AVAX price targets $100 as Avalanche bulls make strong comeback

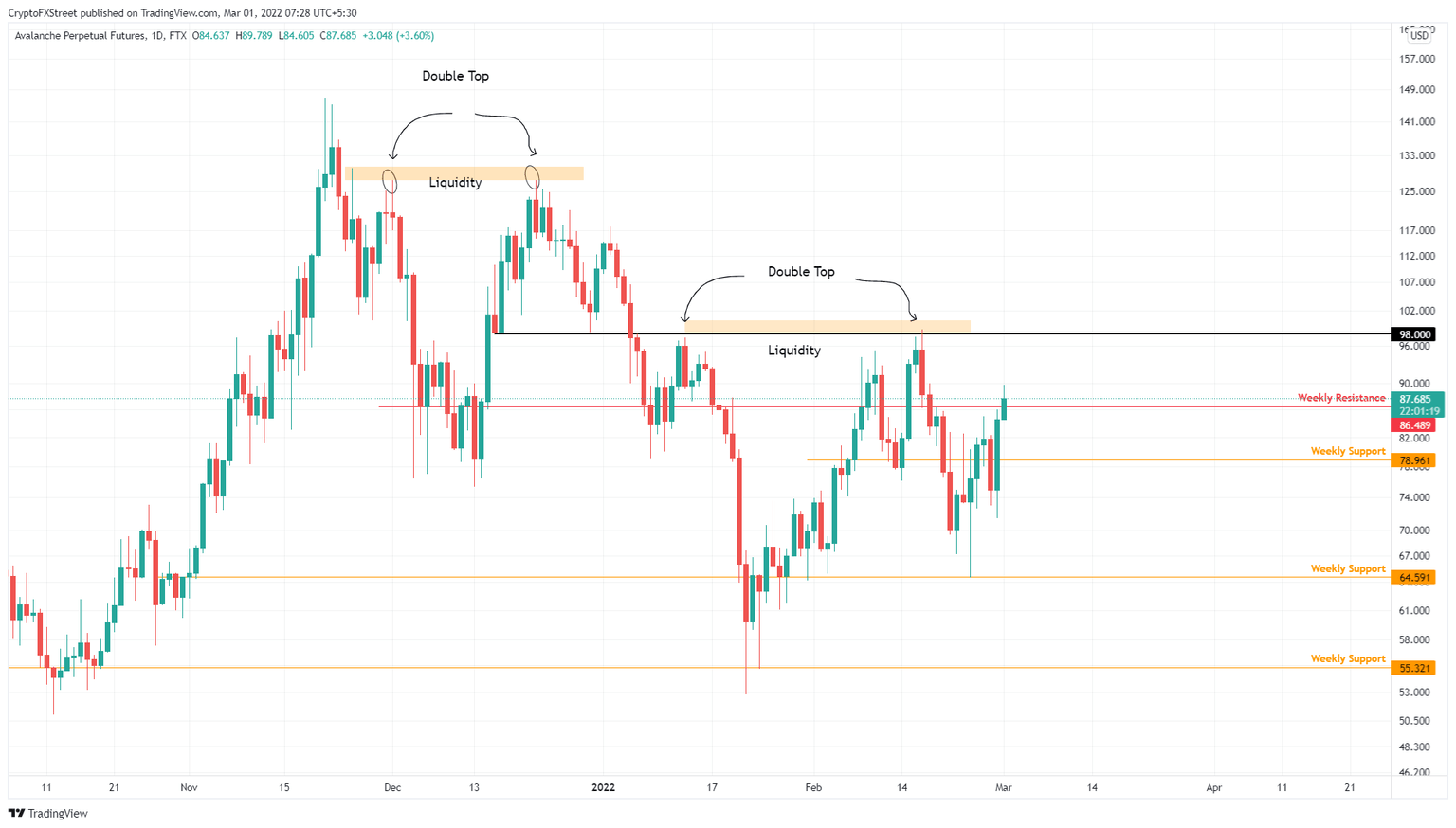

- AVAX price has flipped the $78.96 hurdle into a support level and is doing the same with $86.49.

- A successful retest of this barrier could be the key to propelling Avalanche to the $100 psychological level.

- A daily candlestick close below the $78.96 support level will invalidate the bullish thesis.

AVAX price struggled to kick-start an upswing with multiple steep pullbacks. However, February 22 is where bears gave up, leading to an upswing that is still in progress.

AVAX price continues to soar

AVAX price set a swing low at $64.49 on February 24, and rallied roughly 31% in the next two days, flipping the $78.96 resistance barrier into a support level. This move was briefly undone and looked like Avalanche was heading lower.

However, Bitcoin made a swift comeback, allowing altcoins to do the same. As a result, AVAX price shot up 25%, slicing through another weekly hurdle at $86.49. If the resulting retest holds, Avalanche would have another platform to continue its uptrend.

In this case, AVAX price can make a run for the immediate hurdle at $98.00, but market makers are likely to push the altcoin higher to sweep the buy-stop liquidity resting above it. So, there is a good chance AVAX price can tag the $100 psychological level. This move would constitute roughly 15% in gains and is likely where the local top will be formed.

AVAX/USDT 1-day chart

While the overall outlook of the crypto market is bullish, AVAX price needs to hold above $86.49, a breakdown of which could hinder gains and knock Avalanche down to $78.96. In such a case, buyers need to restart the upswing and take another jab at the immediate hurdle and the subsequent barrier at $86.49.

However, a daily candlestick close below the $78.96 support level will open the path for creating a lower low. Doing so will shift the odds in the bears’ favor and invalidate the bullish thesis for AVAX price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.