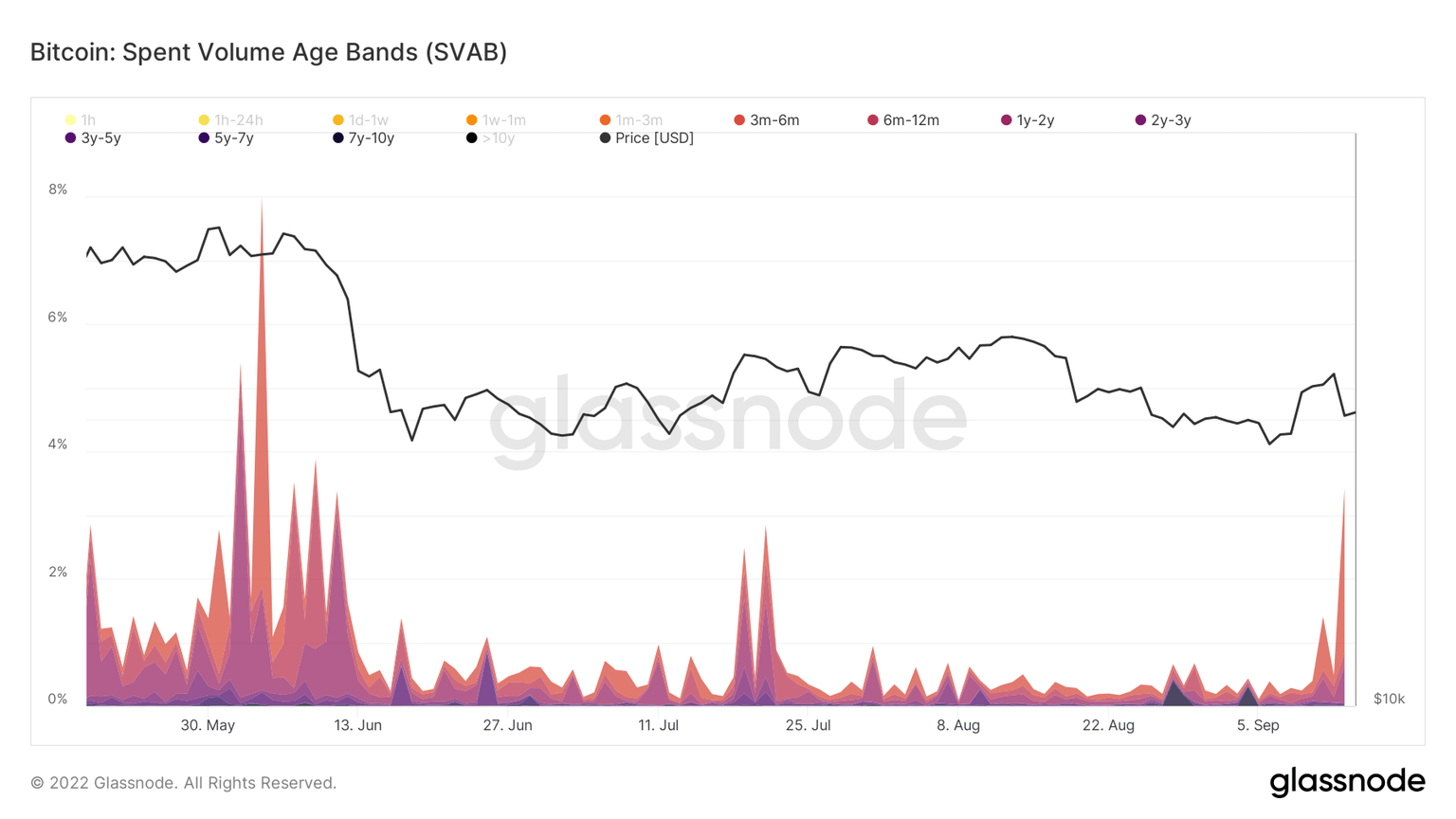

Additionally, the Spent Age Volume bands noted a spike in the three months+ investors’; their activity backs up the accumulation spree, instilling optimism amongst investors.

Whenever LTHs act positively, the market tends to flip its bearishness into bullishness, and the same is expected from Bitcoin hereon, although concrete signs of a rally are yet to appear on the charts.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.