Bitcoin hits record 44M non-zero addresses, thanks to Ordinals: Glassnode

Glassnode noted that this is the first time in Bitcoin history where the network has been used for purposes other than for monetary purposes.

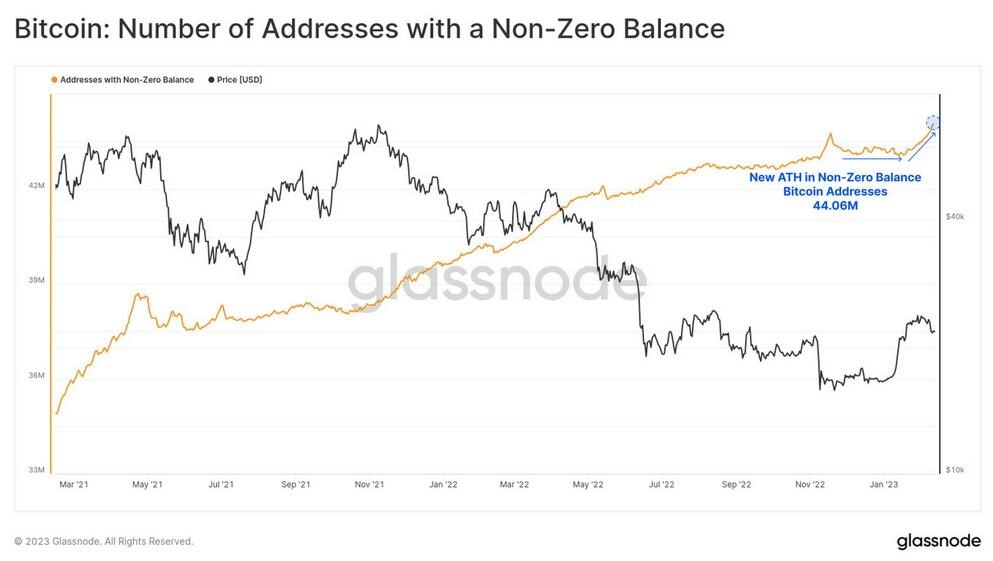

The launch of Bitcoin nonfungible tokens (NFTs) — known as Ordinals — has tipped the number of non-zero Bitcoin addresses to a new all-time high of 44 million, according to crypto analytics platform Glassnode.

In a Feb. 13 report from Glassnode, the firm explained that for the first time in Bitcoin’s 14-year history, a portion of network activity is being used for purposes other than peer-to-peer monetary Bitcoin (BTC) transfers:

This is a new and unique moment in Bitcoin history, where an innovation is generating network activity without a classical transfer of coin volume for monetary purposes.

Glassnode explained that the Ordinals surge has contributed to a “short-term uptick in Bitcoin network usage of late” which has brought many “new active users” with a non-zero BTC balance to the network:

Bitcoin addresses with a non-zero balance is surging. Source: Glassnode

“The primary source of this activity is due to Ordinals, which instead of carrying a large payload of coin volume, is instead carrying a larger payload of data and new active users,” said Glassnode.

“This describes a growth in the user base [...] from usage beyond the typical investment and monetary transfer use cases,” it added.

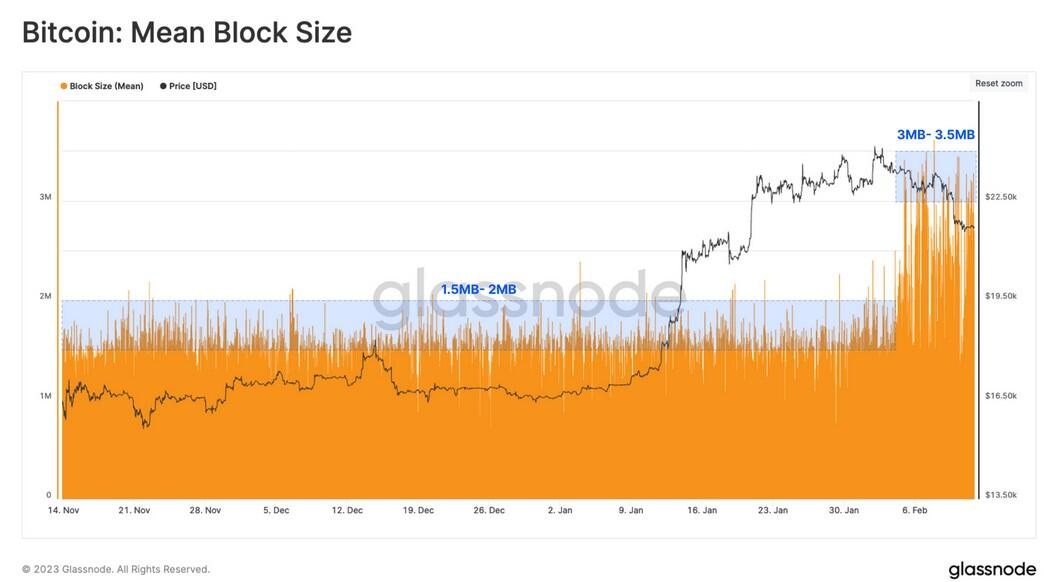

A new player competing for block space

Glassnode noted that Ordinals is now competing for block space demand, which is “creating upward pressure on the fee market,” but noted that this hasn’t led to a significant increase in Bitcoin transaction fees.

