Artificial Intelligence tokens rally after Safe Superintelligence announcement by former OpenAI co-founder

- OpenAI former co-founder Ilya Sutskever announced on Wednesday the launch of a new AI research lab in the US.

- News of Safe Superintelligence Inc.’s launch has catalyzed gains in AI-related crypto tokens.

- The market capitalization of the AI category is up 12% in the past 24 hours.

Prices of Artificial Intelligence (AI) crypto tokens increase on Thursday after news of OpenAI co-founder starting his own firm. Ilya Sutskever, OpenAI’s former chief scientist, announced the launch of a safety-focused AI research lab in Palo Alto and Tel Aviv, in the US.

The news comes amidst concerns surrounding the safety aspect of Artificial General Intelligence (AGI), under development at OpenAI.

The market capitalization of AI tokens is up 12% in the past 24 hours, per CoinGecko data.

Artificial Intelligence tokens note massive gains in prices

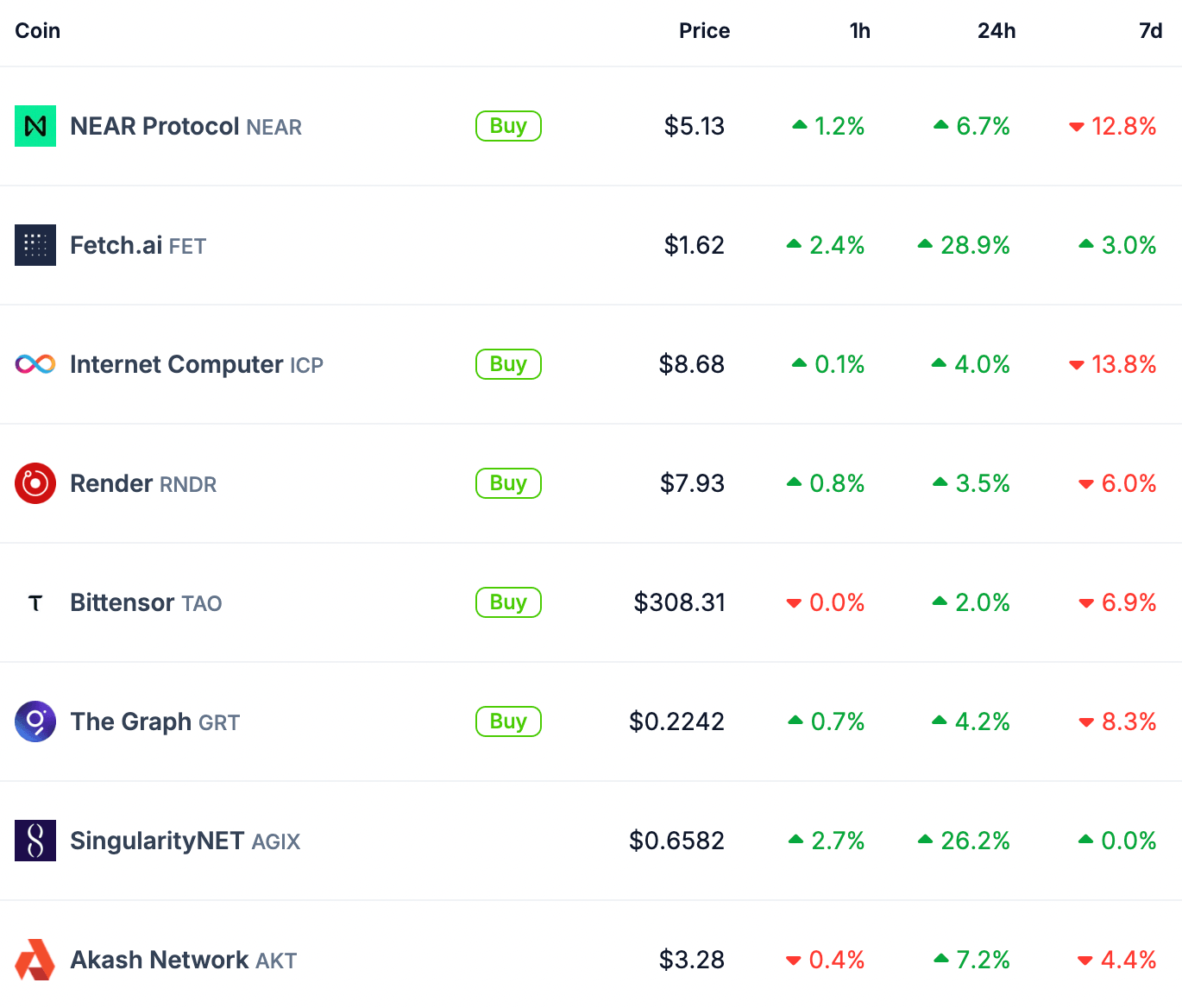

AI tokens such as Near Protocol (NEAR), Fetch.ai (FET), Internet Computer (ICP), Render (RNDR), Bittensor (TAO), The Graph (GRT), SingularityNET (AGIX), and Akash Network (AKT) extended gains in the past 24 hours, per CoinGecko data.

AI tokens

The rally can be broadly attributed to the announcement of the new firm, Safe Superintelligence Inc. The team consists of former co-founder Ilya Sutskever, American entrepreneur Daniel Gross and Daniel Levy, research assistant at computer scientist Stephano Ermon’s lab. Sutsekever was Chief AI scientist at OpenAI, and focused on the “safety” aspect when developing AGI.

Superintelligence is within reach.

— SSI Inc. (@ssi) June 19, 2024

Building safe superintelligence (SSI) is the most important technical problem of our time.

We've started the world’s first straight-shot SSI lab, with one goal and one product: a safe superintelligence.

It’s called Safe Superintelligence…

The announcement of fundraising for AI projects by hedge funds and Venture Capital is another catalyst likely fueling gains in this token category. Pantera Capital unveiled on June 19, its decision to invest $200 million into AI ventures, per a DLNews report.

The leading crypto funds are raising $1 billion, of which AI will receive a 15 to 20% investment. This development is another market mover, likely influencing investors’ sentiment about AI tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.