Bitcoin drops to $21,600 despite new all-time high in mining difficulty, is this a sign to short BTC?

- Bitcoin mining difficulty hit a record high at 39 trillion hashes, hash rates near the peak level.

- BTC price slumped 4% overnight, hitting a local low of $21,600, after the US financial regulator’s crackdown on crypto staking services.

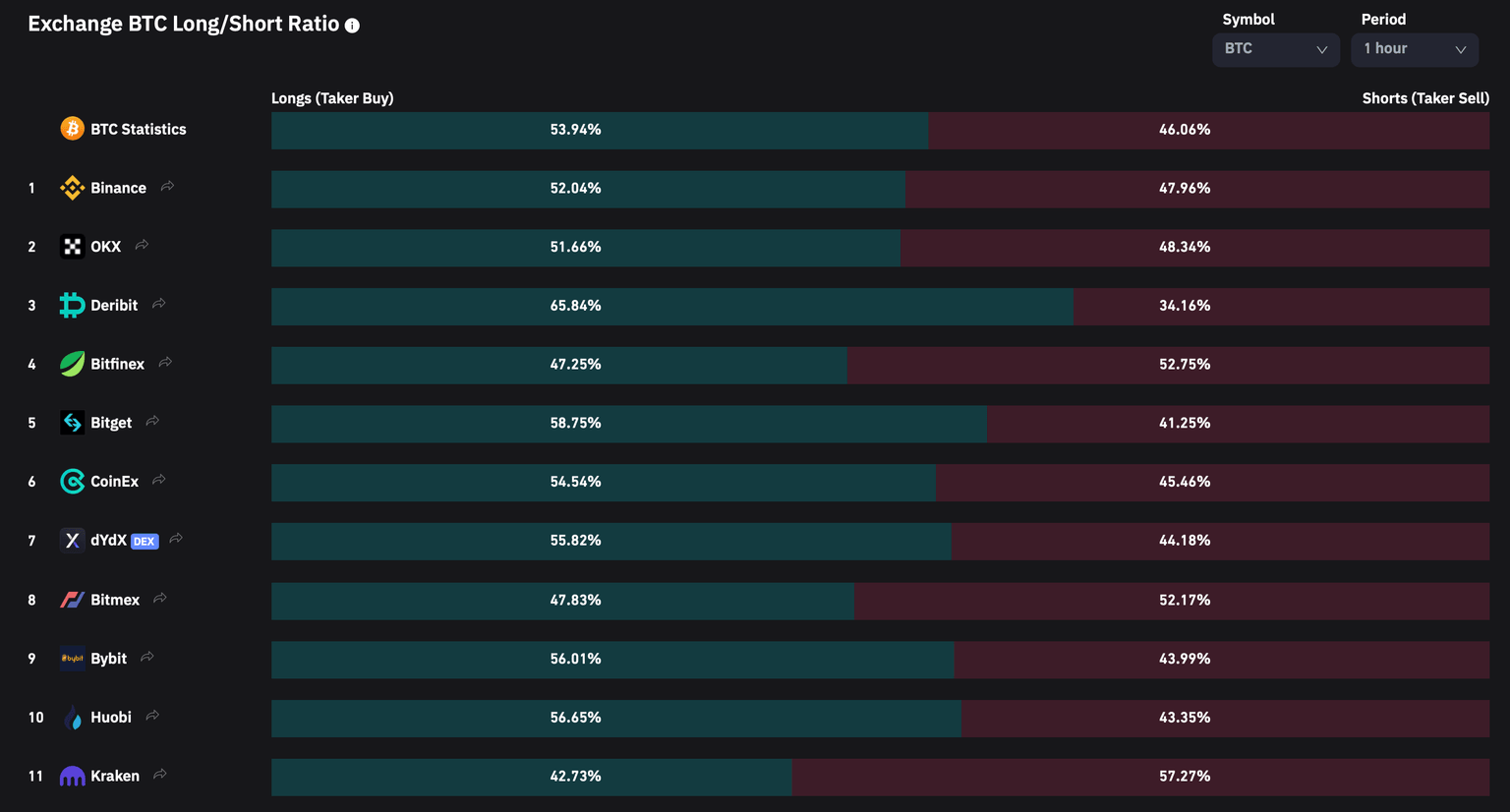

- Bitcoin traders’ short positions exceed longs on top derivatives exchanges dYdX, Kraken and OKX.

