Bitcoin, Cryptocurrencies Back in the Red

Bitcoin (-3.5%) and altcoins are losing ground and are back in the red. The worst performers in the last 24 hours are Litecoin(-5.05%), Bitcoin Cash (-6.12%), Tezos (-6.29%), Ethereum Classic (- 6.12%), and Bitcoin SV (8.5%). Among Ethereum Tokens, LINK(-5.1%), OMG(-6%) and HOT (- 6.6%) are the worst performers, while BAT (+7,8%) , JWL (+10%), THETA(+11%), and ANT (36.6%) are the most acquired assets.

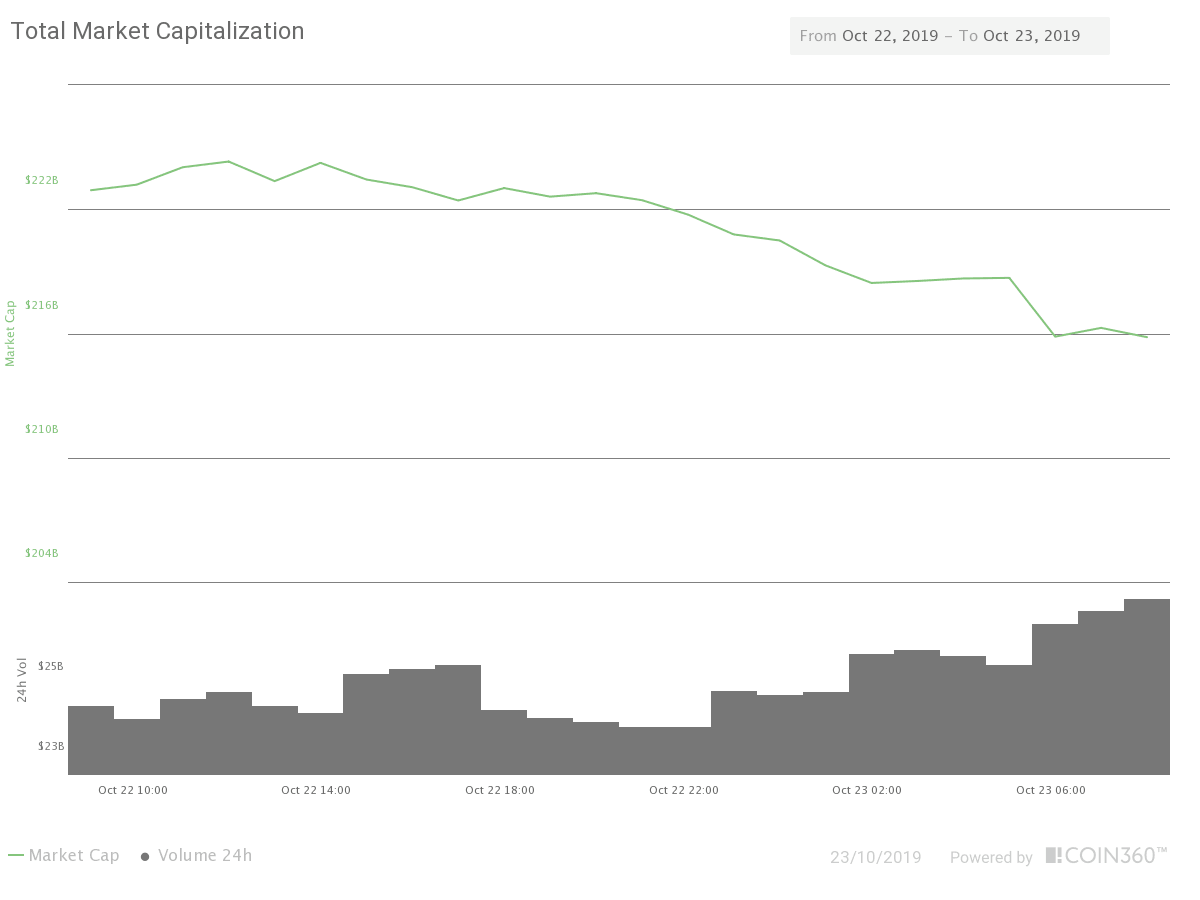

The Market capitalization of the cryptocurrency sector went down to $215.822 billion (-3.07%), and traded volume during the last 24 hours ascended to $27.43 billion (+13.54%). Finally, the market dominance of Bitcoin decreased a bit to 66.32%.

Hot News

TBCASoft, IBM, and SoftBank announced a blockchain-based cross-carrier system (CCPS) for mobile payments. This payment system would enable its users for payments using their phones on local merchants. CCPS is designed for interoperability across different telecom carriers, which should allow the creation of a network of merchants accessible to users of the CCPS system.

