Analysts consider Polkadot and Kusama “money makers,” argue that DOT is massively undervalued

- Earlier this week, Kusama minted NFTs in a limited edition "Kusama Parachain Launch Collection" and sent them to the network's newsletter subscribers.

- Analysts remain long-term bullish on Polkadot, expect a rally to a new all-time high with the launch of parachains.

- Over the past month, Polkadot and Kusama combined, "Dotsama," have had more development activity than any other blockchain project.

Polkadot (DOT) and Kusama (KSM) have emerged as top gainers over the past month. Despite the recent consolidation, analysts are bullish on "Dotsama."

Polkadot is likely to make a comeback

The multi-blockchain protocol focused on creating cross-chain bridges is making strides in its ecosystem development. After successfully completing the first parachain auction on Kusama, the blockchain protocol is now on round two.

The first five parachains resulted in 10% of the KSM supply getting bonded (pulled out of circulation). Historically, scarcity drives prices of assets higher. Therefore, increase in the percentage of KSM supply getting bonded is directly correlated to KSM price.

Interestingly, Polkadot's ecosystem has garnered less attention from the crypto community since projects on the Binance Smart Chain, Polygon, Terra and Solana are live and have attracted traders.

Though the community is still waiting on an announcement for the launch of parachains, Polkadot has fostered a community of developers building projects with strong use cases on DOT. The ecosystem is favorable for massive growth, and it is ready to go.

Lark Davis, cryptocurrency analyst and YoutTube content creator, recently took to Twitter to share his bullish outlook on DOT.

I remain very bullish on the Polka $dot $ksm ecosystem.

— Lark Davis (@TheCryptoLark) September 15, 2021

Thread

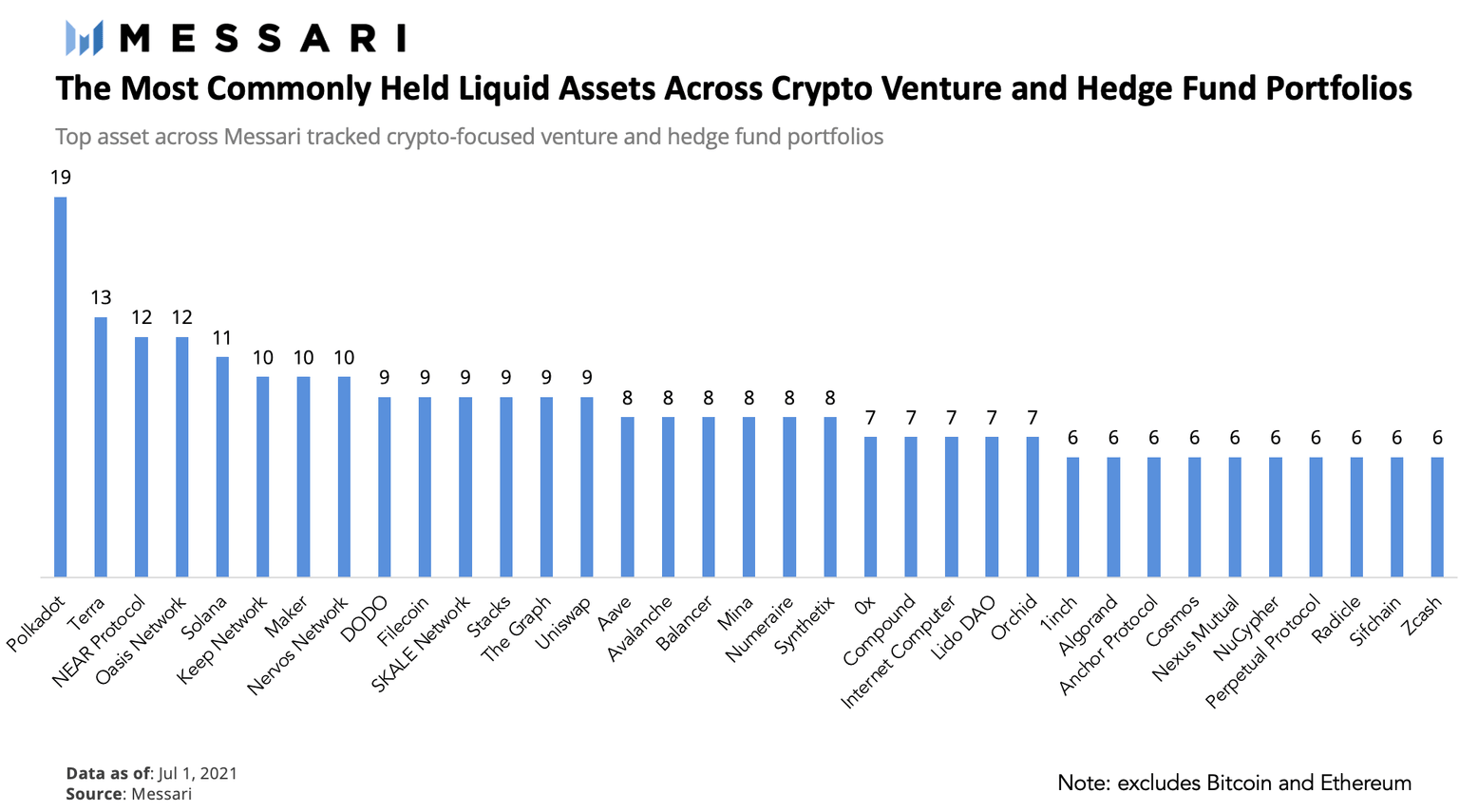

Interestingly, based on a report by crypto research and data platform Messari, Polkadot is one of the most commonly held liquid assets (excluding Bitcoin and Ethereum) across Crypto Venture and Hedge Fund Portfolios, as of July 2021.

Most commonly held crypto assets across institutions.

Institutional interest is expected to skyrocket with the announcement of parachain launch.

In the case of Kusama, the asset is jumping on new trends. Earlier this week, the team dropped a limited edition NFT collection, minting 9,999 NFTs for the "Kusama Parachain Launch Collection."

The NFTs were distributed to the subscribers of the project's newsletter.

Overall, updates in the project’s ecosystem over the past two months have turned analysts bullish on DOT price. "Dotsama" is being referred to as a "money maker" for its upside potential.

Lark Davis states,

Even if you had bought the top on KSM, you would be up 10X on $movr, most who backed them are up 20 to 100X or more. And the real kicker with parachain auctions…. you get your KSM back at the end! This is solid proof Dotsama is a money maker.

FXStreet analysts expect a 40% upswing in DOT price, though the altcoin is currently facing stiff resistance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.