Avalanche eyes $30 target, AVAX could rally 20% for this reason

- Avalanche notes a drop in profitable addresses, 36% of wallets holding AVAX are currently sitting on unrealized gains.

- 34% of active addresses holding AVAX are currently profitable, this implies less selling pressure on the DeFi token.

- AVAX eyes $30 target as technical indicators flip bullish, 20% gains likely.

Avalanche (AVAX) has noted a decline in the profitability of active addresses and overall wallet addresses holding AVAX, per IntoTheBlock data. Combined with bullish technical indicators, this supports a thesis for potential gains in the DeFi token.

On-chain metrics support bullish thesis

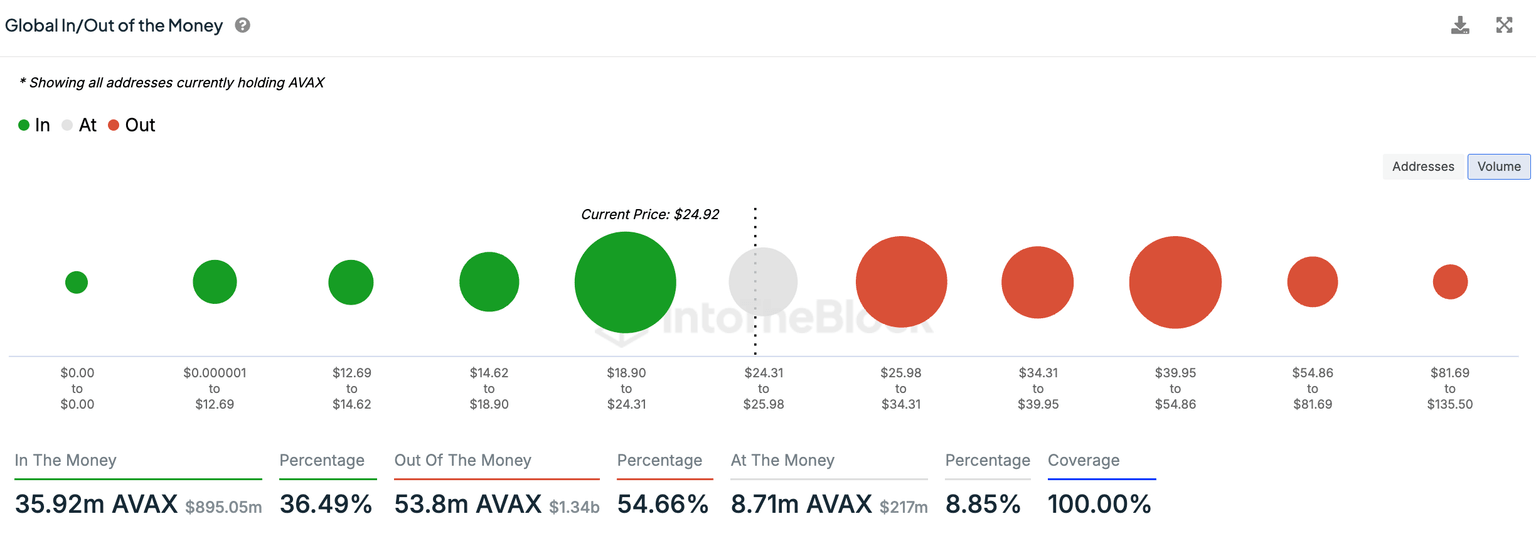

The Global In/ Out of the Money (GIOM) metric is used to track the profitability of entities holding an asset. The metric shows 36.49% of the wallet addresses holding AVAX are sitting on unrealized gains. This is key to AVAX holders since a relatively smaller number of profitable entities ensures that the DeFi token is less likely to face a sell-off and selling pressure on exchange platforms.

Global In/Out of the Money

Active addresses by profitability metric tracks the addresses that transacted within the last 30 days. Of such addresses 34.13%, over 9,000 wallet addresses are profitable. This metric is in line with the GIOM, supporting a thesis of gains in AVAX.

Active addresses by profitability

AVAX eyes $30 target

Avalanche has been in a multi-month downward trend since March 18 top of $65.39. AVAX broke out of its downtrend on September 12. AVAX could extend gains by 20.60% and hit the target of $30.

AVAX faces resistance at $28.59 to $29.43, this imbalance zone is depicted in the AVAX/USDT daily chart.

The Moving Average Convergence Divergence (MACD), momentum indicator, shows green histogram bars above the neutral line. Avalanche is likely primed for gains.

AVAX/USDT daily chart

Avalanche could find support in the zone between $24.10 and $24.61, per the daily chart.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.