OKEx leading exchange platform launches an initiative for the creation of a Global self-Regulated Organization(SRO) aimed at standardizing exchange practices and policies. This idea was launched at the Malta Summit by Enzo Villani, OKEx Head of International Strategy and Innovation, and former Nasdaq executive.

Yesterday, Rep. Sylvia Garcia introduced a new bill before the Senate House Financial Services Committee to classify stablecoins under securities. The bill, aimed at put Libra under the control of the SEC, would affect the rest of the stablecoins such as Tether, whose market cap is about 4.1 billion.

Technical Analysis

Bitcoin

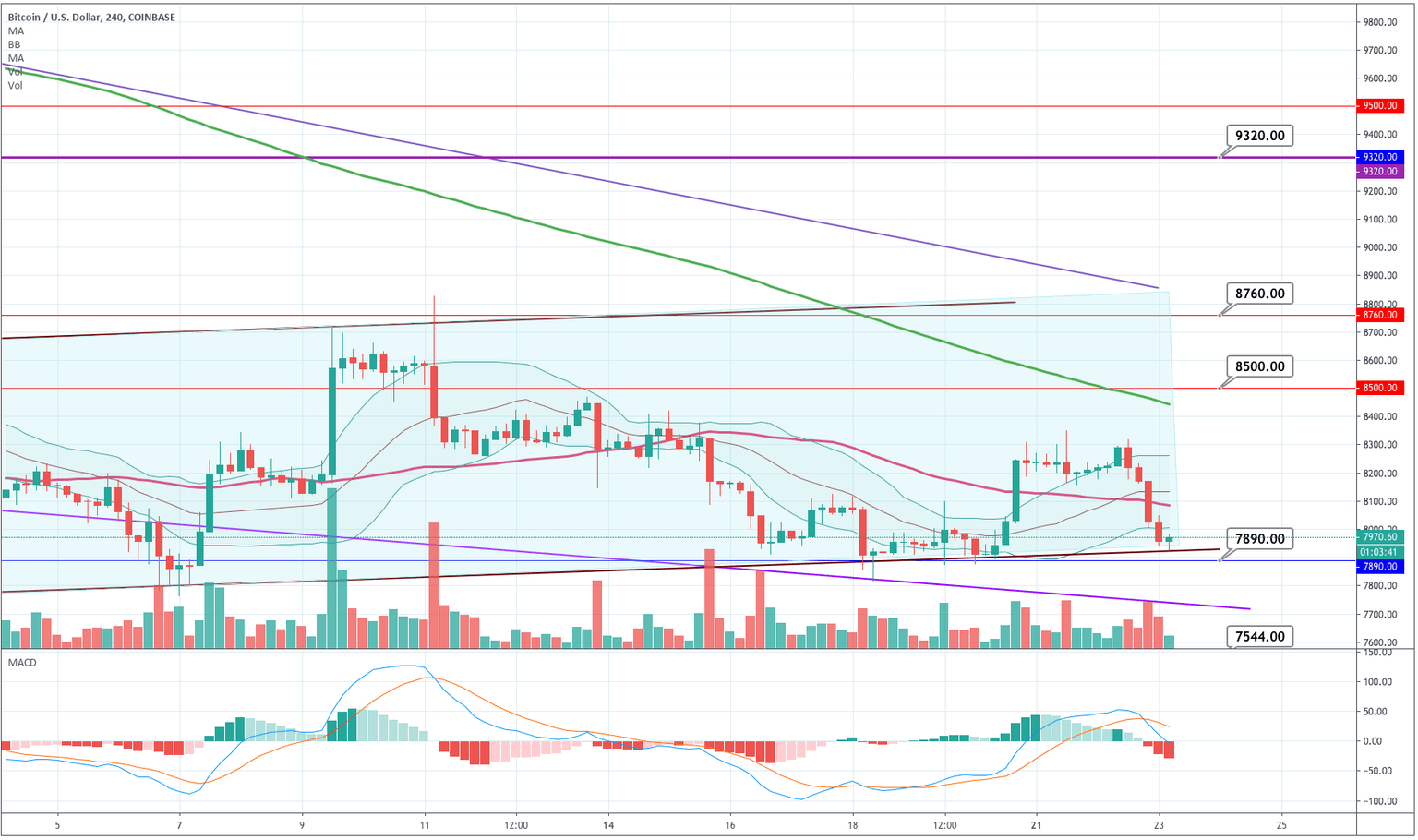

Yesterday, after a final attempt to break the $8,300, Bitcoin's buyers gave up, and the price dropped in a continuous string of red candles to its 7,920 support. The price is now sitting in the lower trendline of its slightly ascending channel.

