Argentina open to exploring idea of Bitcoin playing a larger role in economy

- The President of Argentina has hinted that the Latin American country is open to adopting Bitcoin.

- Digital assets have been playing a larger role in Argentina’s economy.

- President Alberto Fernandez said the country also could explore a central bank digital currency.

The President of Argentina recently hinted that the country is open to the idea of adopting the world’s largest cryptocurrency, following in the footsteps of El Salvador.

Bitcoin adoption could be a ‘good path to take’

During a recent interview with Caja Negra, the President of Argentina, Alberto Fernandez, was asked whether a central bank digital currency would be considered in the country and whether Bitcoin would be adopted as legal tender.

El Salvador recently made the move to recognize Bitcoin as legal tender in the country. In response to the question of whether Argentina would follow the example of El Salvador, Fernandez said that “there is no reason to say 'no.'”

The Argentinian president stated that adopting Bitcoin could be “a good path to take.” He added the inflationary effect in the country could be nullified with the benefit of the bellwether cryptocurrency.

Inflation has been an issue in Argentina for some time, with its annual inflation above 50% for the first time in July. Goldman Sachs analyst Alberto Ramos added that high inflation continues to be one of the key macroeconomic challenges facing the government.

President Fernandez explained that cryptocurrencies are a topic he is approaching with caution, due to the nature of the asset class and its unfamiliarity.

He further highlighted the concerns of the volatility of Bitcoin price, pointing to the fact that the value of BTC has increased throughout the years.

Bitcoin price to bounce on golden cross

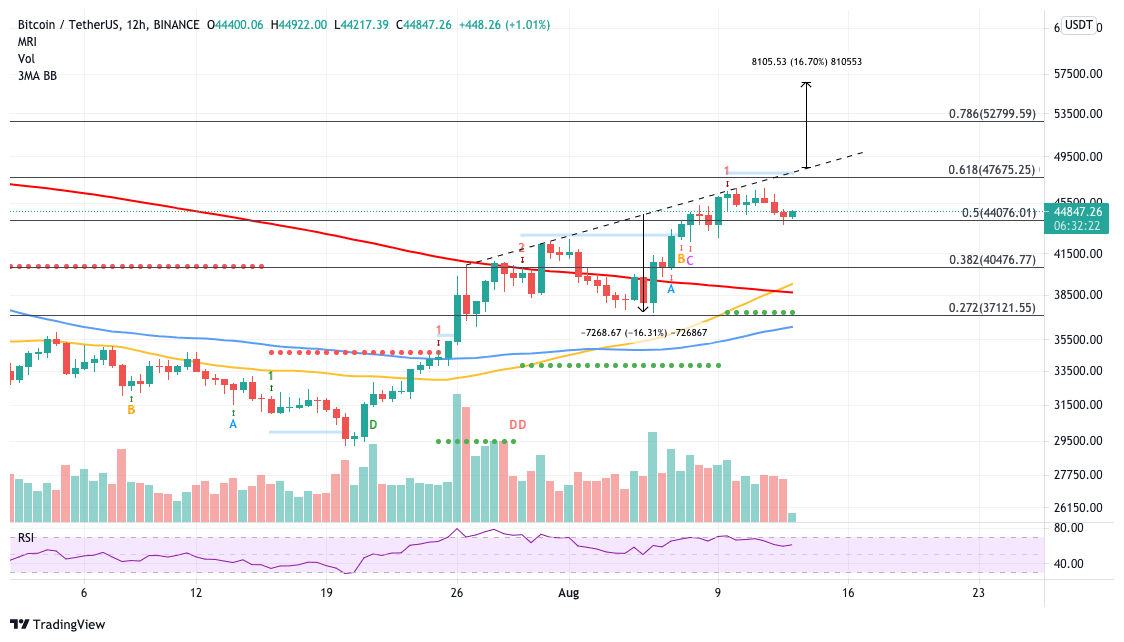

Bitcoin price has presented a golden cross on the 12-hour chart, which could boost BTC higher.

Bitcoin price is currently securing support at the 50% Fibonacci extension level at $44,076 before its next leg up.

It appears that Bitcoin price is forming a head-and-shoulders pattern that would only be confirmed if BTC slices through the diagonal trend line, above the 61.8% Fibonacci extension level at $47,675.

Should the technical pattern materialize, Bitcoin price could see a 16% surge from the neckline of the head-and-shoulders pattern, reaching a bullish target of $56,749.

BTC/USDT 12-hour chart

However, Bitcoin price must break above the 78.6% Fibonacci extension level at $52,799 as well for the upside target to be in the offing.

If selling pressure sees a spike, Bitcoin may be forced to retest lower levels of support, at the 38.2% Fibonacci extension level at $40,476 before slumping further to the 50 twelve-hour Simple Moving Average (SMA) at $39,246.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.