Assessing the possibility of Bitcoin price crash to $20,000 after US NFP rises to 517,000

- Nonfarm Payrolls in the US increased by 517,000, 2.5 times higher than the forecast of 185,000.

- The jobs data came in higher than expectations, which bodes well for the US Dollar, but could trigger a sell-off in risk-on markets like Bitcoin or stock markets.

- With a massive spike in jobs, average hourly earnings came in at expectations, 0.3%.

The United States unemployment rate for January came in at 3.4% which is lower than forecast of 3.6%. The Nonfarm Payrolls (NFP) data shows that 517,000 jobs were added in January, which is much higher than the expected 185,000. The last important component in the jobs sector is the average hourly earnings year-over-year which landed at 4.4% as opposed to the expected 4.9%.

To put it simply, the jobs data is bullish for the US Dollar but a threat to the risk-on markets and the rally it experienced at the Federal Reserve's policy meeting on February 1. Hence, market participants need to exercise cautions as a short-term sell-off in the equities and cryptocurrencies could be around the corner.

If the disinflation, as suggested by the Fed Chairman Jerome Powell continues, the interest rate hikes will remain at 25 basis points or lower, allowing the committee to achieve their highly-anticipated soft landing.

Also read: Bitcoin Weekly Forecast: Nonfarm Payrolls on the radar after Powell’s speech propels BTC higher

Bitcoin price feels the effects of higher NFP print

Bitcoin market participants’ excitement from the US Federal Reserve’s rate hike dovish commentary faded after the release of the US jobs data. Since the NFP showed an addition of 571,000 in January, the bullish outlook seen over the last 24 hours seems to be winding down, which can be seen in BTC’s 4.24% drop.

A stronger jobs report where the actual data exceeds expectations is generally seen as a positive development of economic conditions. Hence, it promotes a strong US Dollar, which in turn results in a sell-off in risk-on assets.

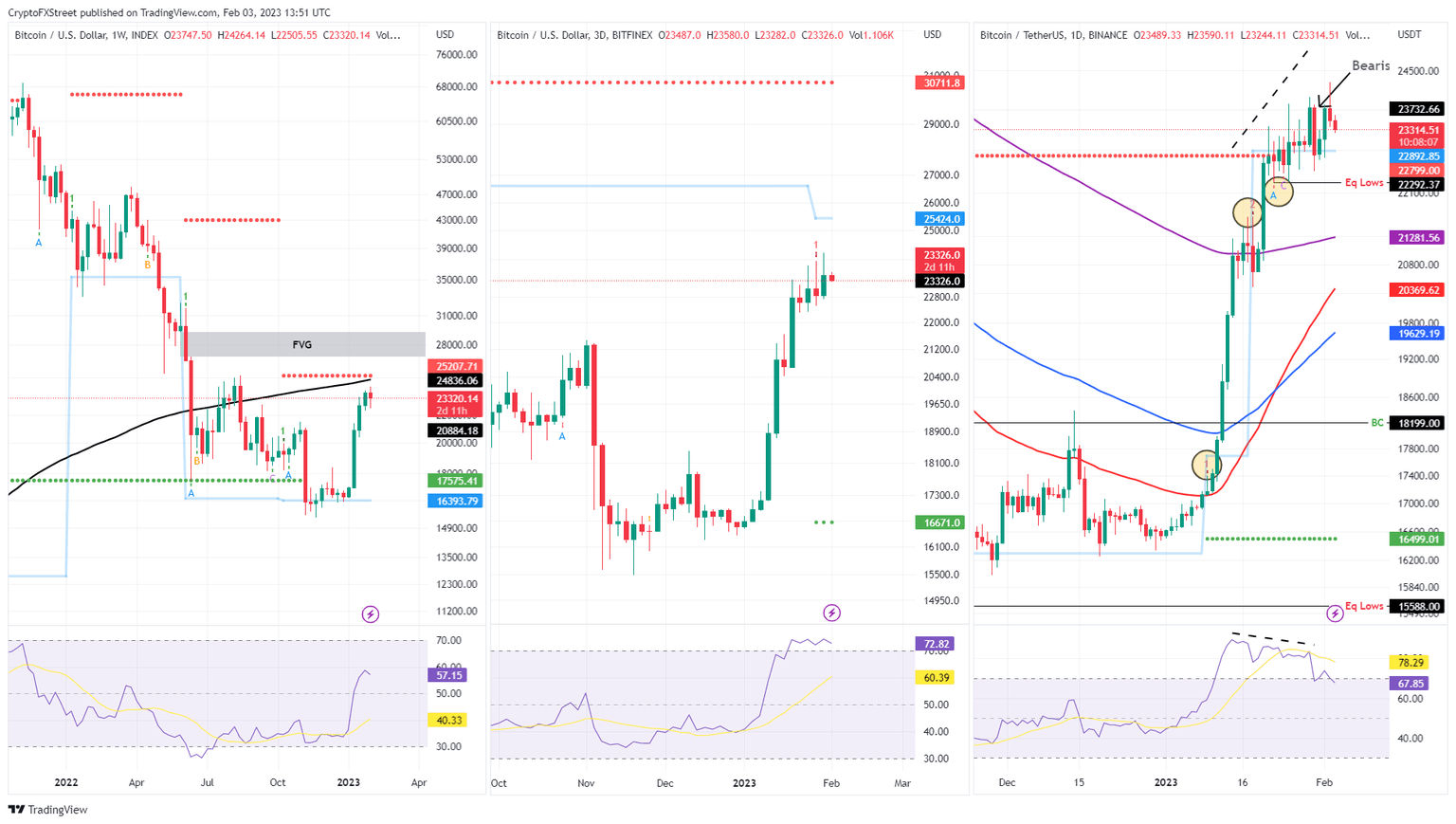

The weekly, three-day and daily charts show a sell-signal or signs of exhaustion. The weekly chart, in particular, shows that BTC is close to tagging the 200-week Simple Moving Average (SMA), which could result in a rejection.

Additionally, the one-day chart also shows the presence of a bearish divergence, which could result in a sell-off with the NFP data acting as a catalyst.

The $23,000 to $18,600 support zone is extremely important for traders should BTC nosedive in the coming hours.

BTC/USDT chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.