Algorand rallies by 27% as FIFA launches its NFT marketplace

- FIFA+ Collect went live on September 22, bringing historic FIFA moments in the form of NFT to collectors.

- The Genesis Drop, launched with 532,980 editions, will allow collectors to own and trade these NFTs.

- Algorand being the official blockchain platform, noted a surge in buying pressure, rising by 12% in the span of 24 hours.

The FIFA World Cup 2022 is one of the most anticipated events ever, and with worldwide crypto adoption spreading rapidly, it was certain for the World Cup to integrate it as well. FIFA leaned into crypto through NFTs, and with its marketplace going live, Algorand is enjoying a good run-up on the charts.

FIFA turns history into NFTs

Under the FIFA+ umbrella, the International Federation of Association Football launched their NFT marketplace FIFA+ Collect. This is set to bring about a new medium of fan interaction for World Cup enthusiasts and allow FIFA to tap into a new form of audience.

Since these NFTs (also known as “highlights”) will hold value thanks to both rarity and history, they will find takers amongst the niche as well as mainstream individuals.

As the marketplace went live on Thursday, FIFA introduced the Genesis Drop containing highlights from the crucial moment in the history of FIFA. The Drop has been launched with 532,980 editions, with each edition containing three such highlights.

While analyzing the response to the launch can be premature, the impact noted on Algorand makes it seem to have been positive.

Algorand welcomes the bulls

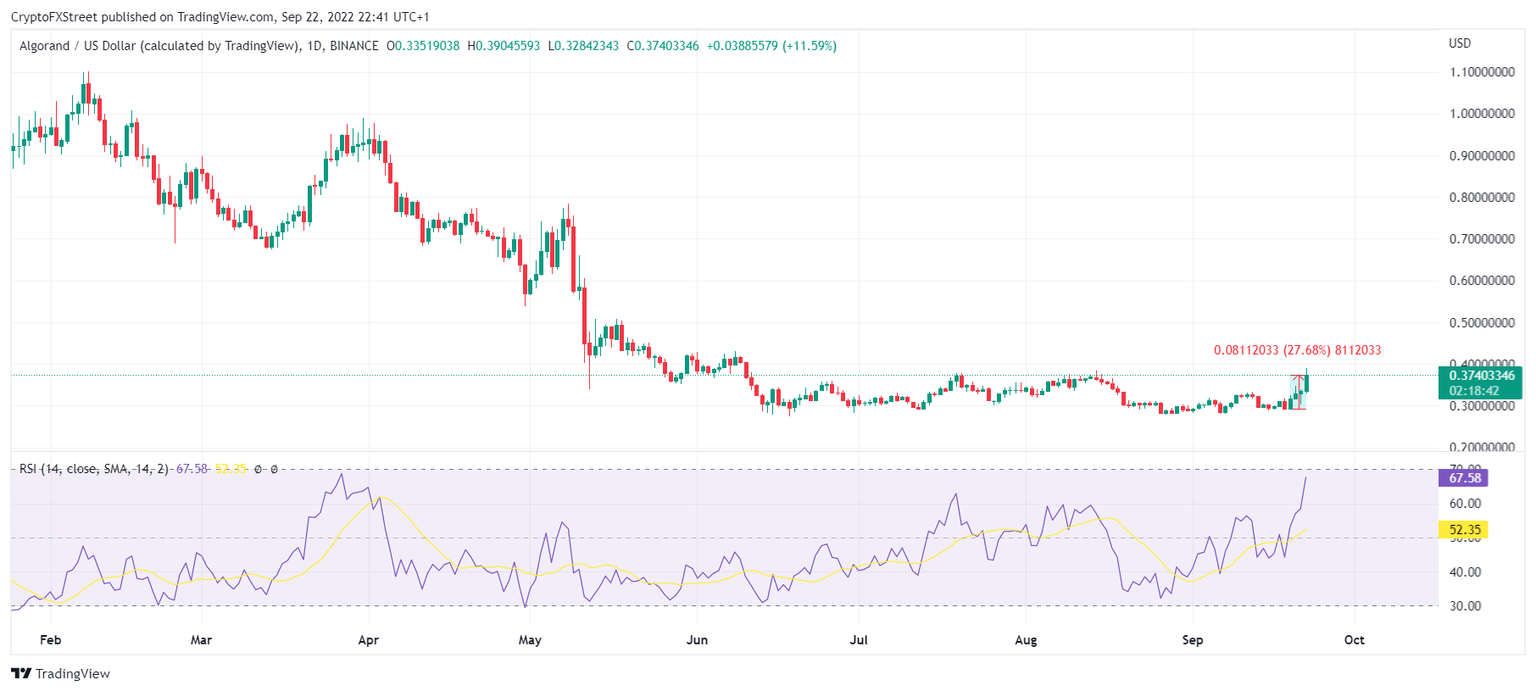

As the official blockchain platform partner of the FIFA World Cup 2022, Algorand observed rising bullishness at the hands of its investors. In the last 24 hours, ALGO advanced by 12%, bringing the week-long rally to 27.68%.

The price rise was triggered by the increasing buying pressure, the highest in six months, which is evinced by the uptick in the Relative Strength Index (RSI). However, trading at $0.373, ALGO is also nearing the possibility of a trend reversal. If the RSI crosses the 70.0 mark, it will enter the overbought zone, which could cause a change in an active uptrend and eventually result in corrections.

Furthermore, ALGO isn’t too far away from its June crash lows when the altcoin fell to $0.29, which happens to be the next critical support for ALGO. In order to maintain this bullishness, ALGO needs to avoid revisiting this level.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.