Arbitrum price pulls back from charting 2023 lows as final Security Council voting commences

- Arbitrum price, trading at $0.88, rose by more than 3.5% over the past 24 hours.

- The voting will take place over the next 21 days, after which users will be given 13 days to withdraw their funds.

- The Arbitrum Security Council election results are expected to be announced by November 9.

Arbitrum price had been making a steady recovery before dipping slightly over the past few days. However, owing to the Arbitrum Security Council elections, the altcoin has made some growth as the final round of voting kicked off on Friday.

Arbitrum Security Council members to be selected within a month

Arbitrum Security Council elections have been underway for a couple of weeks now, and are now entering their last leg. The voting for the second and possibly last round began on Friday and will be conducted over the next 21 days.

Once the voting period is ended, the six candidates that receive the most votes will be selected to join the council. At the time of writing, the Tech Lead at Plutus DAO stood in the lead with the most votes, amounting to 1.6 million ARB.

The results of the election, however, will be announced on November 9 as a grace period of 13 days will begin after the voting ends. As noted by Arbitrum, this grace period will allow Arbitrum users to withdraw their funds before the new council members are put into place.

This duration is also required so that the election results can propagate to the Security Council contracts across all relevant chains.

Round 2 of the @arbitrum Security Council elections is now live on Tally! Look through all the nominees and cast your votes here https://t.co/lxNnjdZQWA

— Arbitrum (,) (@arbitrum) October 6, 2023

Here’s a good tl;dr of how Round 2 works over the next 21 days https://t.co/xiw6sjrmGH pic.twitter.com/kAqXo0l4wn

While the impact of the elections on Arbitrum price could vary, at the moment, the altcoin is enjoying the bullishness arising out of the ongoing voting.

Arbitrum price climbs back

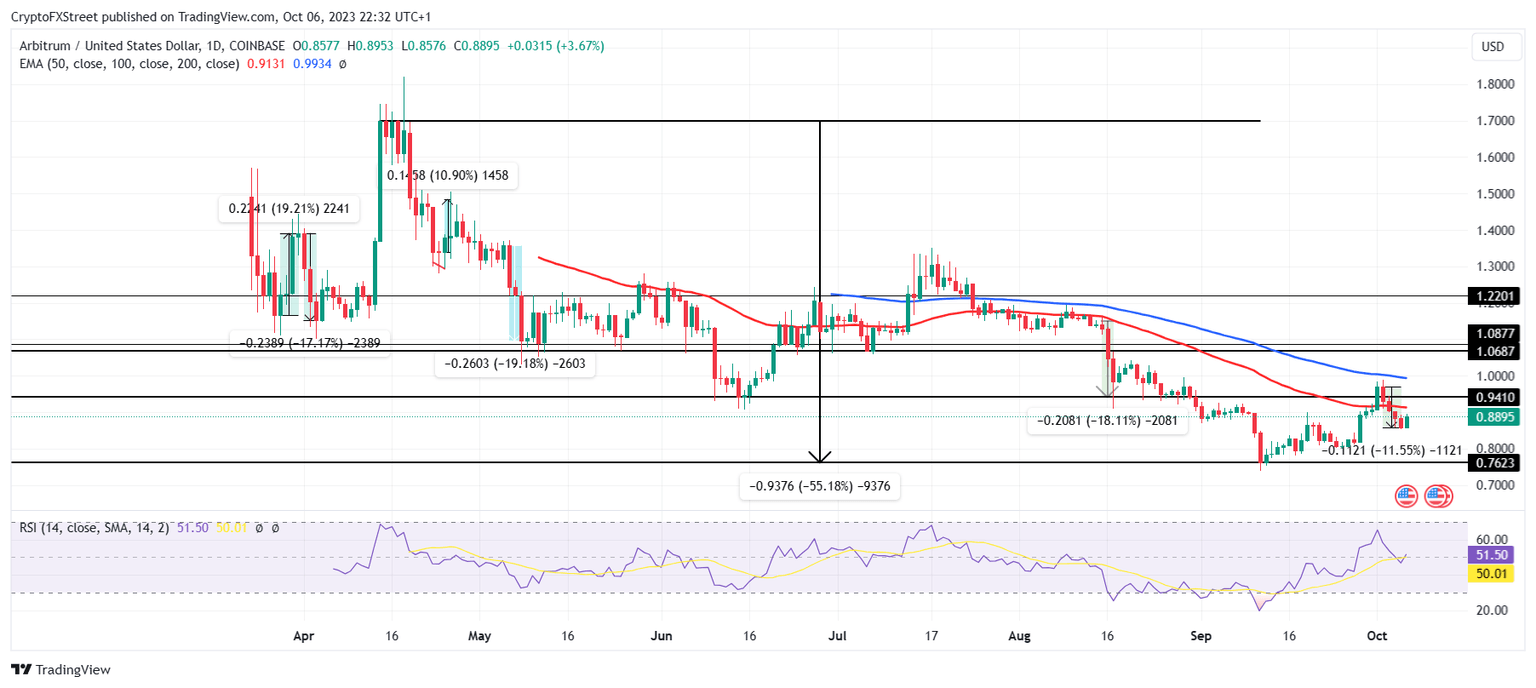

Arbitrum price, at the time of writing, could be seen trading at $0.88, just below the 50-day Exponential Moving Average (EMA). The altcoin slipped below the $0.94 support line in the past week when ARB fell by over 11% in four days.

However, if the cryptocurrency sees more upside akin to the past 24 hours' 3.67% rise, it might be able to reclaim $0.94 as a support floor. The Relative Strength Index (RSI) is creeping back into the bullish zone above the neutral line marked at 50.0. Further upside would support the indicator to test the neutral line as support, which would allow ARB to climb above $1.00.

ARB/USD 1-day chart

Nevertheless, if the bullishness lacks the strength to enable a breach of the $0.94 resistance level, the altcoin could fall back down. This would leave Arbitrum price vulnerable to testing the support floor of $0.76, losing which would not only invalidate the bullish thesis but also potentially send ARB down to $0.70.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.