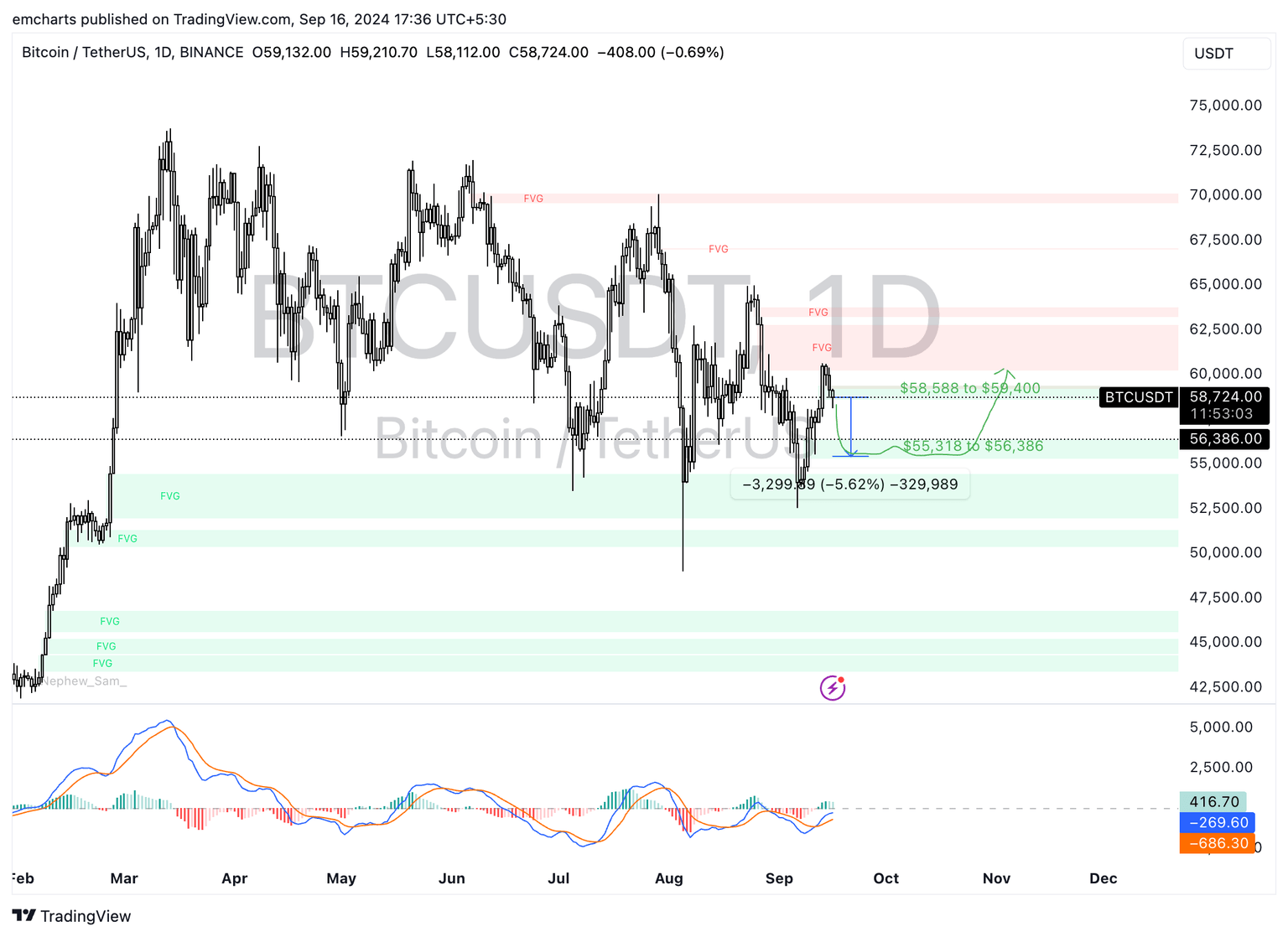

Bitcoin extends correction below the $60,000 level

- Bitcoin corrects on Monday, down nearly 1% as it settles back under the $60,000 level.

