Avalanche Price Prediction: A volatile upswing targets $29

- Avalanche price is up 91% since January 1.

- AVAX price shows potential for a rise toward $29.

- A breach of $19.50 would validate the bullish bias.

Avalanche price continues to display bullish technicals as the third trading week progresses. Since January 1, the highly scalable block-chain based gaming token is up 91%. The rally has surprised market participants as the sentiment throughout 2022 was clouded with talks of inflation and bear market woes. Nonetheless, the Avalanche price has been unfazed by the economic turmoil and continues to reward loyal investors and traders with a keen eye.

Avalanche price uptrend still intact

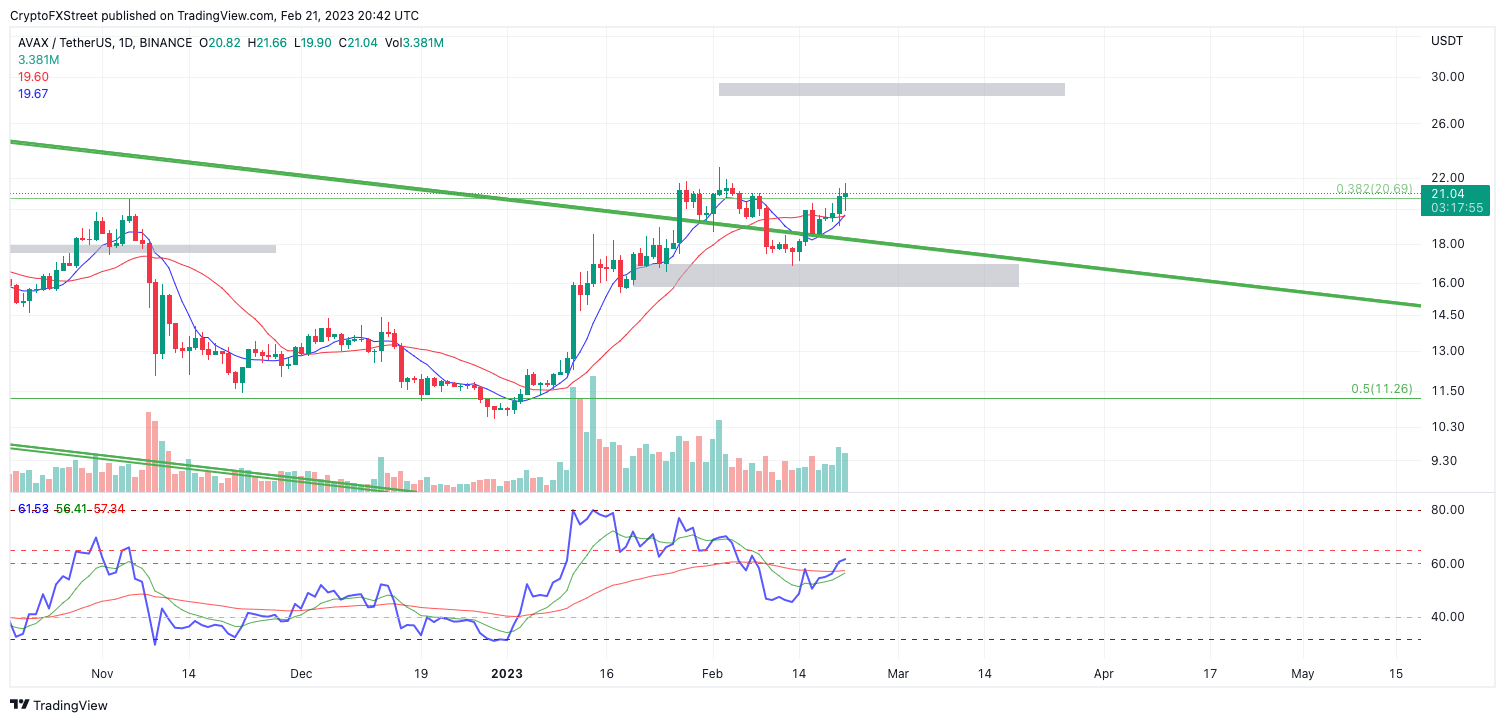

Avalanche prices currently auction at $21.03. on February 21, the digital token witnessed a bullish cross of the 8-day exponential and 21-day simple moving average. This is a signal many day traders look for to begin entering smaller time frames while anticipating a continuation of the trend.

The volume indicator also shows confounding evidence that the 1X uptrend that began midwinter will continue. According to the Binance Exchange API, the consolidation that has been taking place near the $21 zone has come under significantly less volume when compared to the previous uptrend surge that raised the AVAX price towards the $17 zone. For instance, the highest volume day occurred on January 13, with an influx of 20 million transactions near the $17 zone. The bears have only achieved an average of 4 million transactions during any red day since the initial volume uptick.

It is worth noting that the bulls retested the $17 zone nearly a month later on February 12 and have since rallied by 17%. Although a second retest is always possible, at the current time, the first retest seems poised enough to prompt an additional uptrend hike.

Considering these factors, the Avalanche price could break out to the upside in the coming days. A pivotal level to aim for would be the $29 zone, a liquidity level established during the 2022 sell-off in July. The bearish scenario would create the potential for a 35% increase from Avalanche’s current market value.

AVAX/USDT 1-Day Chart

Still, risk management should be applied during this highly volatile phase in the market. A tag below the crossing moving indicators at $19.50 would invalidate the bullish thesis. The breach could lead to a much steeper decline challenging liquidity levels within the 1X rally as low as $13.40. The Avalanche price would decline by 35% if the bears were to succeed.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.