AVAX price can gain 20% if Avalanche bulls can overcome this hurdle

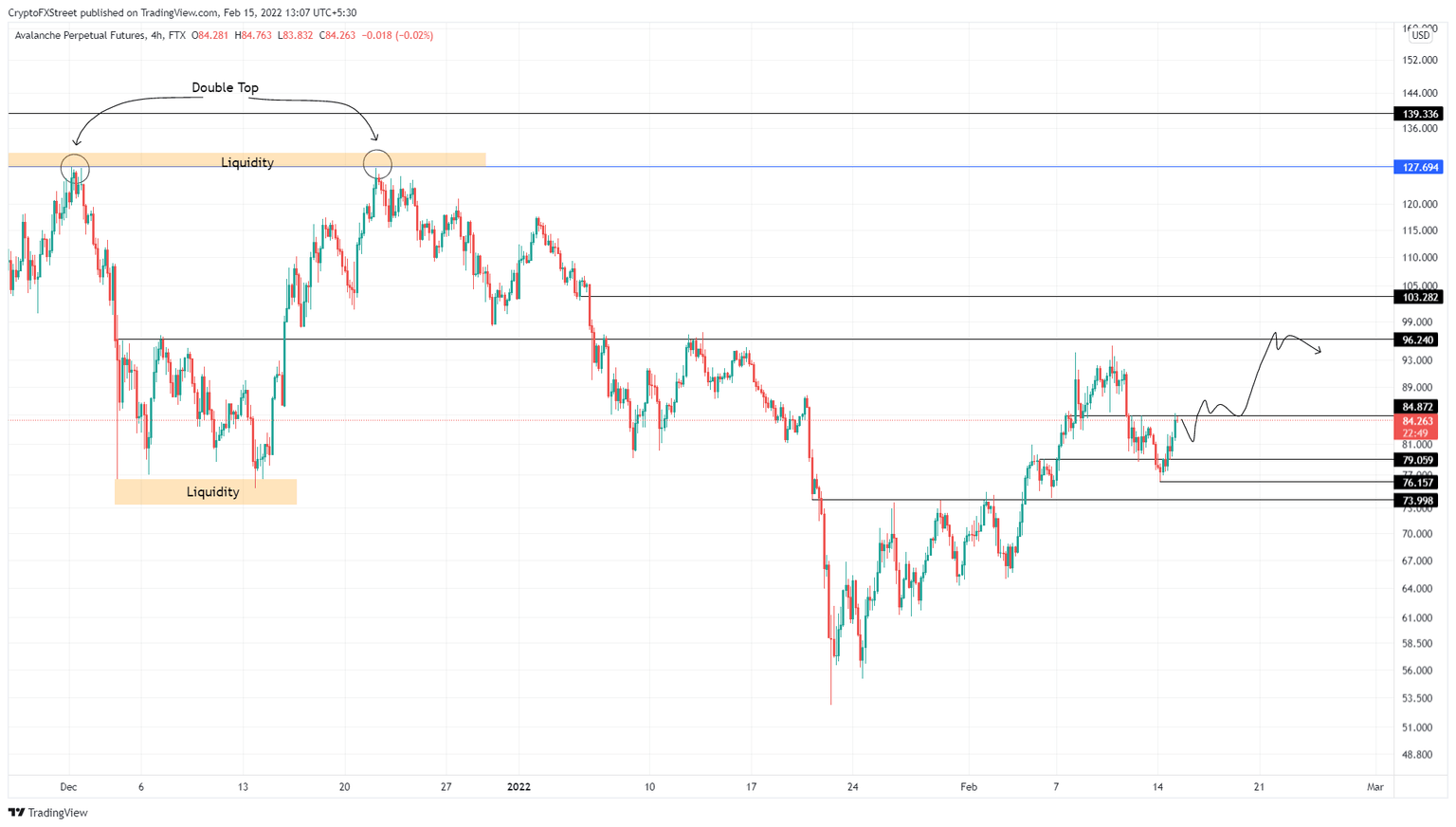

- AVAX price has the potential to rally 20% if it can clear the $84.87 resistance barrier.

- A minor retracement seems likely before Avalanche bulls breakout above the $84.87 hurdle.

- A breakdown of the $76.16 support level will create a lower low and invalidate the bullish thesis.

AVAX price has been consolidating below a crucial hurdle for roughly three days. Although Avalanche bulls are currently trying to breach this barrier, a bullish retracement might be necessary to finish the job.

AVAX price needs the right push

AVAX price dropped 19% as it sliced through the $84.87 and $79.06 support levels, flipping them into resistance barriers. This downswing bottomed at $76.16 and then made a U-turn that has since overcome the $79.06 hurdle and is making its way toward the next resistance level.

Clearing this blockade is crucial for Avalanche bulls to open the way for a run at the $96.24 ceiling and collect the buy-stop liquidity resting above it. This move would constitute a 14% ascent from the current position.

In some cases, the rally could extend to $103.28, where AVAX price will likely set a local top, representing a 21% gain.

While the above scenario is straightforward, an alternative outlook could see AVAX price retrace lower, allowing the bulls to recuperate their momentum before making a run at the $84.87 hurdle.

AVAX/USDT 1-day chart

On the other hand, if AVAX price fails to recover from this retracement, it will encounter the $79.06 support level, where buyers can attempt a comeback. A four-hour candlestick close below $76.16 will create a lower low and invalidate the bullish thesis.

This development could be the key to triggering a downswing to $74, where sidelined buyers could rescue the freefalling altcoin.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.