Arbitrum price veers as hard fork proposal receives 99.84% votes in favor

- Arbitrum price fell by nearly 4% in the past 24 hours before recovering to trade at $1.091.

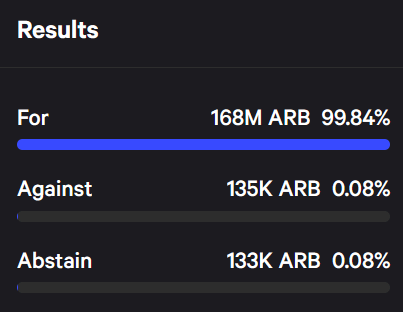

- The Arbitrum hard fork proposal received 99.84% votes in favor, with 168 million ARB from 50k votes.

- The hard fork is set to introduce a number of improvements, including support for the EVM Shanghai upgrade.

Arbitrum's price surpassed expectations as the altcoin managed to restrict the fluctuation over the past 24 hours. This is because ARB was forecasted to rally following the result of the proposal to essentially hard-fork the chain.

Arbitrum DAO approves hard fork

Arbitrum DAO recently concluded voting on the proposal to hard-fork the network in order to introduce a plethora of improvements to the chain. The Arbitrum Improvement Proposal (AIP): ArbOS Version 11 received over 50,000 votes, of which 99.84% were in favor of executing the proposal.

The hard fork is important in advancing the chain as it would include support for the EVM Shanghai upgrade and the PUSH0 opcode. Additionally, the upgrade would also implement retryable fixes, which ensure that retryable fees properly utilize both infrastructure and network fees.

Arbitrum DAO proposal voting result

While the native token ARB's value did not change much following the conclusion of voting, there is still a chance of Arbitrum price rallying once the hard fork goes live.

Arbitrum price remains sideways

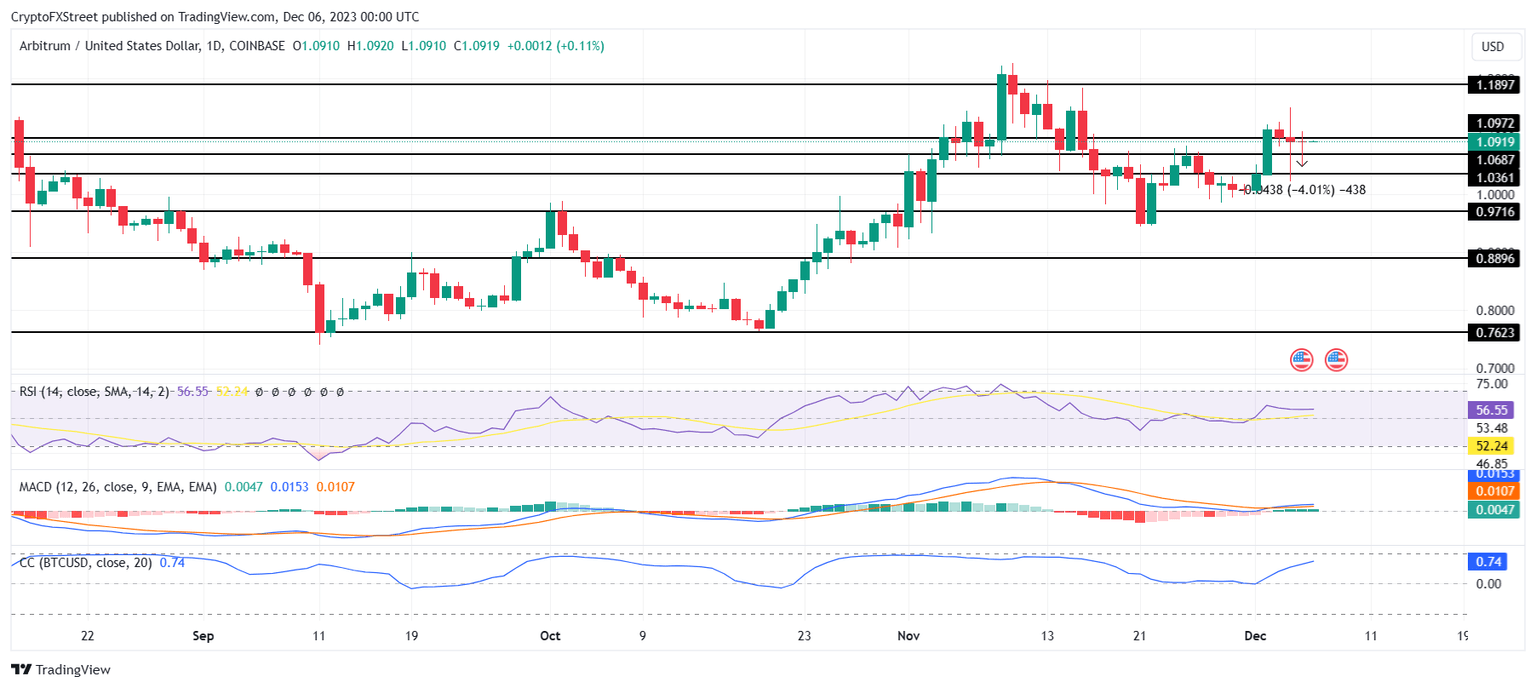

Despite the ups and downs throughout November, Arbitrum price maintained its presence above the $1.000 mark, which was briefly invalidated. Trading at $1.091 at the time of writing, ARB slipped by nearly 4% during the intra-day trading hours before recovering.

This was observed on Monday as well when Arbitrum price crashed by more than 6% but recovered soon after to mark a 0.59% decline in 24 hours. But looking at price indicators, it seems likely that the next move would be in the upward direction. Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are exhibiting bullishness.

This sentiment is crucial in driving the Arbitrum price beyond $1.100, which, flipped into a support floor, would enable a rise to a November high of $1.190.

ARB/USD 1-day chart

But if the altcoin fails to breach the barrier at $1.097, a decline is more likely the probable outcome. Although ARB would have a bunch of opportunities to recover by bouncing off the support lines, it will see a drawdown to $1.000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.