Bitcoin holders expect high volatility as roughly 100,000 BTC options contracts expire Friday

- Speculators have been bullish on Bitcoin ahead of its $6 billion options expiry on Friday.

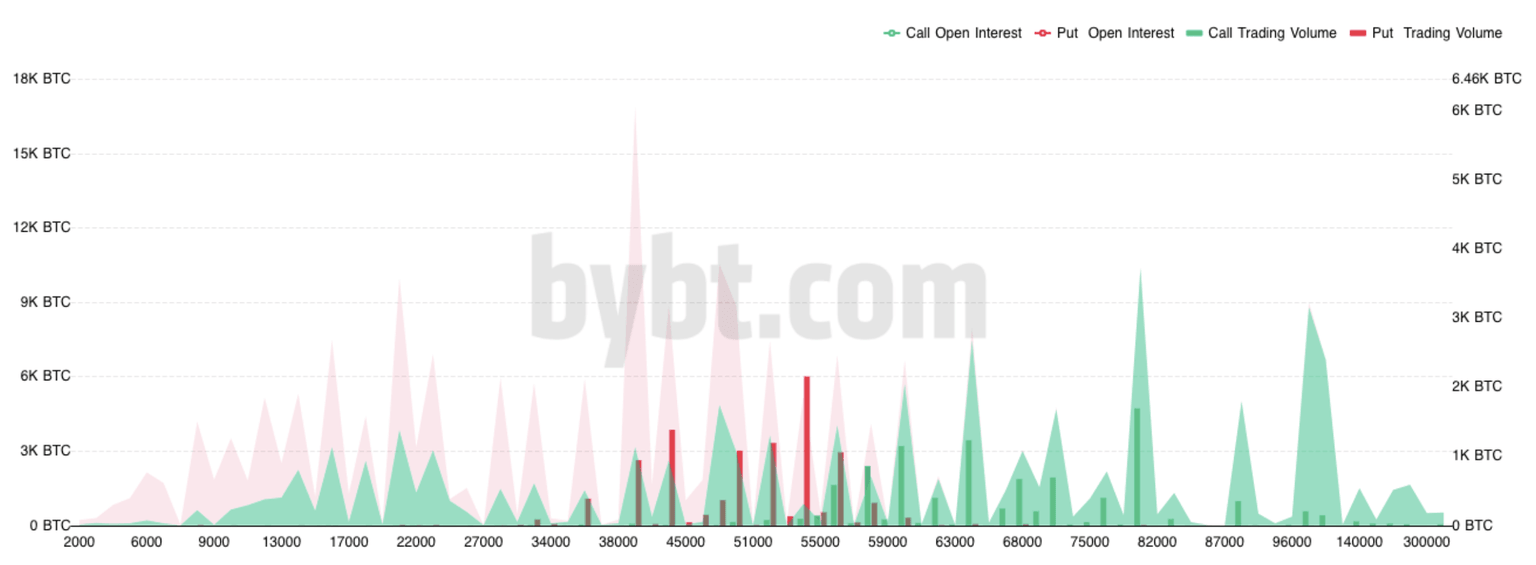

- There is more open interest in call options than put, a recurring trend since early 2021.

- April could be a more volatile month for Bitcoin price than ahead of the options expiry on March 26.

Bitcoin price is about to witness a swell of volatility as around $6 billion worth of BTC options are about to expire on March 26. According to trading data, speculators have been bullish ahead of the record expiry, as there are more open interest "buy" options than "sell" options.

Bitcoin options trading interest has risen sharply

A Bitcoin option is a type of derivative contract that gives the investor the right but not an obligation to buy or sell the cryptocurrency at a set price at or before an expiration date. Compared to trading Bitcoin futures or perpetual swaps, purchasing BTC options offer investors a more cost-effective and low-risk solution to trade the digital currency.

Without having to trade the underlying asset — Bitcoin — these options contracts allow traders to hedge their risk against spot and futures positions.

There are two types of options, call – rights to purchase Bitcoin on the assumption that its price will climb – and puts – rights to sell the crypto asset on the assumption that its price will fall. Both types of options contracts will have an expiration date and a strike price — referring to the price of which the investor has the right to buy or sell Bitcoin before or on its expiration date.

Since 2018, derivatives exchange Deribit has been offering Bitcoin options trading. It was only until the last few months that interest has risen sharply, as the pioneer digital currency made new all-time highs reach over $60,000.

Bitcoin options offer a unique opportunity for investors to get exposure to the underlying digital currency and have become a popular way of speculating on the crypto asset.

Around 100,000 Bitcoin worth around $6 billion is about to expire on March 26, marking a more significant effect on the market than the previous $4 billion expiry set on January 29.

However, January 29 recorded the largest expiry on record — an astonishing $3.5 billion worth of options contracts expired, which roughly translates to 36% of all open interest in that period. Open interest refers to the total number of remaining Bitcoin options that have not been settled.

Although not every option will eventually result in a trade, speculators have been increasingly bullish on Bitcoin since the start of 2021, as call options have been substantially larger than puts.

43% of options contracts are already worthless

Some Bitcoin options contracts may become worthless if the underlying cryptocurrency trades above the call strike price or vice versa – below the put strike price.

BTC options open interest by strike price

While the upcoming $6 billion Bitcoin options are about to expire, around 43% have already been deemed worthless. With the remaining open interest, Bitcoin bulls are mainly in control as the cryptocurrency's price surge to its recent all-time high has wiped out 84% of the bearish options.