From a technical perspective, the price is below the 200, 50, and 20-period moving averages and the MACD is in a bearish phase. But it is also moving in an ascending channel and is at support levels.

The critical level to observe is $7,890. If it is pierced, it will call for more downside. To the upside, an unlikely movement back to the upper side of the Bollinger bands would mean another bounce to the $8,200 $8,300 area.

| Supports | Pivot | Resistances |

| 7890 | 8,150 | 8500 |

| 7544 | 8750 | |

| 7280 | 9100 |

Ripple

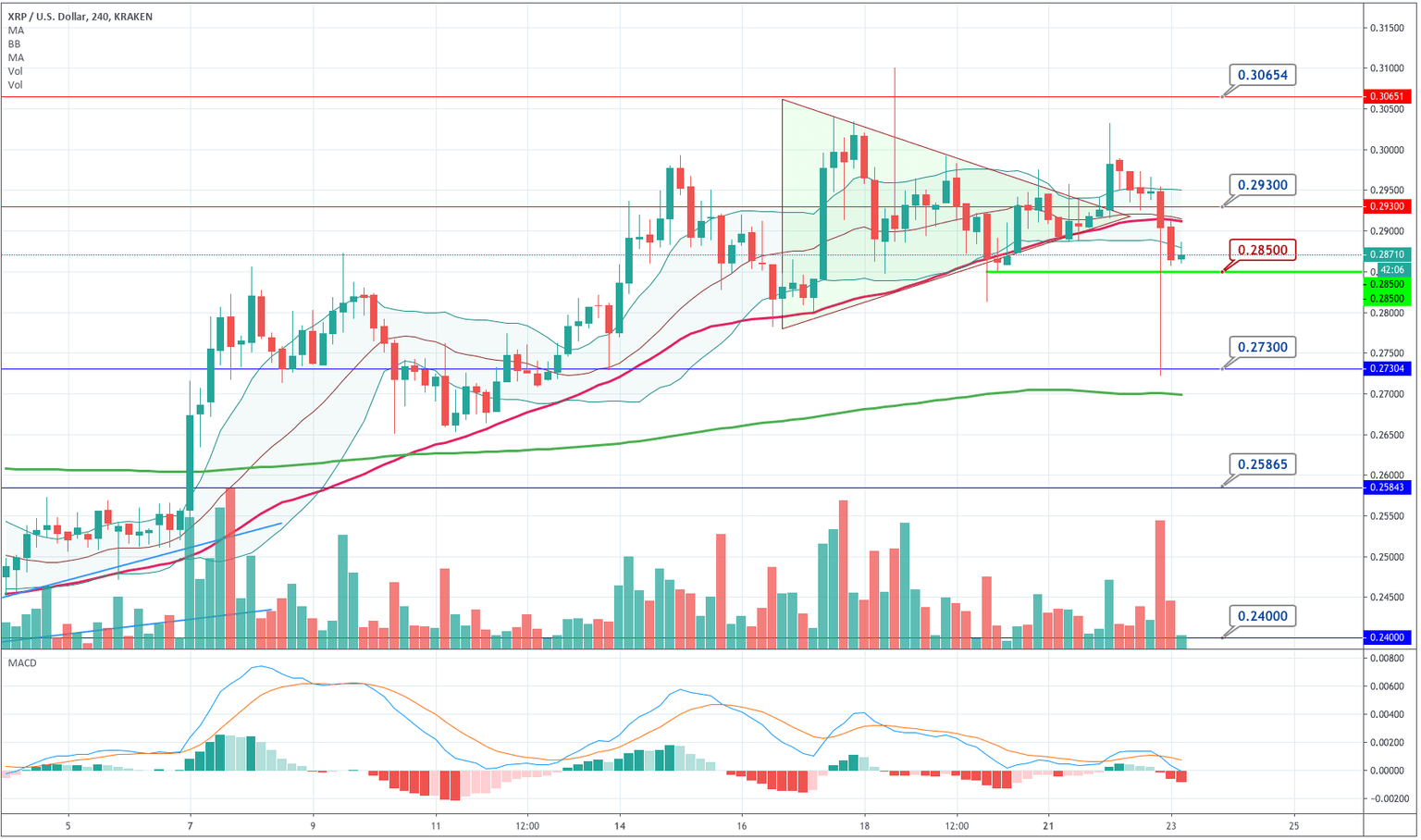

Ripple's triangular formation was broken to the upside, but it failed and went southwards on a sharp selloff spike, which went to $0.27 and retraced up. Now its price is above the $0.285 support level. The MACD and the price below the -1SD Bollinger line has changed the outlook of Ripple's trend. It is still possible that its price action is kept contained in a range between 0.285 and 0.30, but the technical signals point to a bearish bias.

