Arbitrum price rally likely to extend as ARB TVL doubles in a year

- Arbitrum Total Value Locked more than doubled from $1 billion to $2.44 billion between January 2023 and 2024.

- ARB active addresses and volume climbed starting January 7, supporting ARB price gains.

- ARB price gained 8% in a week and 65% in a month.

Arbitrum (ARB) price has climbed more than 65% in the past month, following the broadly bullish crypto market sentiment stemming frrom anticipation of a spot Bitcoin ETF approval. Adding to this, the Layer 2 chain has registered a steady increase of its Total Value Locked (TVL) over the past week, and . ARB’s on-chain metrics support further gains ahead.

Also read: Bitcoin price upside likely capped, lawyers state SEC is unlikely to kill ETF applications

Arbitrum TVL more than doubled since 2023

The Total Value Locked (TVL) on the Arbitrum chain has more than doubled in the last year. The TVL climbed from $1 billion in January 2023 to $2.479 billion on January 10, 2024, according to data from DeFiLlama.

Arbitrum TVL. Source: DeFiLlama

An increase in TVL typically indicates the relevance of a chain among users and demand among market participants. Arbitrum price has rallied more than 65% in the past 30 days, alongside theincrease in its TVL.

On-chain metrics such as active addresses and volume on Arbitrum have been increasing consistently since January 7 according to data from Santiment.

Arbitrum volume and active addresses. Source: Santiment

Arbitrum currently dominates the Layer 2 market with 49.2% share of the $19.91 billion ecosystem. Data from L2Beat shows that Arbitrum is followed by Optimism, with a market share of 28.41%.

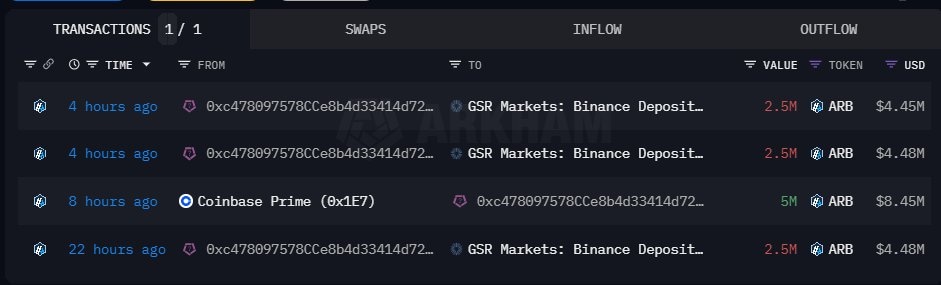

Arbitrum’s on-chain metrics support an ARB price gains thesis. However it remains to be seen whether ARB price suffers a correction or extends its gains. Crypto analyst behind the X account @OnChainDataNerd noted on Wednesdaythat market makers have deposited a large amount of ARB tokens to exchanges in the last 24 hours,. Generally, an increase of the supply on exchanges is considered a bearish sign because they are more likely to be sold.

Market makers GSR and Wintermute deposited 7.5 million and 4.78 million ARB tokens, respectively, to exchanges. These deposits account for a total of over $20 million worth of ARB. It remains unclear whether these tokens will be sold or held in exchange wallets.

Market maker transactions. Source: OnChainDataNerd’s tweet

If market makers shed their token holdings, it is likely to increase selling pressure on ARB and influence the price negatively.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B12.30.47%2C%252010%2520Jan%2C%25202024%5D-638404718197834092.png&w=1536&q=95)