If the Bitcoin price continues to trade above $52,000, a growing number of put options will lose their value, which increases the advantage for bullish call options.

The positioning of large players in the next month

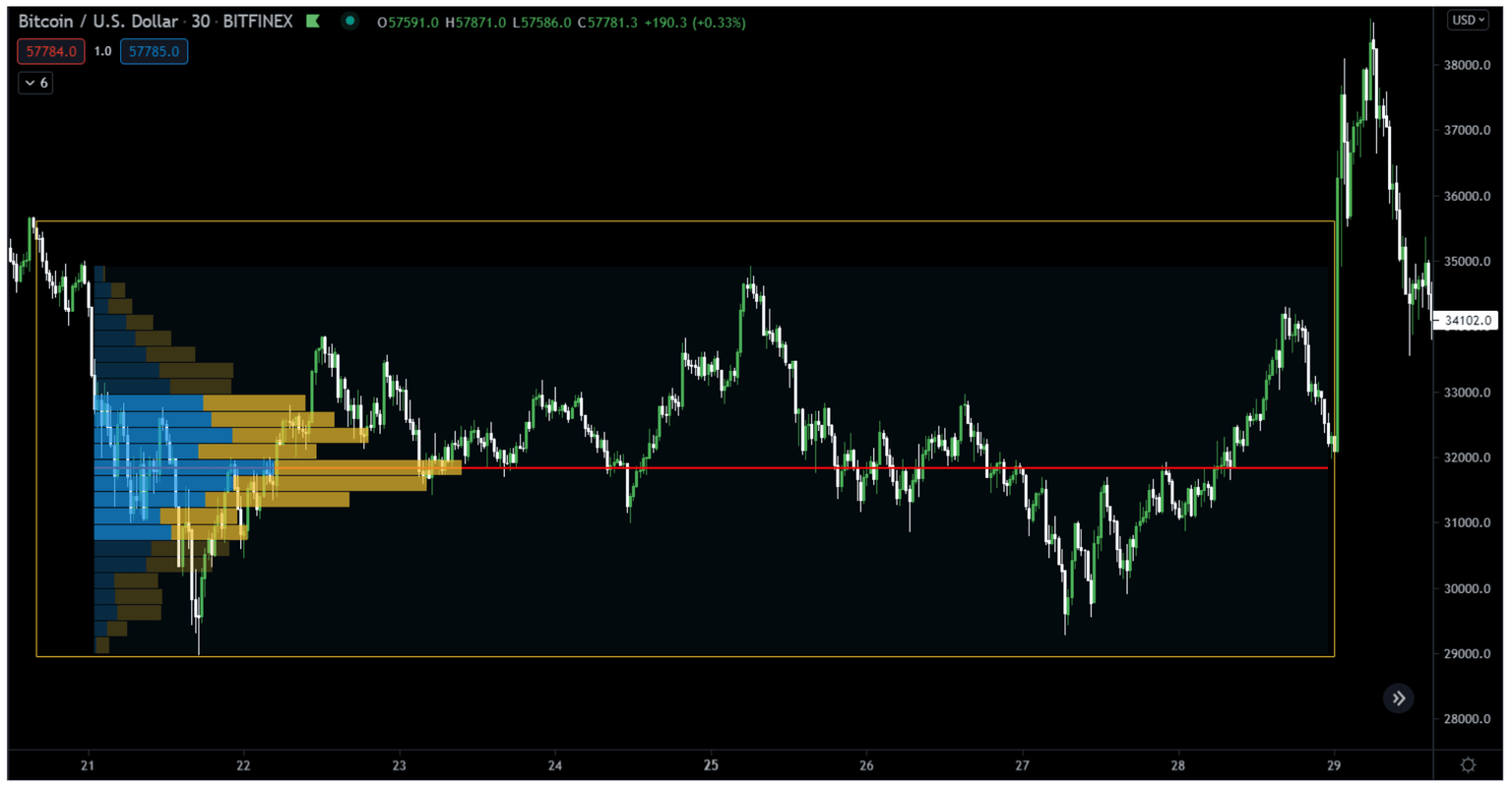

While anticipating the $6 billion options expiration, looking back at the week of January 29, Bitcoin's price action was magnetized toward the $31,000 region.

BTC/USD 30-mins chart

Looking at Bitcoin's price action in the past week, a similar trend could be seen as BTC has been centered around the $58,000 level. A large amount of interest has been surrounding the inner and outer gamma bands of the price action. Traders could be hedging positions as the expiration date approaches.

Once the Bitcoin options contracts expire, there is less need to hedge with spot volume, meaning that there could be more volatility following the expiration date – which was a trend seen after the previous January 29 Bitcoin expiry date.

Looking ahead of the larger players in the next month, traders are very bullish, taking Bitcoin volatility to a higher upswing.

As governments continue to flood their economies with cash in the form of stimulus payments, worries over inflation and currency devaluation have become a key driver for the boost in the Bitcoin price. With the complexities involved with trading, options volumes are a good indicator of the number of sophisticated investors that have been trading Bitcoin.

Seamus Donoghue, vice president of sales at crypto-security firm Metaco, said:

Institutional adoption of Bitcoin should drive continued underlying growth for futures and options volumes.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.