According to Glassnode, since Ordinals launched on Jan. 21, the upper range of the mean Bitcoin block size has increased from 1.5-2.0 MB to 3.0-3.5 MB in a matter of weeks.

Mean Bitcoin block sizes over the last three months. Source: Glassnode

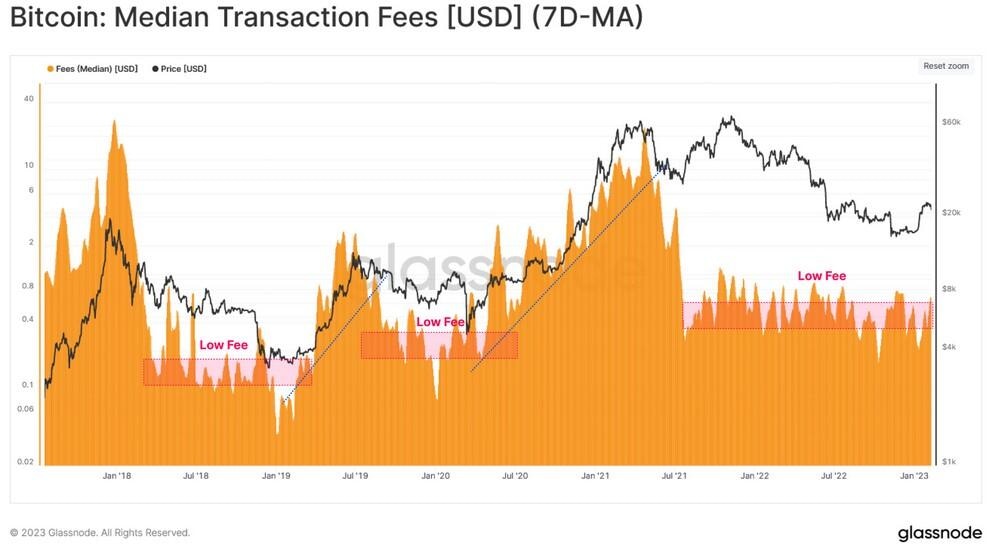

However, this hasn't led to a surge in fees. While there have been some short-lived spikes, Glassnode stated that a “new lower bound transaction fee required for block inclusion” has been reached since Ordinals made their mark on Jan. 21.

Median transaction fees on the Bitcoin network over the last five years. Source: Glassnode

The technological applications behind the Ordinal protocol were enabled by the Taproot soft fork, which took effect in November 2021. Bitcoin Ordinals launched on Jan. 21.

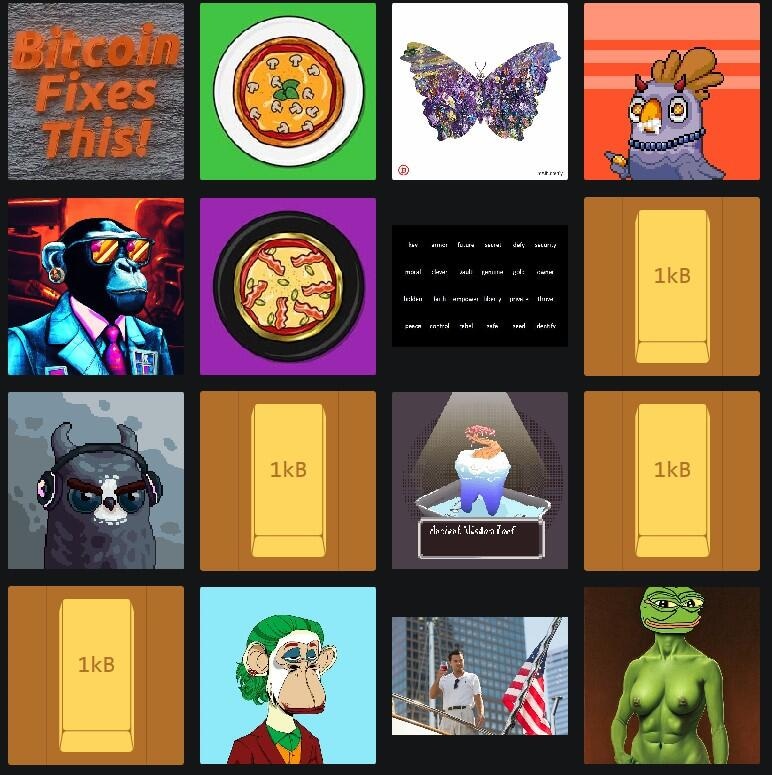

Through the use of the Ordinals numbering scheme, Bitcoin users can assign arbitrary content to satoshis — the smallest denomination of BTC — which enables them to inscribe Bitcoin-native, nonfungible token (NFT)-like images.

There have been over 78,400 NFT-like images and videos inscribed thus far.

The latest Ordinals inscripted onto the Bitcoin network. Source. Ordinals

The impact of the NFT-like images on Bitcoin hasn’t come without controversy though.

Some notable “Bitcoiners” such as Blockstream CEO Adam Back have recently expressed their dislike for the Ordinals protocol, suggesting that it deviates from Bitcoin’s purpose as a peer-to-peer electronic cash system.

However, others have been more open to the idea. Bitcoin bull Dan Held has asserted on several occasions that Ordinals bring more “financial use cases to Bitcoin.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.