Bitcoin price wiped out its recent gains, dropping to a local low at $21,600. Mining difficulty hit a new all-time high at 39 trillion hashes, increasing the pressure on miners in the Bitcoin ecosystem. Volume of short positions on top derivatives exchanges exceeded longs as BTC price plummeted.

Also read: Is Bitcoin price out of the woods? Derivatives traders bet on massive rally in BTC

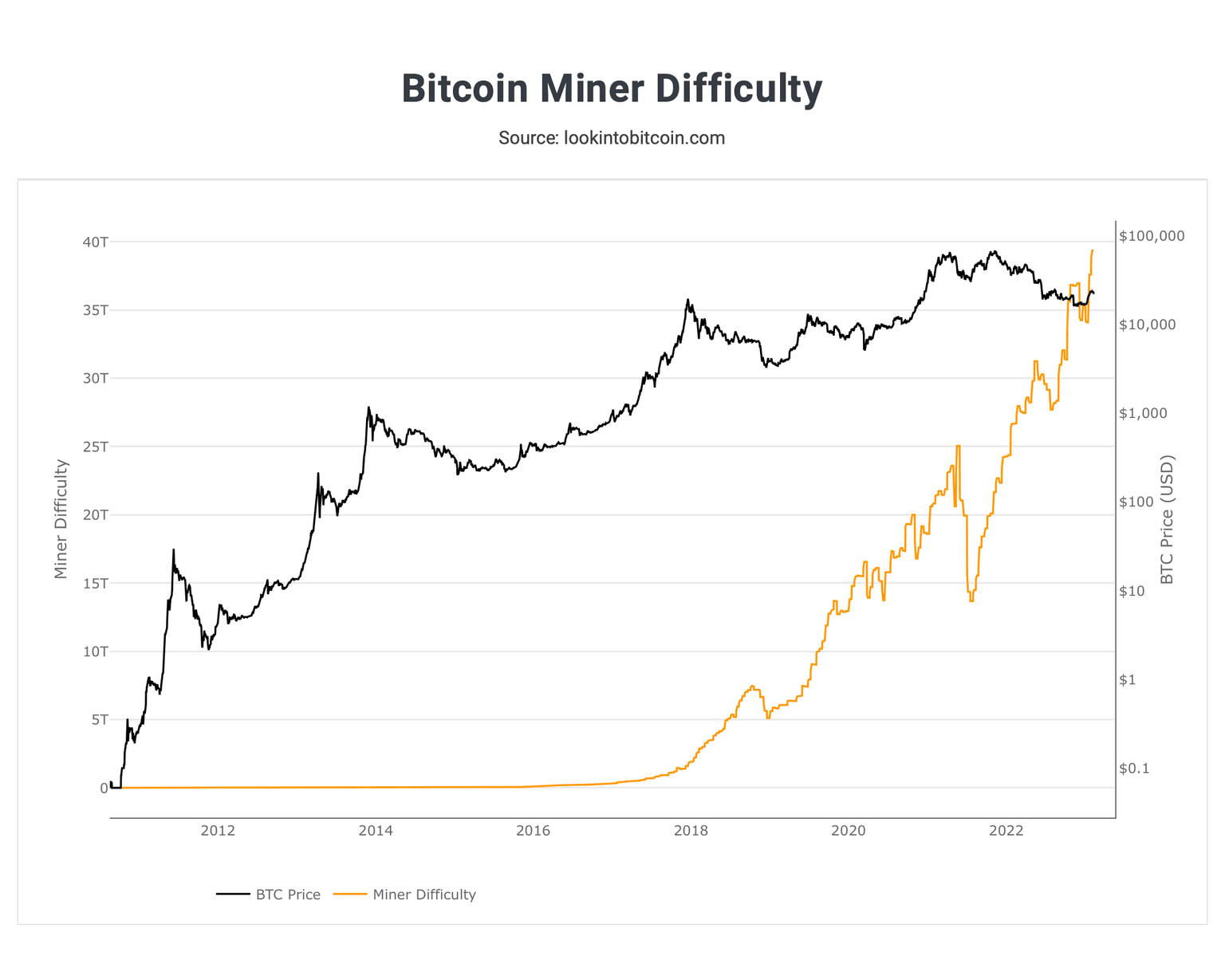

Bitcoin mining difficulty hits record high

Bitcoin network’s difficulty has hit its highest level at 39.35 trillion hashes. Mining difficulty has hit peak levels, implying that it is harder than ever for miners to secure the next block. BTC miners must perform 39.35 trillion hashes to find the next Bitcoin block. Difficulty is the measure of the competition between miners on the network to produce a block.

Bitcoin Miner Difficulty

Bitinfocharts reported a hash rate of 300 exahashes per second EH/s, just shy of its late January peak of 316 EH/s. These developments have hit mining profitability and the metric plummeted to multi-year lows. Since February 2022, mining profitability has tanked 66% to current levels.

Bitcoin bleeds under regulatory crackdown and selling pressure

Bitcoin price is negatively influenced by US financial regulator Securities and Exchange Commission’s regulatory crackdown on Kraken for its crypto-as-a-staking product. Colin Wu, a Chinese reporter shared details of the SEC’s charges against the cryptocurrency exchange platform.

The U.S. SEC charged Kraken with failing to register the offer and sale of their crypto asset staking-as-a-service program and advertise annual investment returns of as much as 21 percent. Kraken agreed to immediately cease staking products and pay $30 million penalties.

— Wu Blockchain (@WuBlockchain) February 10, 2023

