Bitcoin cleared $70,000 and Ethereum, $4,000: What’s next for crypto?

- Bitcoin and Ethereum prices have cleared the $70,000 and $4,000 psychological levels, respectively.

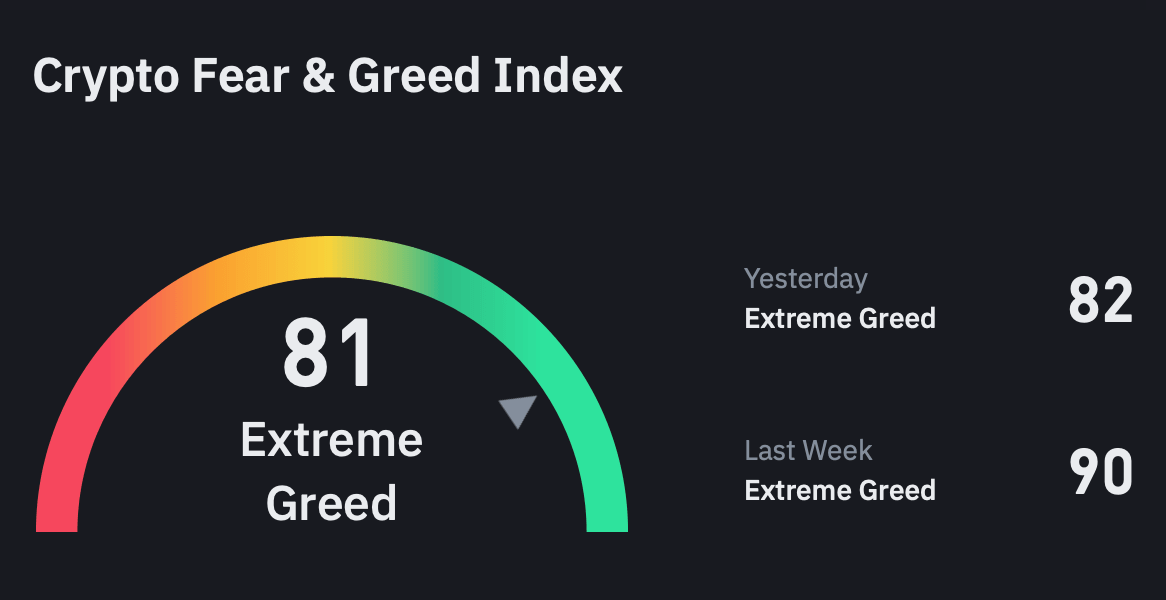

- This development has pushed the Fear and Greed index to extreme greed as the indicator points to 81.

- Major altcoins seem to have stopped in time as they move sideways, devoid of volatility.

The cryptocurrency bull rally that started in January 2023 is going strong, with Bitcoin clearing old all-time highs (ATH) at $69,000 and Ethereum clearing the $4,000 psychological level. This cycle has caused many altcoins to grow by multiples in short durations. But as BTC dominance reaches April 2021 levels, what’s next for crypto markets?

Also read: El Salvador is sitting on $84M profit from its Bitcoin holdings

Crypto market sentiment screams cautiousness

The Fear and Greed Index (FGI) stands at 81, which indicates that the crypto markets are in “extreme greed” conditions, where potential corrections could erupt due to profit-taking.

The FGI ranges from 0 (extreme fear) to 100 (extreme greed), reflecting crypto market sentiment. The lower range, aka extreme fear, signals that the markets are oversold, while the upper limit indicates that a potential market correction could be around the corner.

Crypto Fear & Greed Index

Bitcoin dominance on the rise

Bitcoin dominance, the ratio of BTC’s market capitalization vs. the rest of the crypto market, is currently hovering around 54.05%. In less than two months, Bitcoin dominance has risen roughly by 8 percentage points and is fast approaching a tipping point of 56.62%. This level is the midpoint of the 39.62% to 73.63% range formed in the first two quarters of 2021.

Typically, a declining Bitcoin dominance suggests that investors are interested in altcoin opportunities and vice versa. The recent spike suggests that altcoin profits or new capital could be moving back to BTC. Additionally, the London Stock Exchange (LSE) accepting BTC was a factor that helped Bitcoin’s price to break above $70,000.

BTC Dominance

The rise in BTC dominance, while bullish for Bitcoin, could translate into a potential correction for altcoins.

