Are Cardano whales gearing up for ADA price recovery rally?

- Cardano whale and shark addresses holding between 10,000 and 10 million ADA have accumulated 659.53 million tokens since November.

- ADA price is yet to recover from its 2022 drop below $1.21, experts believe this signals a lower risk in buying Cardano.

- Cardano price is close to its weekly high of $0.36, the asset yielded 6.6% losses since February 7.

Cardano network’s large wallet investors have increased their activity in the altcoin. Whale and shark addresses holding between 10,000 and 10 million ADA scooped up a higher volume of Cardano since the FTX exchange collapse.

The outlook on ADA price is bullish based on on-chain metrics and whale activity.

Also read: Will Ethereum bulls regain control of ETH with massive exchange outflow?

Cardano whales are bullish on ADA with a spike in activity

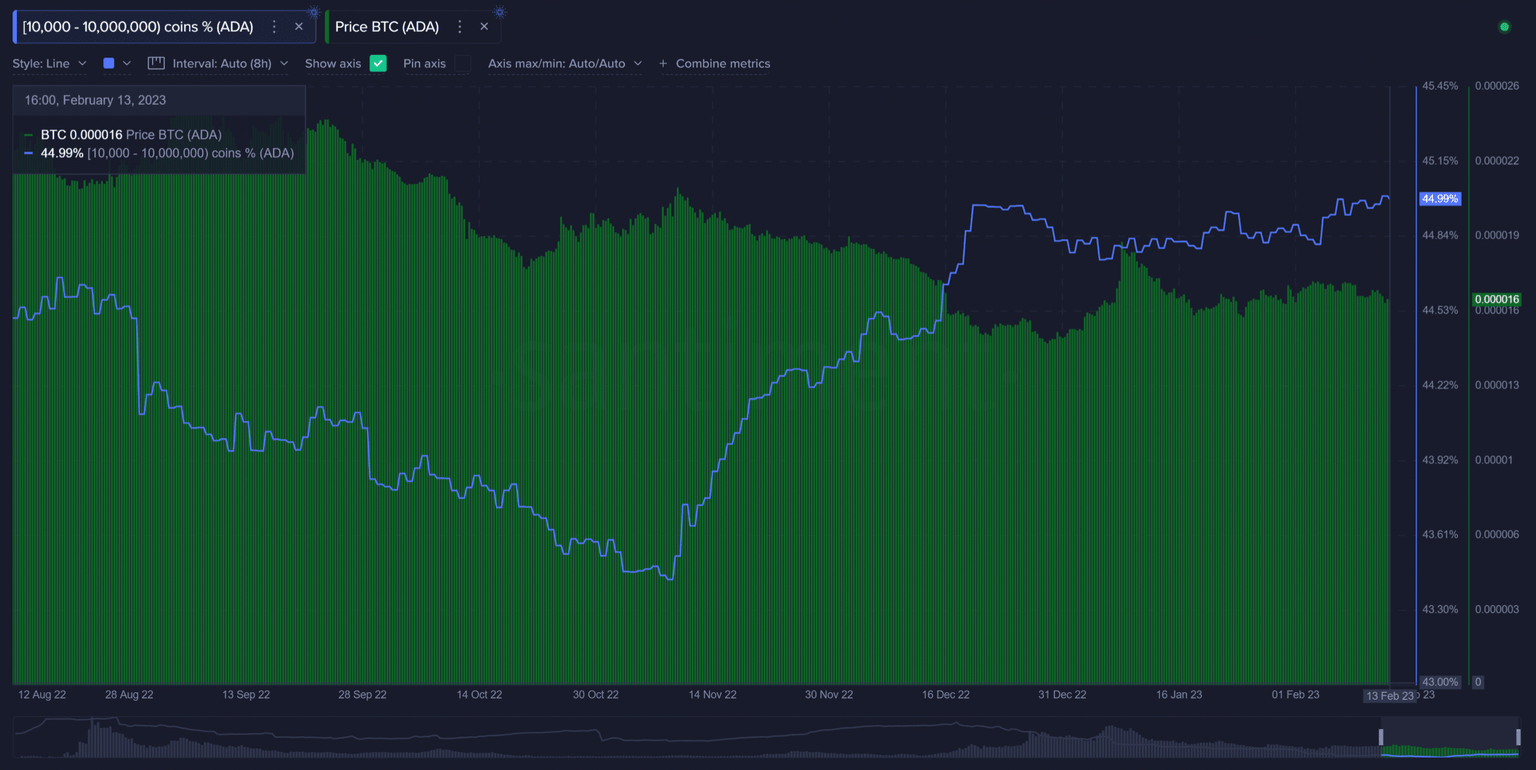

Cardano network’s large wallet investors have scooped up massive amounts of ADA token since the FTX exchange collapse in November 2022. Based on data from crypto intelligence tracker Santiment, there is a spike in the volume of ADA held by sharks and whales holding between 10,000 and 10 million Cardano tokens.

Cardano accumulation by whale and shark addresses

Whales have scooped up 659.53 million ADA tokens worth nearly $235.5 million since November 2022. Since large wallet investors are major stakeholders of Cardano, this turnaround is considered bullish for the Ethereum-killer altcoin.

Why it is a good time to buy ADA compared to Cardano’s history

Typically, traders buy a cryptocurrency during a dip in its price. Based on the recent four-week price correction in Cardano, the altcoin is yet to regain the $0.41 level from February 4. The altcoin is trading at less than half its price in 2022, therefore there is a lower risk in buying ADA now vs. an average time in Cardano's history.

Cardano is currently exchanging hands at $0.35 close to its weekly high of $0.36. The Ethereum-killer altcoin has yielded 1.2% losses for investors since February 13.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.