Bitcoin becomes this cohort’s target after capitulating for the sixth time in history

- Trading at $19,200, Bitcoin has been unmoved for more than a month straight, minimizing windows of profits.

- The net unrealized losses ratio to relative profits shows that BTC is still in capitulated thanks to a lack of recovery.

- Long-term holders might use this opportunity to accumulate Bitcoin as this is the ideal time.

Bitcoin, which once reigned at $67,000, is struggling to even close above $20,000 successfully today. The fall of the crypto market has left investors yearning for an exit, but the global markets’ bearishness is keeping the crypto market subdued as well.

Following the failed recovery back in September, Bitcoin is back at the lows that might support a bullish bias.

Bitcoin capitulates again

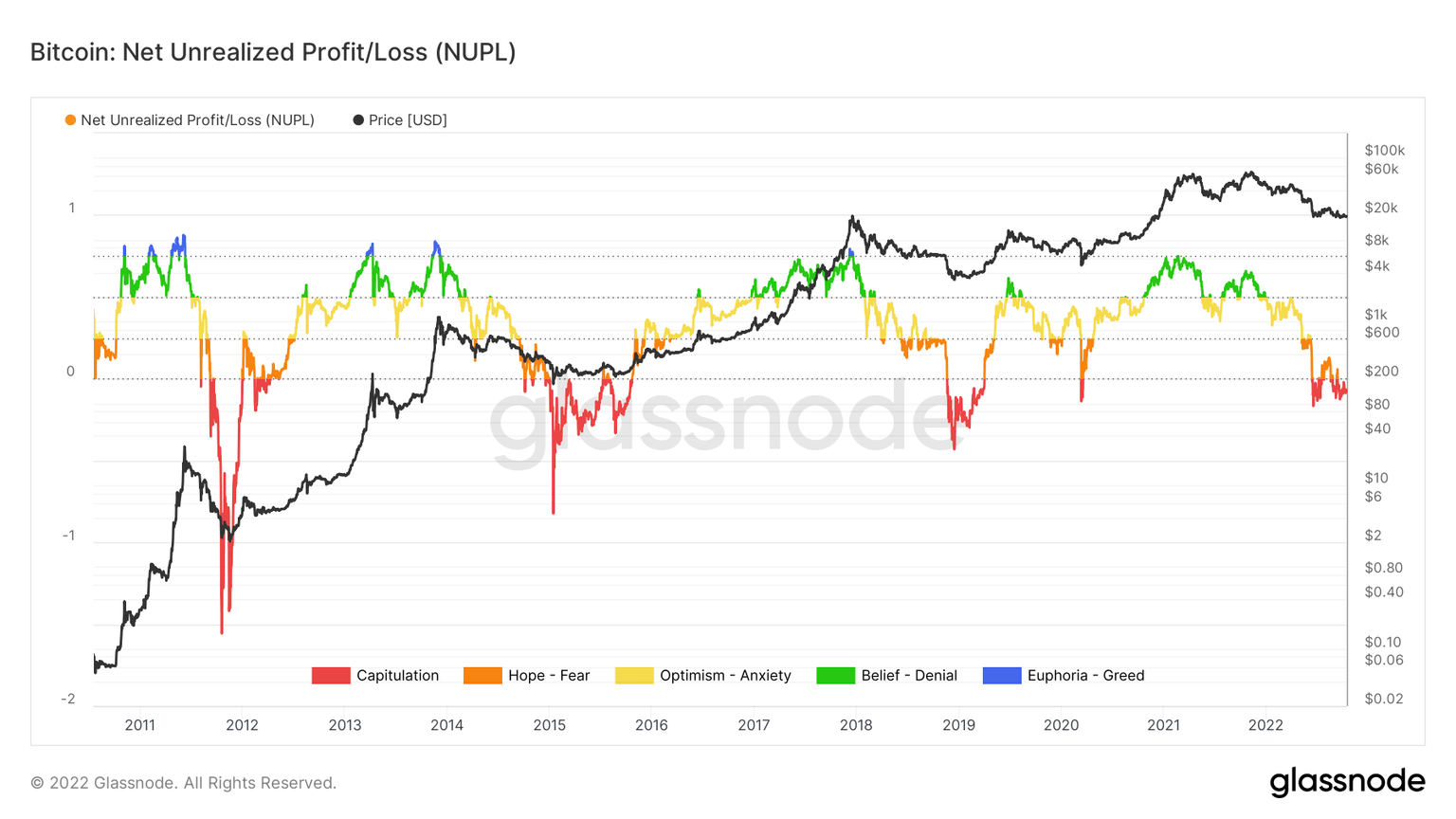

According to the Net Unrealized Profit/Loss (NUPL) ratio, Bitcoin is cushy in the capitulation zone, which it entered for the second time this year alone. The crash of June was the first time that BTC visited these lows, and it recently went back down in August after BTC fell from $23,000 to $19,000.

This year stands to be one of the most disappointing years for the crypto market in terms of profits. Not only is this Bitcoin’s second capitulation this year, but the sixth in its entire 12-year history.