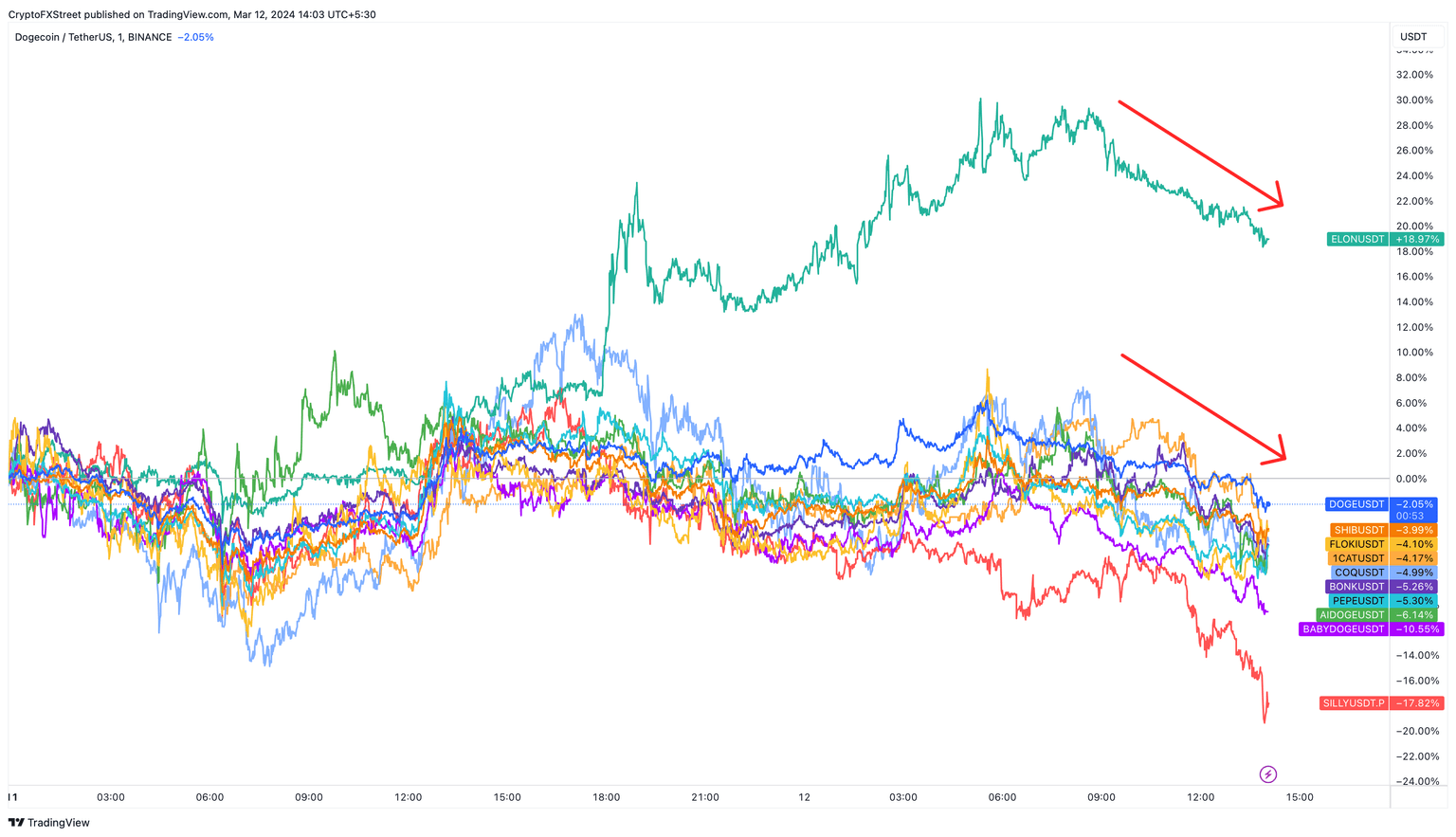

Evaluating potential altcoin market reset

A hypothetical scenario that could occur in the next few days is that altcoins lose momentum as BTC's dominance continues to rise. This outlook could push investors to book partial profits, causing altcoins to slide lower.

Dogwifhat (WIF), Pepe coin (PEPE), Dogecoin (DOGE), Shiba Inu (SHIB), and other meme coins that noted a raging rally in the past few weeks are already correcting.

Eventually, this profit-taking scenario could spread to major altcoins like Solana (SOL), Avalanche (AVAX), Wordlcoin (WLD), and Fetch.aI (FET), pushing investors to convert their unrealized gains into profits.

Meme coin performance

Other considerations

While a potential correction could be brewing, some altcoin exceptions could trend higher. These altcoins could rebel against the dominant trend and potentially rally with Bitcoin.

Read more about trending altcoins here - link

Here are the top three altcoins that could rebel against a potential correction and rally higher:

- Arbitrum (ARB): The Arbitrum Gameathon, which began on Monday, has already caused gaming tokens to surge in the past week. This event will end on March 18, which means it could continue to influence gaming-related altcoins.

- Worldcoin (WLD): The Artificial Intelligence (AI) ecosystem could see a massive uptrend due to the upcoming Nvidia AI conference, which will take place from March 18 to 21.

- Ethereum Dencun upgrade: This much-awaited upgrade will be implemented on March 13, making prices of ETH-related altcoins like Arbitrum (ARB), Optimism (OP), LidoDAO (LDO) and others to shoot up.

Also more: Arbitrum Arcade launch could fuel narrative for crypto gaming tokens

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.