Bitcoin-based meme coin ORDI price action wobbles after 1,100% rally

- ORDI price breached the $60 level over the past day, bringing its value to $62.

- ORDI's bullishness has been wavering over the past few trading sessions on a short-term scale.

- Once Bitcoin's bull run stops, selling may become rampant as investors capitalize on ORDI's 1,104% rally.

The Bitcoin-based BRC-20 meme coin, which had people confused as being an actual valuable token, is now slowly creeping up to that status. ORDI price rise over the past couple of days has been astonishing, and with BTC driving the price and crossing $44,000, ORDI is also gaining rapidly. But not for long

ORDI price might see a correction

ORDI price rally first made headlines back at the beginning of November when the Bitcoin-based meme coin was mistaken as the native token of Ordinals protocol. While this was corrected soon after, the altcoin did not.

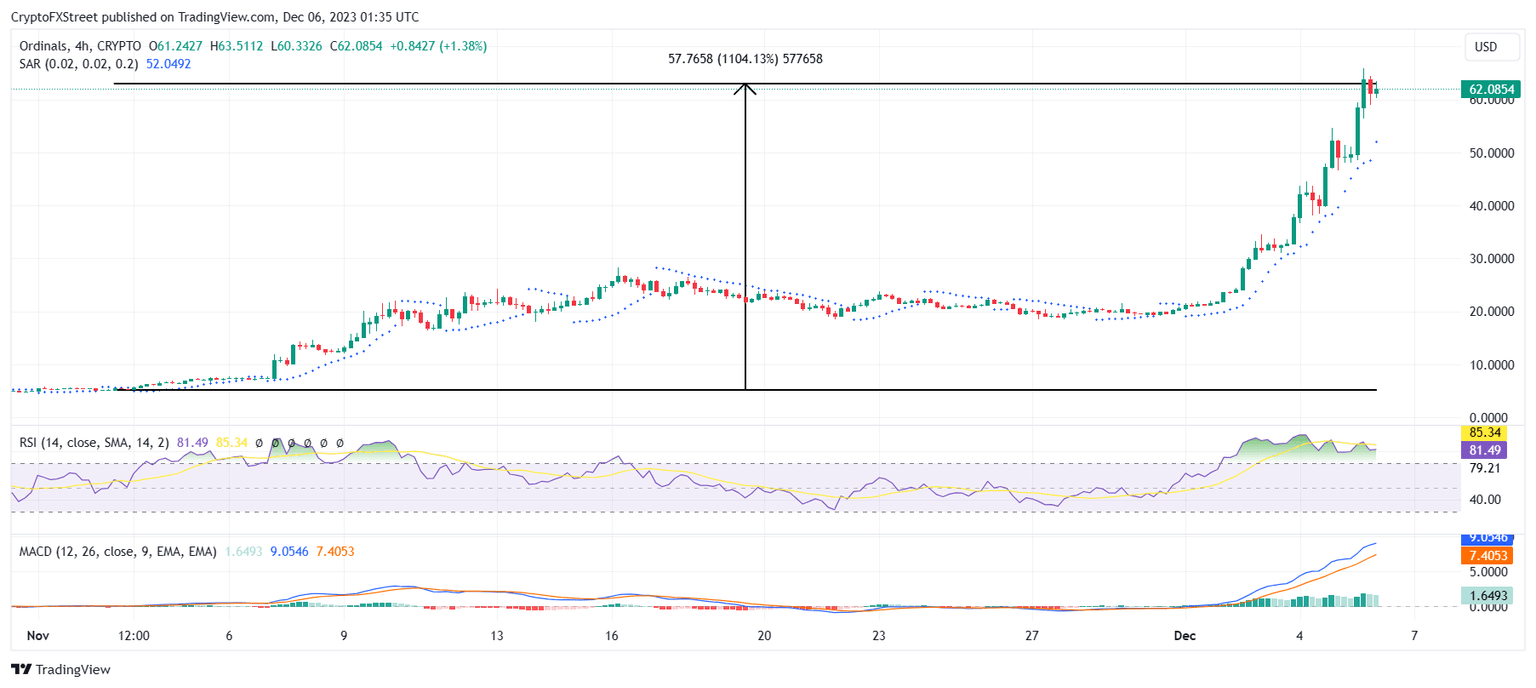

Since then, ORDI has witnessed stellar growth, rising by more than 1,104% to trade at $62 at the time of writing. However, some of this could be reversed as the bullish momentum wavers slightly. The Moving Average Convergence Divergence (MACD) indicator exhibited a little potential slowdown in the bullish momentum.

If this is true, ORDI might have just witnessed the peak of its price rise, marking fresh all-time highs of $63.4. From here on, the journey will likely be towards the downside.

ORDI/USD 1-day chart

ORDI price would likely find some support at $60 when investors recognize the saturation and sell to book profits. Right now, the meme coin is following Bitcoin's price action, which means that sooner or later, when BTC's rally halts, ORDI will also likely stop rising, which will induce further selling to confirm gains by investors.

This could send ORDI price tumbling towards $55 and potentially even $50.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.