Usually, this low is a sign of trend reversal, but that is no longer a certainty given Bitcoin’s growing correlation with the broader markets. As of last month, the correlation shared between BTC’s price and the S&P 500 index stood at 0.59, and the same with NASDAQ reached 0.62.

Furthermore, Trading at $19,200 at the time of writing, BTC has seen no change in its price in over a month due to the lack of bullish cues. Treading just above the critical support line of $18,600, BTC is still under the 50-day Simple Moving Average (SMA) as well as the 100-day SMA.

It is cues as such that evince just how much longer investors will have to wait in order to regain their profits.

Long-term holders back at it

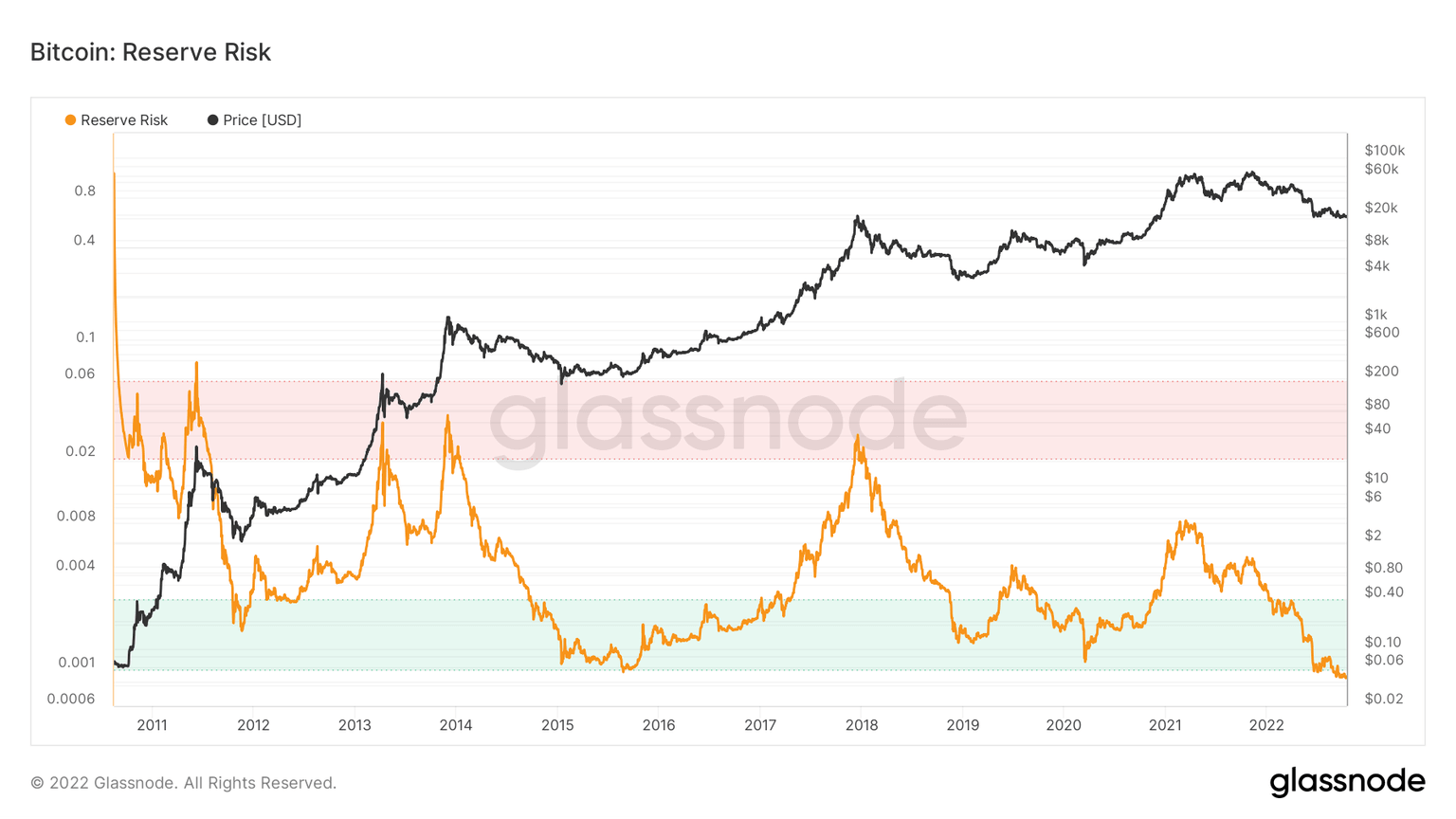

The one cohort that can certainly make the most even of this situation is the long-term holders (LTH). According to the Reverse Risk, this cohort is just below the ideal zone of accumulation that has been the indicator’s home for almost the entire year.

During periods of high confidence and low price, BTC presents an attractive risk/reward to invest, which LTH can benefit from, provided there is a potential for recovery. As mentioned above, this could take time but since the average time a Bitcoin is held by LTHs is at three years, they might just end up accumulating.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.