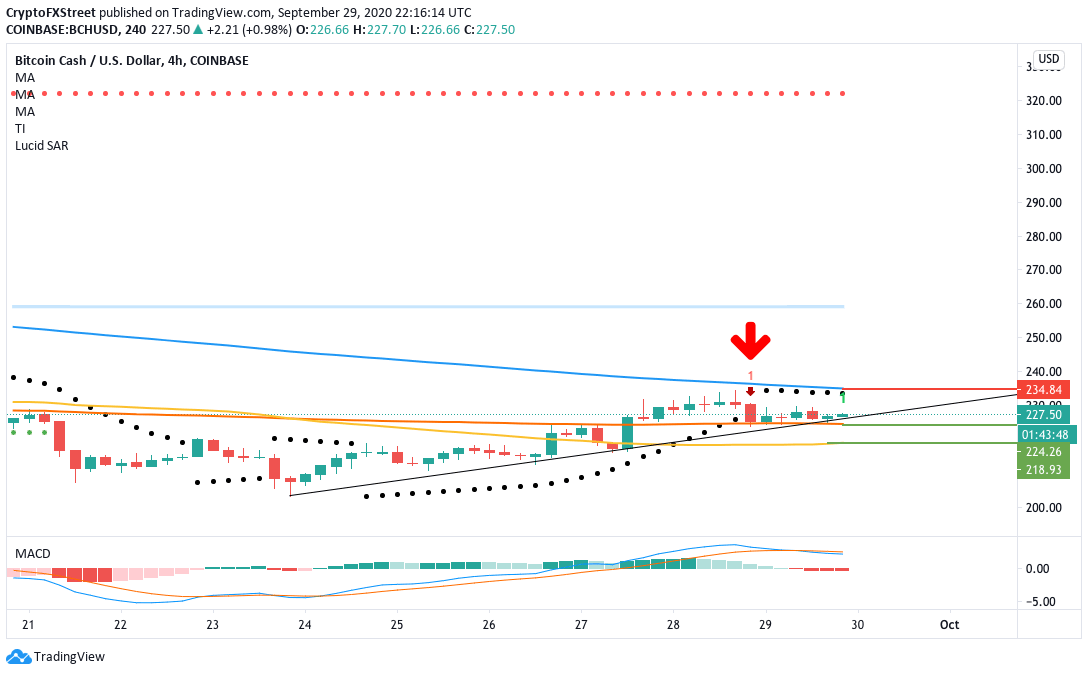

Bitcoin Cash Price Analysis: BCH flashes sell signals in 4-hour and 12-hour charts

- The parabolic SAR has reversed from bullish to bearish in the 4-hour chart.

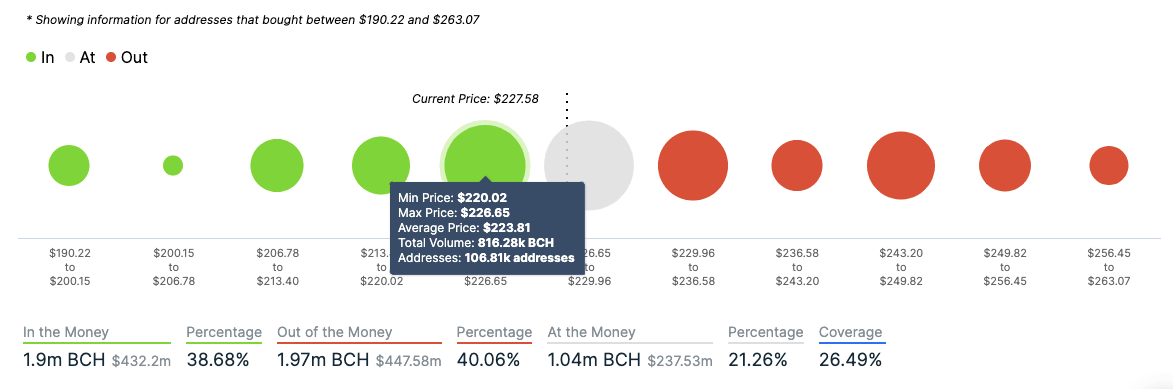

- The IOMAP shows that the price is currently sitting on top of a healthy support wall.

The BCH 4-hour chart flashed a sell sign in the TD sequential indicator. After flashing the signal, the price has been trending horizontally over the next six sessions.

BCH needs to break below the upward trending line and the SMA 200 ($224.25) to validate that sell signal and strengthen the downtrend. The parabolic SAR and MACD are both bearish, which shows that the price should ideally break below this period of consolidation. However, why is the price consolidating in the first place instead of going down? For that, we need to look at the IOMAP.

BCH IOMAP

IntoTheBlock’s “In/Out of the Money Around Price” model (IOMAP) shows us that BTC is presently sitting on top of a strong support wall at $223. At this level, around 106,810 addresses had previously purchased 816,280 BCH. As per the IOMAP, this support wall absorbs a lot of the selling pressure, which is preventing the downward trend, for now. However, if the sellers do break below this level, they may have enough momentum to take the price below $200.

On the upside, we have a moderate-to-strong resistance level, $233. In this level, 96,400 addresses had bought 594,000 BCH.

BCH 12-hour chart

The 12-hour chart helps us gain a better understanding of the potential price action. The latest candlestick has also flashed a sell signal in the TD sequential indicator. To solidify this downtrend, the price must break below the SMA 50 ($224) to have a bearish breakout from the flag formation. Following this, the price will probably drop down to the $214.45 support level. The relative strength index (RSI) is trending around the neutral zone, which shows that the sellers have plenty of room to move before the asset becomes undervalued.

BCH Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.