Band Protocol Price Analysis: Alleged BAND oracle flaw could lead to disaster

- The audit requested by Band Protocol came out earlier and identified an issue with the oracle network.

- According to the report, the data from the oracles 'must be implicitly trusted.'

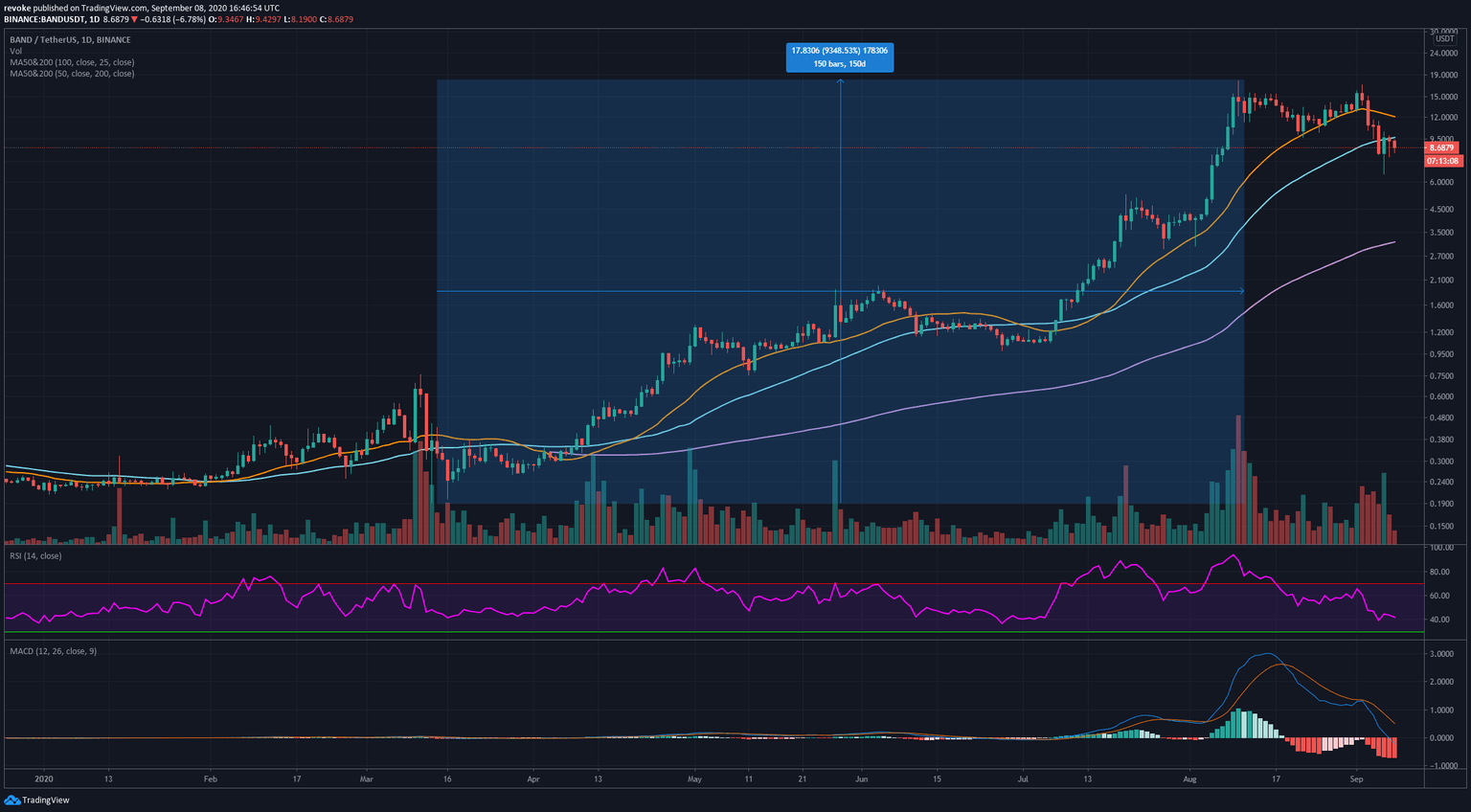

Band Protocol had a colossal bull rally since March 12, increasing in value by more than 9,000% in just six months. Like most coins, BAND is currently under consolidation after a notable market crash; however, the digital asset is at risk of falling further due to an unfavorable audit report.

Major issues with Band Protocol could drive the price down significantly

There are several issues found in the audit. The report has five suggestions for BAND to improve. One of the suggestion synopsis states:

The BandChain Protocol will record validators that do not report data when requested and reward validators based upon their previous activity. In an instance that a MissReport function is called on a validator, they are then marked as inactive and unable to get a portion of the oracle reward. While this provides incentive for data availability, which is stated to be the main goal of this phase of the BandChain oracle, it does not provide any guarantees on data correctness.

$BAND commissioned an audit. Biggest issue identified is the "oracle" network has no mechanisms to ensure data validity & no clear path to do so considering the underlying Tendermint system.

— $run the juels (@nullpackets) September 7, 2020

Is "data (that) must be implicitly trusted" really decentralized?@bandprotocol #CTO pic.twitter.com/MTZfRwhoc6

Most critics are now saying that BAND can't be called an oracle anymore. Furthermore, it seems that the team of Band might not be able to fix all the issues due to the intrinsic design of the protocol itself.

BAND/USD 12-hour chart

Considering the significant selling pressure from the entire market, this new report could have a devastating effect on BAND's price in the short-term. There are practically no support levels on the 12-hour chart beside the 50-MA and a low at $3 established on August 2, which coincides with a psychological level. If the current market momentum continues, BAND could slip towards $3 as the 50-MA would probably not be enough to hold the price. The RSI would become overextended, however, if the downward move is propelled by the audit, the technical indicator loses strength.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637351807388243992.png&w=1536&q=95)