Bitcoin extends its correction to Asian session, liquidations more than double to $660 million

- Bitcoin price crashed 7.53% in the past 24 hours and currently trades at $67,788.

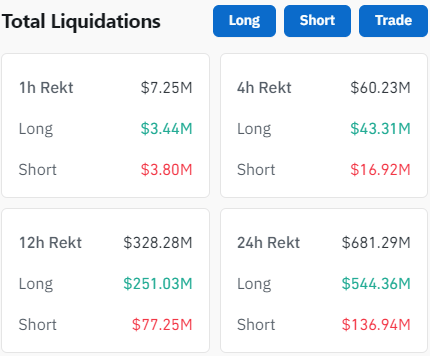

- Coinglass data shows that this BTC move has triggered $657.18 million worth of position to face liquidation.

- The single largest liquidation order occurred on OKX exchange for the BTC -USDT-SWAP worth $13.3002 million.

Bitcoin (BTC) hit an all-time high on March 14 and has been trending lower ever since. Recently, BTC underwent a sudden selling pressure that has caused massive market-wide liquidations.

Bitcoin volatility wipes out nearly 200,000 orders

Bitcoin volatility resulted in long liquidations worth $522.18 million in the past 24 hours. While BTC still has the potential to trade higher in the coming weeks, these liquidations serve as a sobering reminder to temper overconfidence in the market. Notably, Bitcoin alone witnessed liquidations totaling around $219.05 million across both long and short positions, highlighting the extent of market turbulence.

However, amidst the bearish move, significant trading opportunities have emerged for those seeking to take positions in the largest crypto asset. The total number of liquidated orders stands at approximately 193,356, underscoring the widespread impact of the market movement.

Total liquidations

Liquidations occur when traders are forced to close their positions due to insufficient margin to cover their leveraged positions.

Given Bitcoin's dominance, most coins in the market experienced losses, with approximately 90% of the top 100 cryptos posting declines over the past 24 hours.

Why the short-term bearish move?

One potential factor contributing to the short-term bearish movement is the increasing interest of traders in speculative memecoins with low liquidity. Data from crypto intelligence firm Santiment suggests that traders swiftly reallocate profits to these meme tokens with every new BTC high.

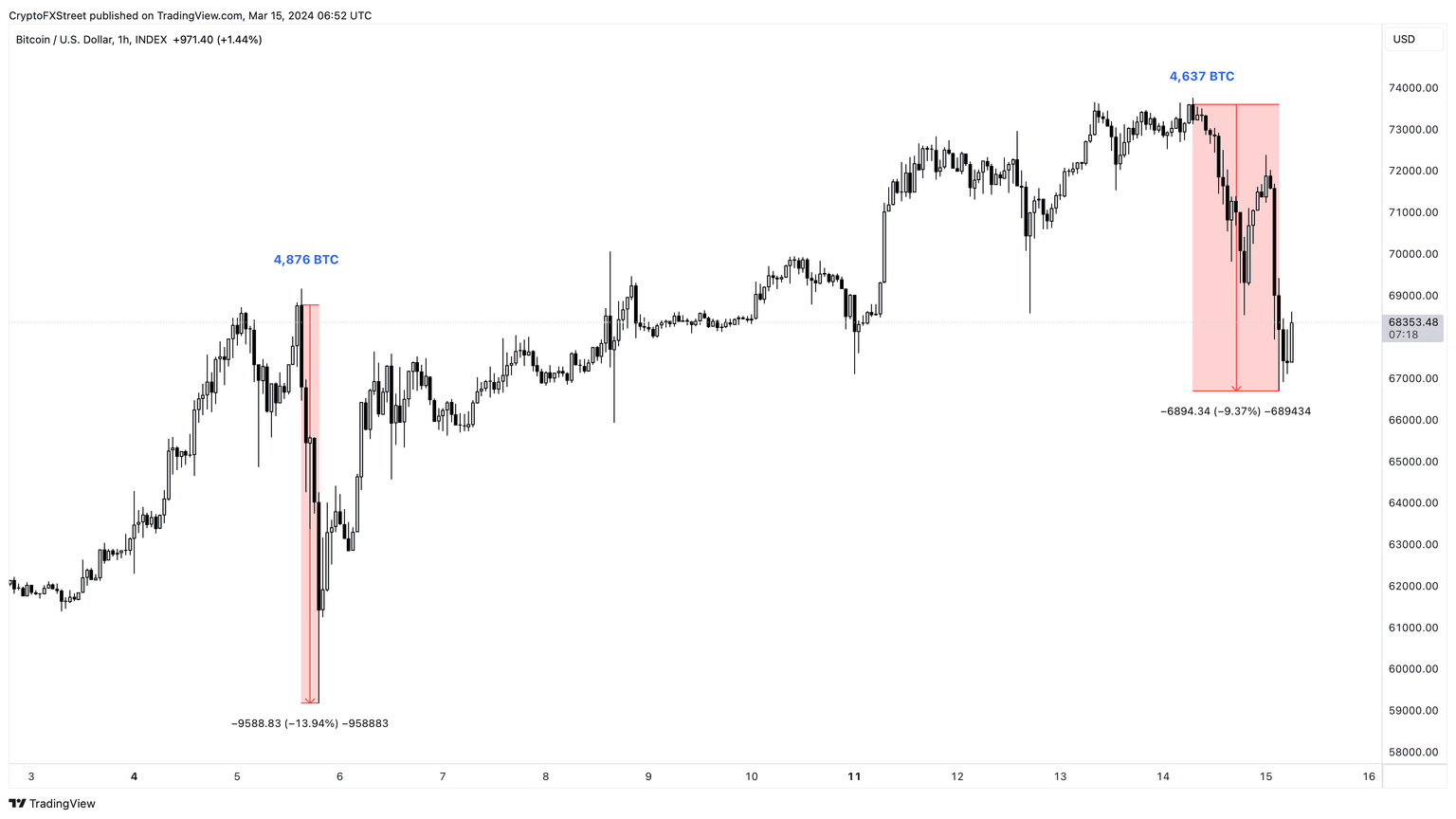

Additionally, the LookOnChain data platform notes that a Binance wallet deposited 4,637 BTC worth nearly $330 million to Binance Hot Wallet in the past 24 hours. Interestingly the same wallet also deposited 4,876 BTC on March 5 as well, which triggered 14% correction.

BTC/USD 1-hour chart

As the market navigates these dynamics, anticipation grows for the Bitcoin halving, with long and short traders poised for a showdown. The interplay of various factors will undoubtedly shape the market's trajectory, highlighting the need for caution and strategic insights among investors.

Read more: Bitcoin price advances to $80K as BTC ETFs now manage more than half as much as Gold ETF assets

Author

FXStreet Team

FXStreet