Bitcoin Lightning Network capacity falling to a 14-month low should not worry BTC investors

- Bitcoin Lightning Network, a Layer-2 solution that scales the network, has seen a consistent decrease in the cumulative BTC held by all nodes.

- The decrease in capacity is actually bullish as it enables protocols to align capital and manage channels.

- Bitcoin Lightning Network nodes stand at the same number as they did in January 2023, which is a sign of lack of adoption.

Before Bitcoin Ordinals and BRC-20, the world’s first cryptocurrency network ran the most prominent Layer-2 solution – Lightning Network (LN). Over the past, the network was widely utilized for conducting faster transactions, but LN seems to be losing the amount of BTC on it at the moment.

Bitcoin Lightning Network loses BTC

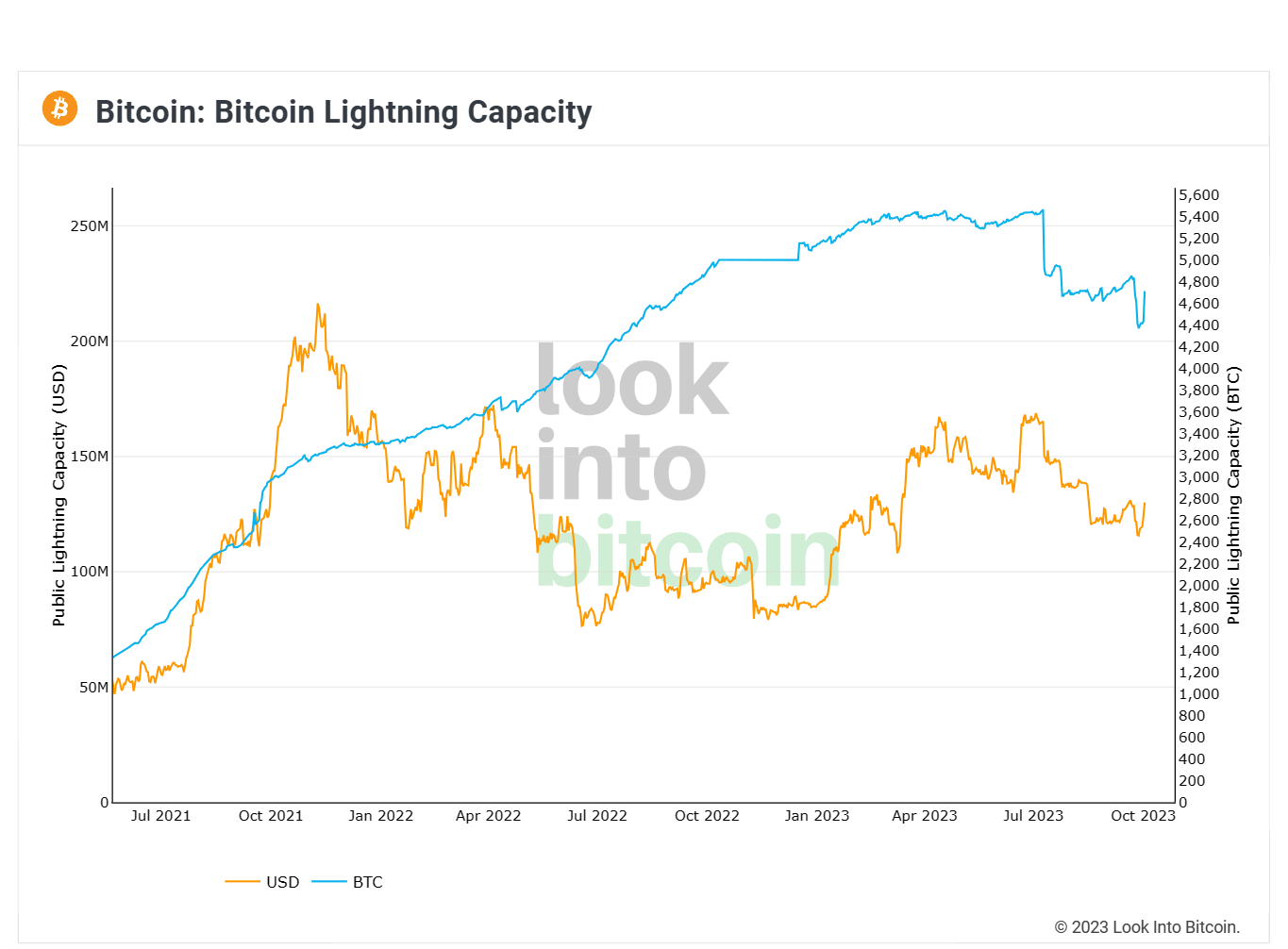

Bitcoin Lightning Network, at its peak in March 2022, was operating more than 20,000 nodes. Since then, the nodes on the network began falling considerably. However, the BTC capacity of the LN continued rising, reaching its all-time high of 5,498 BTC in July this year. Both nodes and capacity help in measuring the demand of the network.

A lightning node is the point of contact that verifies the transactions interacting directly with the network. These nodes represent computers connected to the network, which makes the transfer of BTC quicker and cheaper.

The capacity, on the other hand, refers to the BTC present on the network at the given time. This, however, is not as important as nodes. The reason behind it is that capacity simply represents the liquidity function of the network, which can increase or decrease as it only refers to the volume of total payment.

Thus, the recent decline in the capacity is not a matter of concern. Over the past four months, the number of BTC on the network has been declining consistently, falling by 13.7% from 5,468 BTC to 4,716 BTC.

Bitcoin Lightning Network capacity

Analyzing the same, Sam Wouters, Research Analyst at River Lightning, an LN protocol, stated,

“Node operators are beginning to discover that they can accomplish the same or more with less capacity.”

This was in reference to the protocol slashing its nodes’ capacity by 48% towards the end of August, stating the reason behind the decision to properly align capital and manage channels to the right peers.

Bitcoin LN nodes aren’t growing

While the decline in capacity is not a concern, a fall in nodes or lack of growth certainly is. The rise and fall in nodes provide an insight into the rising or falling adoption of Lightning Network. Since the beginning of the year, the number of nodes on the network has been the same despite the increase and decrease at around 17,000.

Bitcoin Lightning Network nodes

The impact of the same on investors has not been significant, which leaves BTC holders safe from any sudden volatility. However, from a wider view,the fall in nodes would be a bearish sign for the network.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.