Selling pressure on the asset increased, sending BTC to a local low at $21,600. Short positions have overtaken longs on derivatives exchanges.

Based on data from Coinglass, there is a massive increase in short positions on dYdX, Kraken and OKX.

Exchange BTC Long/Short ratio

The high percentage of short positions versus longs indicate the bearish bias towards Bitcoin, among derivatives traders on cryptocurrency exchange platforms.

Is this the right time to short Bitcoin?

Crypto traders on Twitter shared their profitable BTC short setups as Bitcoin price dropped to local low at $21,600. Akash Girimath, cryptocurrency analyst at FXStreet shared his setup for a profitable BTC short of 316%. The expert opened the short at an entry price of $23,383 and tooke profits when BTC nosedived to $21,857.

When patience pays off: $BTC https://t.co/WdqanK5trv pic.twitter.com/8AkRo7IB04

— Akash (@Mangyek0) February 10, 2023

Traders at a trading group “Castillo Trading” booked 40% profits with Bitcoin’s decline from $23,663 to $21,827.

Bitcoin price has sustained above the $21,000 level, trading at $21,700. The leading cryptocurrency is in a short term downtrend, it is therefore expected to continue declining in the short term.

The pair has declined below the support zone between $22,351 and $23,362. A break above $22,351 would imply a bounce is in progress with a likely run up to the top of the support zone at $22,362.

Based on the Bitcoin 1D price chart, $21,286 is a key support level for the asset and a decline to this level could be followed by a recovery and an attempt to break into the support zone that starts at $22,351.

BTC/USDT price chart

With derivatives traders exhibiting a bearish bias, the asset’s uptrend has come to a grinding halt. There is a likelihood of recovery in the short-term if BTC price sustains above the $21,286 level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.