Binance clarifies $1 billion BUSD-peg stablecoin backing gap was a “timing mismatch”

- Binance admitted that due to periodically rebalancing, Binance-Peg BUSD did not always seem to be backed by Paxos-issued BUSD.

- Binance further clarified that the data imbalance did not impact the redemption made by users.

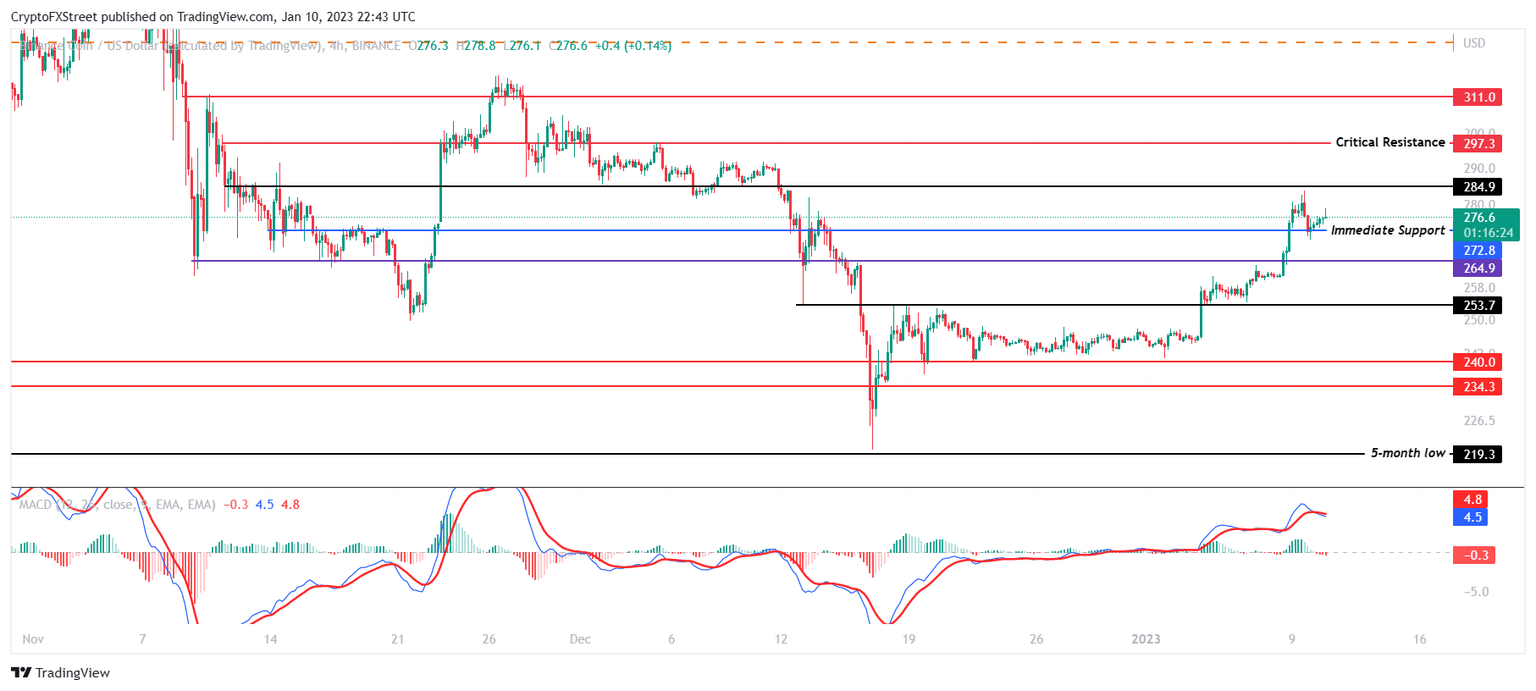

- Binance Coin price can be seen heading towards the $300 mark and would need to mark a 10% rally in the next few days by maintaining the support of $272.

Binance has been attempting to establish itself not only as the biggest cryptocurrency exchange but also as a completely transparent organization. This attempt was threatened on Tuesday when reports emerged alleging a gap in the backing of the Binance-pegged BUSD is undercollateralized.

Binance explains the BUSD misunderstanding

Binance acknowledged the ongoing reports about the exchange’s past and explained the historical discrepancies in a blog post on January 10. According to the crypto exchange, the inconsistency observed in the backing of Binance-Peg BUSD with BUSD (Binance USD) issued by Paxos is due to a delay in updation.

Over the last couple of hours, reports alleging a gap in Binance-Peg BUSD reserves came to light, which stated that there were moments over the last two years when the stablecoin was undercollateralized. Per ChainArgo founder Jonathan Reiter, who brought forward these discrepancies, the gap at times was larger than $1 billion.

Binance clarified that there was simply a timing mismatch in backing the Binance-Peg BUSD with BUSD, which made it appear as if there was an imbalance. According to the crypto exchange, the rebalance did not always keep up with the demand for Binance-Peg BUSD. Binance added,

“Having identified this ourselves last year we now rebalance more frequently to ensure that Binance-Peg BUSD is transparently fully backed. This will be included in the Proof of Reserves system that we continue to develop.”

Despite the imbalance, Binance assured the users that no redemptions were impacted and that it also had no impact on BUSD issued by Paxos.

Binance Coin price attempting to turn the clock back

Binance Coin price noted significant growth over the last few days as the exchange token rose to trade from $245 to $277. BNB is now looking to climb back to its December highs of $300, which might be on the cards provided its present conditions persist.

Bouncing off the immediate support at $272, Binance Coin price would need to breach the next resistance level at $284 and flip it into a support floor. This will allow the cryptocurrency to rally further and tag the critical resistance at $297, from where BNB can rise to $300, marking a 10% rally.

BNB/USD 4-hour chart

However, if the bullish momentum fades and the price declines, the Binance Coin price would slip to tag the support level at $264. Losing this level would bring the price to the critical support at $253.A daily candlestick below the key level would invalidate the bullish thesis, resulting in a fall to $240.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.