The critical level to observe here is, obviously, $0.285. A Breakdown of this level would drive XRP down to visit $0.273 again.

| Supports | Pivot | Resistances |

| 0.277 | 0.293 | 0.306 |

| 0.261 | 0.325 | |

| 0.244 | 0.343 |

Ethereum

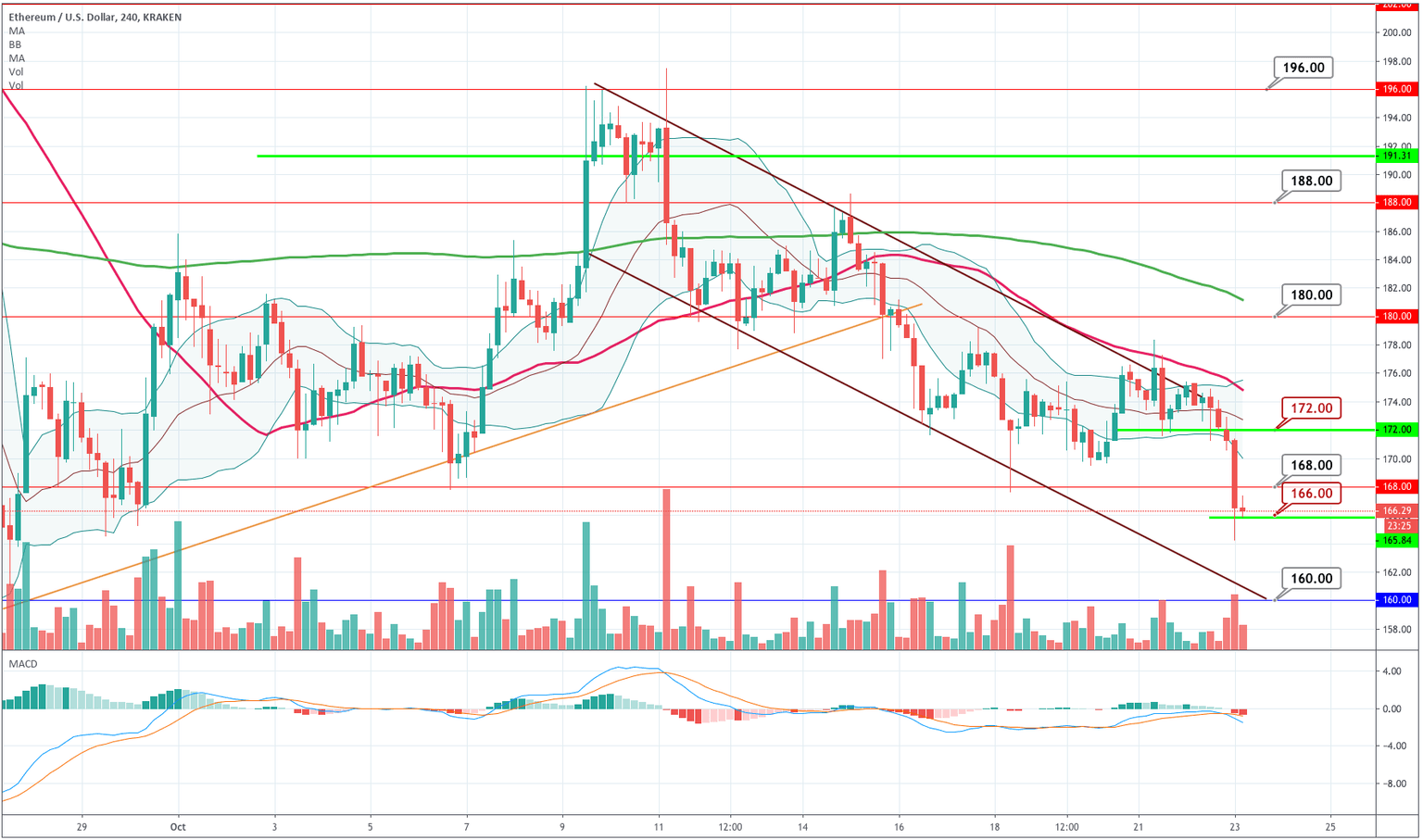

Ethereum broke the $172 level and descended on increased volume, also breaking the $168 support. Now the price is retracing a bit, as it has a short-term oversold condition. All indicators point to a bearish trend in the 4H chart with a potential visit to the $160 level soon.

The low of the current candlestick is the level to observe for a breakdown, although the oversold condition points to a short-term correction of this drop.

| Supports | Pivot | Resistances |

| 166 | 177 | 188 |

| 156 | 198 | |

| 153 | 208 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and