Bitcoin fixes this' – US infrastructure bill would add $250B to US debt mountain

The hotly-debated legislation is no surprise to hard money supporters, as Cameron Winklevoss saying that it would "plunder" future generations.

The United States tax bill which could hurt Bitcoin (BTC) and crypto holders will “continue the plunder of future generations,” Cameron Winklevoss argues.

According to new estimates, the proposed Infrastructure Bill currently under discussion in Washington would pile on an extra quarter of a trillion dollars in debt.

Bill may add $256 billion in debt

As the contentious bill makes its way through government, crypto voices continue to warn about a potential tax nightmare that, they argue, can still be easily avoided.

As Cointelegraph reported, language in the Bill may place undue demands on holders and businesses alike.

An effort is currently underway from pro-Bitcoin senators and the crypto industry to change Bill’s phrasing to reduce the future burden.

Nonetheless, the Bill in and of itself is a cause for concern on an economic level, Winklevoss says.

“The infrastructure bill is estimated to add another $256B to the federal budget deficit,” the Gemini exchange co-founder tweeted Friday.

“It will not be fully paid for. The plunder of future generations continues. Bitcoin fixes this.”

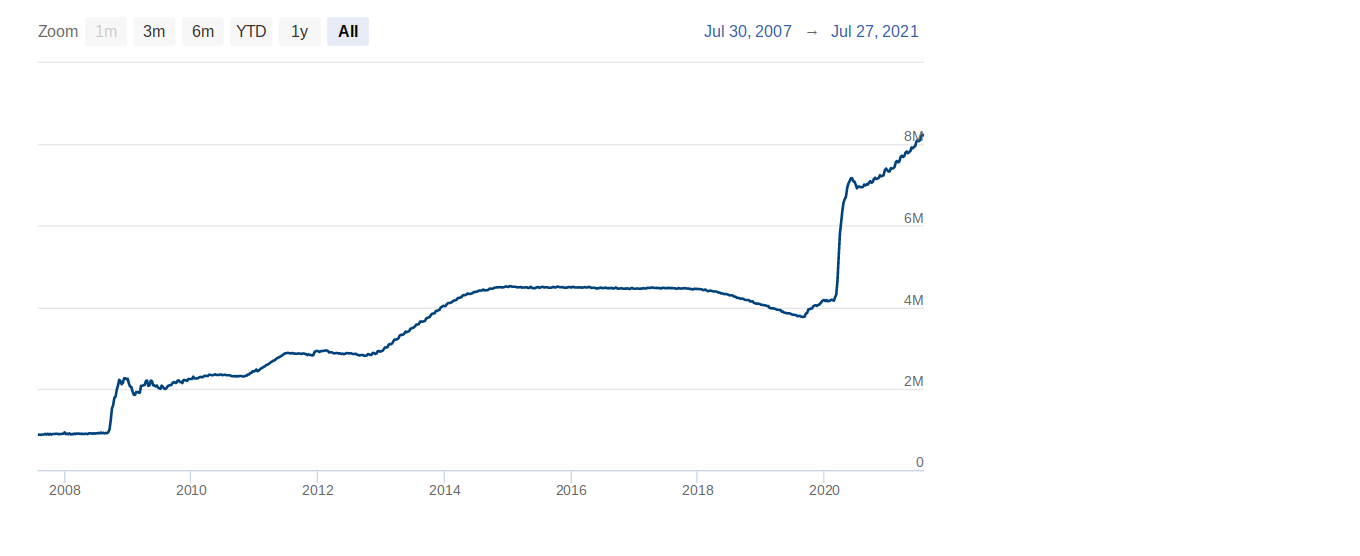

His words come the week after the Federal Reserve saw a new record on its balance sheet, which topped $8.24 trillion for the first time on July 26.

Federal Reserve balance sheet chart. Source: Federal Reserve

More broadly, central banks worldwide have favored the continuation of asset purchases regardless of future debt implications, flagging new variants of the Coronavirus as the impetus.

“The wrinkle, now, is Delta: if Delta causes the labor market to heal much more slowly, then that's going to cause me to step back,” Minneapolis Fed President Neel Kashkari said Thursday, quoted by Reuters.

Caution over BTC price reaction

Short-term headwinds for Bitcoin are thus skewed by progress on the Bill, something which was already forecast to be a major market force this week.

Traders were of mixed opinions on its market impact once passed, with popular Twitter account Pentoshi arguing that Bitcoin has already overcome more significant setbacks.

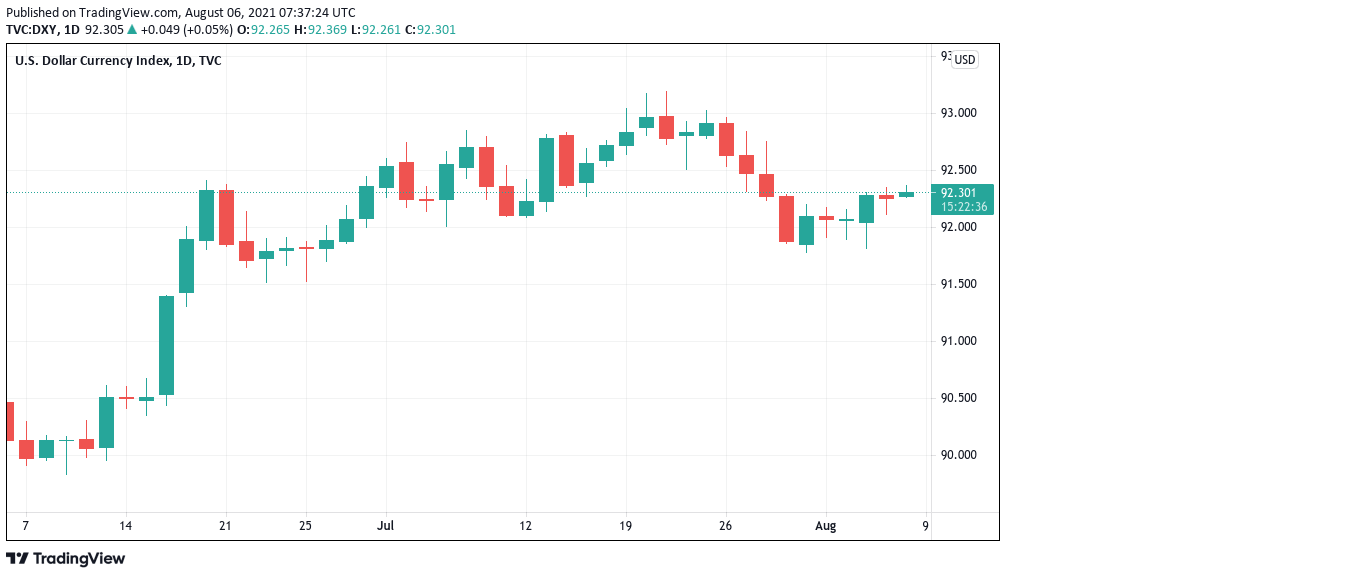

Other macro signals remain more muted, with the U.S. dollar currency index (DXY) treading water after recent volatility.

DXY 1-day candle chart. Source: TradingView

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.