Attackers gain temporary access to Avalanche and ZkSync official Discord channels, AVAX, ZK hold steady

- Avalanche announces official Discord has been resecured after recent incident, ZkSync admin lost access of channel to attacker.

- AVAX and ZK teams informed users of the attack and started an investigation per official updates.

- AVAX holds steady at $27, ZK erased 1.62% of its value on Monday, down to $0.1279.

Crypto projects’ official Discord channels suffered security breaches in the past week. Polygon’s Chief Information Security Officer, Mudit Gupta asked users to refrain from clicking on any links in the official Discord channel on August 24.

The largest Ethereum scaling solution confirmed the security breach and regained control of the channel on the communication platform Discord.

A similar incident has hit Avalanche and ZkSync communities.

Avalanche, ZkSync Discord under attack, teams investigate and resecure communication

Discord is a communication channel popular among crypto communities. There has been a rise in security breaches on this channel with Polygon, Avalanche and ZkSync facing a scare in their official channels within one week.

Avax discord looking sus…disabled chat in all channels and an announcement about “claiming Avax from the foundation”

— Stog Chog (@stogchog) August 25, 2024

My advice?

…don’t click anything in that discord for a while… pic.twitter.com/x9MLy4vPeX

Twelve hours ago Avalanche issued a security alert to the users of its Discord channel, informing that the communication platform for AVAX users has been compromised and resecured it within two hours. An official update was posted on X:

UPDATE: The official Avalanche Discord has been resecured and will reopen when CMs deem appropriate. https://t.co/bMwSI87TAs

— Avalanche (@avax) August 25, 2024

ZkSync team faced a similar incident per the chat and screenshots shared by several users. The Layer 2 project did not share official comments on X, however they made note of the incident on Discord.

Screenshot from the announcement channel pic.twitter.com/uQPfSioIMe

— Ali Taslimi (@AliTslm) August 25, 2024

And now, zkSync's Discord was hacked as well... pic.twitter.com/p1B0s4zASj

— DarkRay (@darkray_musings) August 25, 2024

The incident on Avalanche and ZkSync occured less than 48 hours post the Polygon incident, attackers shared malicious links in airdrop or token distribution messages.

AVAX holds steady, ZK suffers decline

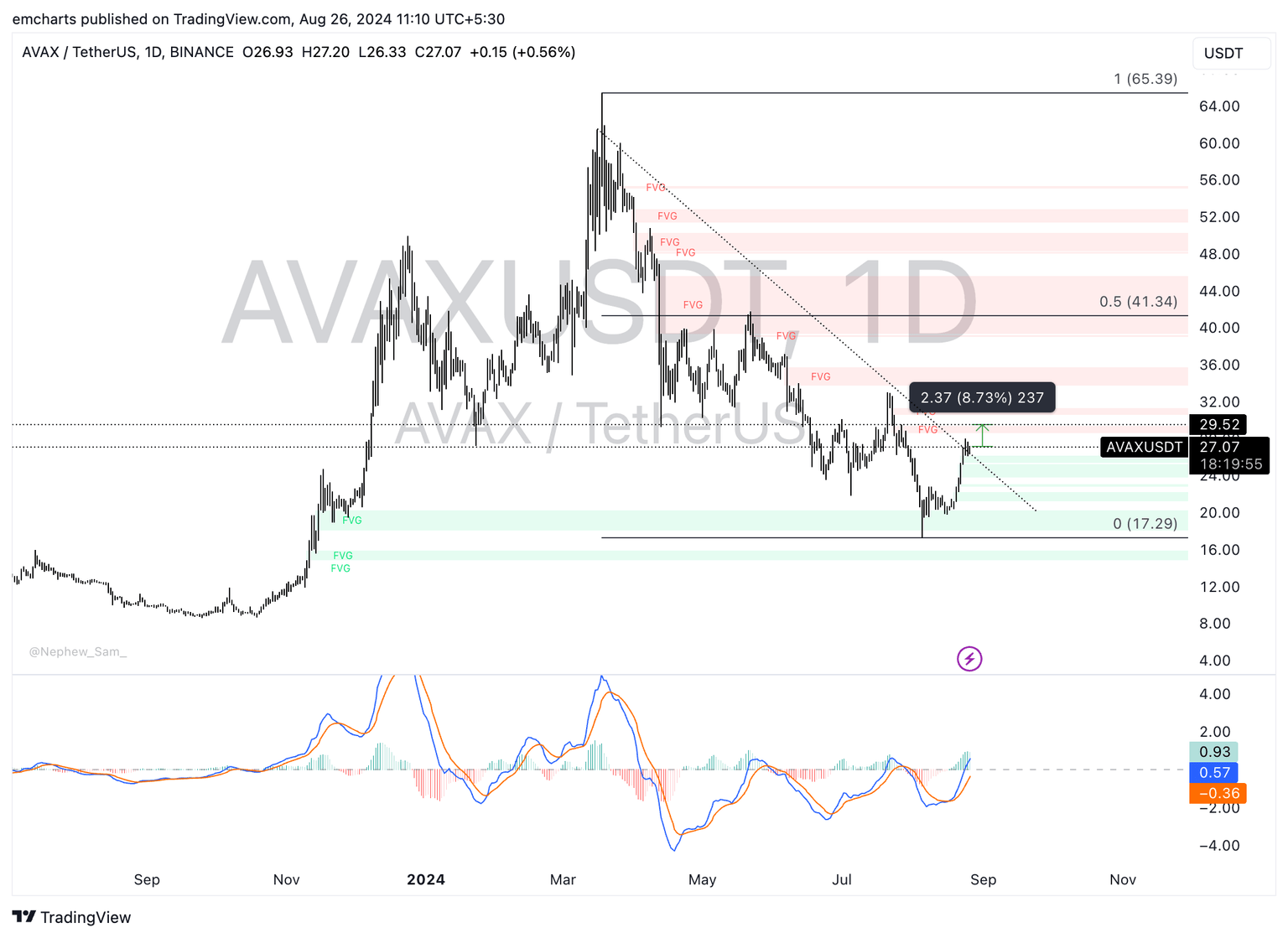

Avalanche is in a downward trend since its March 18 top of $65.39. The DeFi token could extend gains by another 8.73% and rally towards key resistance at $29.52. This level acted as support for AVAZ throughout 2024, as seen in the AVAX/USDT daily chart.

The Moving Average Convergence Divergence (MACD) indicator flashes green histogram bars above the neutral line, signaling there is underlying positive momentum in AVAX price trend.

AVAX/USDT daily chart

ZK trades at $0.1279 at the time of writing, erasing 1.62% of its value on the day.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.