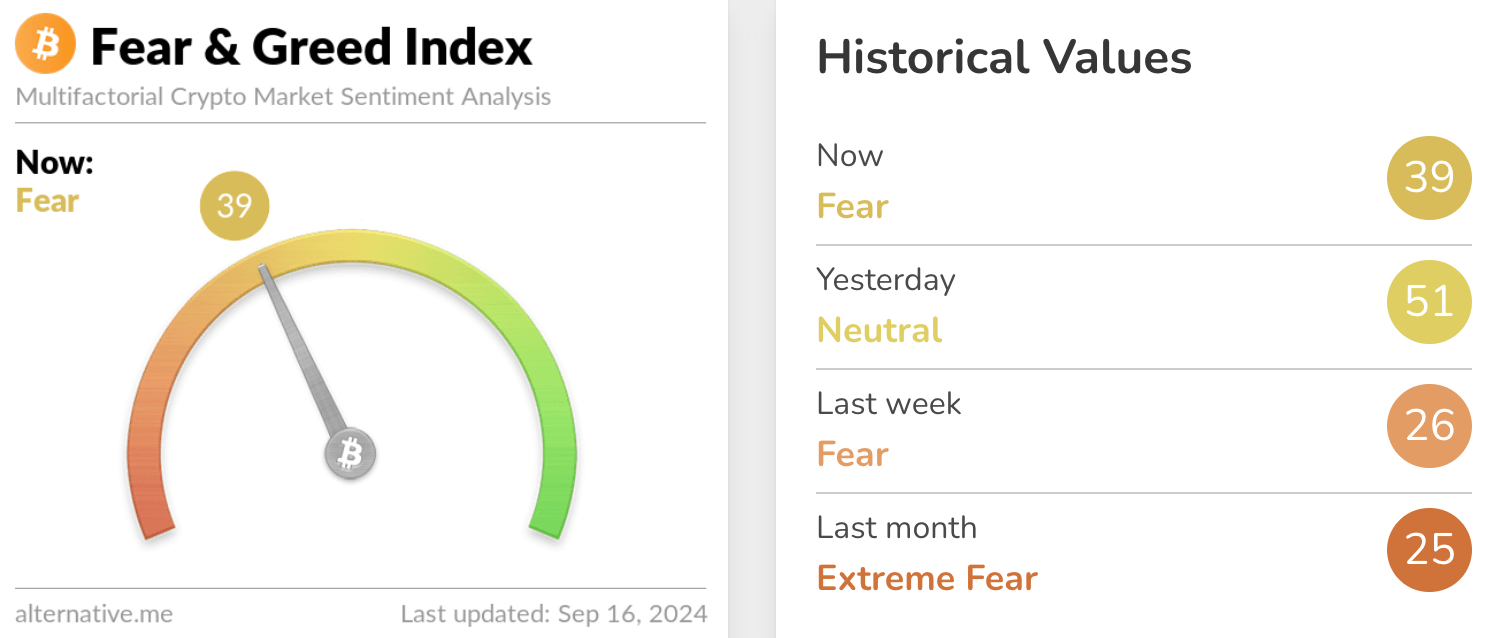

- Crypto Fear and Greed Index flashes “fear” as Bitcoin erases recent gains.

- Bitcoin traders continue to take profits, with nearly $720 million in profits realized in the last six days.

Bitcoin (BTC) extends correction and erases Friday’s gains after being unable to hold above the psychologically important $60,000 level over the weekend. Since Saturday’s opening, BTC erased nearly 3% of its value and trades near $58,500 at the time of writing on Monday.

The crypto Fear and Greed Index, which measures the sentiment among market participants on a scale of 0 to 100, shows “fear” among traders.

Bitcoin loses value over the weekend and Monday

Bitcoin, the largest cryptocurrency by market capitalization, has been correcting since the weekend. BTC suffered a drop after being unable to hold above the psychological level of $60,000.

The Crypto Fear and Greed Index turned neutral when Bitcoin made a comeback above $60,000 on Friday. Since the asset’s dip below the key level over the weekend, the Index is back at “fear” levels. This shows the importance of the $60,000 price level for the asset’s traders.

Bitcoin Fear & Greed Index

Data from crypto intelligence tracker Santiment shows that Bitcoin traders have consistently taken profits, nearly $720 million in realized gains between September 10 and 16, at the time of writing, as measured by the Network Realized Profit/Loss metric (NPL), which tracks the net realized profit/loss of all tokens traded in a day.

Large-scale profit-taking could push prices lower since it increases selling pressure on BTC.

Bitcoin price and NPL

Where is Bitcoin headed?

Bitcoin could extend losses and sweep liquidity at the lower boundary of the Fair Value Gap (FVG) between $55,318 and $56,386. From the current level, BTC could erase nearly 6% of its value to reach the target of $55,318, the September 8 high.

The Relative Strength Index (RSI), a momentum indicator, hovers above 50 on the daily timeframe at 50.40. RSI at 50 marks the neutral level, meaning Bitcoin is neither overbought nor oversold and signalling a lack of directional momentum.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars above the neutral line, signaling underlying positive momentum in Bitcoin’s price trend. Bitcoin could try a recovery once it sweeps liquidity in the imbalance zone and attempts a rally to the $60,000 level, a psychological barrier.

BTC/USDT daily chart

Looking down, BTC could find support at the September 6 low of $52,550, this marks the lowest level for Bitcoin this month.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B12.55.52%2C%252016%2520Sep%2C%25202024%5D-638620887169960798.png&w=1536&q=95)