Bitcoin at $62K ‘great buy’ before next surge, says fund manager

Bitcoin (BTC) looked set to retest previous all-time highs on Thursday as a fund manager called it a “great opportunity to buy.”

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Cointelegraph Markets Pro and TradingView showed a 3.3% daily comedown for BTC/USD taking aim at new support levels on Thursday.

Bitcoin outlook “wildly bullish”

After surging to nearly $65,000 on Monday, Bitcoin began to consolidate in a new range as the buzz around Coinbase’s successful Nasdaq listing cooled.

At the time of writing, the largest cryptocurrency traded at around $62,600, around $700 higher than March’s record of $61,700.

This area, Vailshire Capital Management CEO Jeff Ross believes, should now set the scene for a support-resistance flip, which, if successful, will allow BTC/USD to continue rising.

“Healthy retest of previous consolidation wedge ceiling. Macro view: Wildly bullish. On-chain analytics: Wildly bullish,” he wrote on Twitter on the day.

“Opinion: Price should close above old ‘ceiling’ of ~$61,250, then surge higher. Great opportunity to buy before next leg higher.”

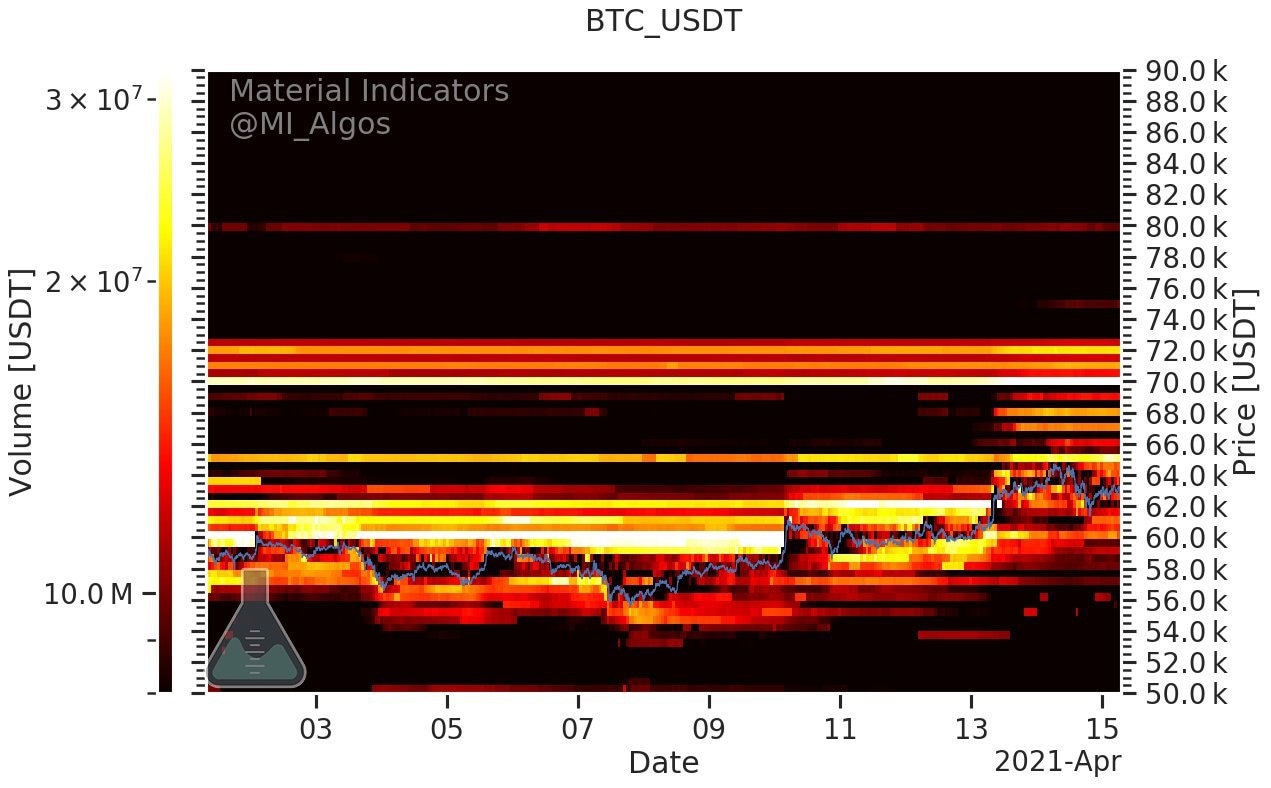

Sellers cool off under $70,000

A look at exchange order books appeared to confirm appetite even among ardent sellers for allowing Bitcoin a few thousand dollars’ further growth on short timeframes.

On Binance, sell orders were lined up first at $65,000, with a more significant band of resistance now in place at $70,000 and $72,000.

BTC/USD buy and sell order heatmap. Source: Material Indicators

Those upper levels have long been the focus of analysts, with one even describing them as “destiny” for the short term.

Other on-chain metrics showed sustained engagement from investors across the board, with the total number of Bitcoin wallet addresses containing 0.01 BTC or more passing 9 million for the first time.

Bitcoin wallets with 0.01 BTC or more. Source: Glassnode

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.