Algorand Price Prediction: Is ALGO setting up for a spike higher?

- Algorand price has risen by 43% since January 1.

- ALGO could witness a rally toward the $0.30 zone.

- Invalidation of the uptrend could occur if the $0.219 level is breached.

Algorand price has a bullish bias so long as the current market conditions persist. Key levels have been defined to gauge where the ALGO price will head next.

Algorand price hovers above support

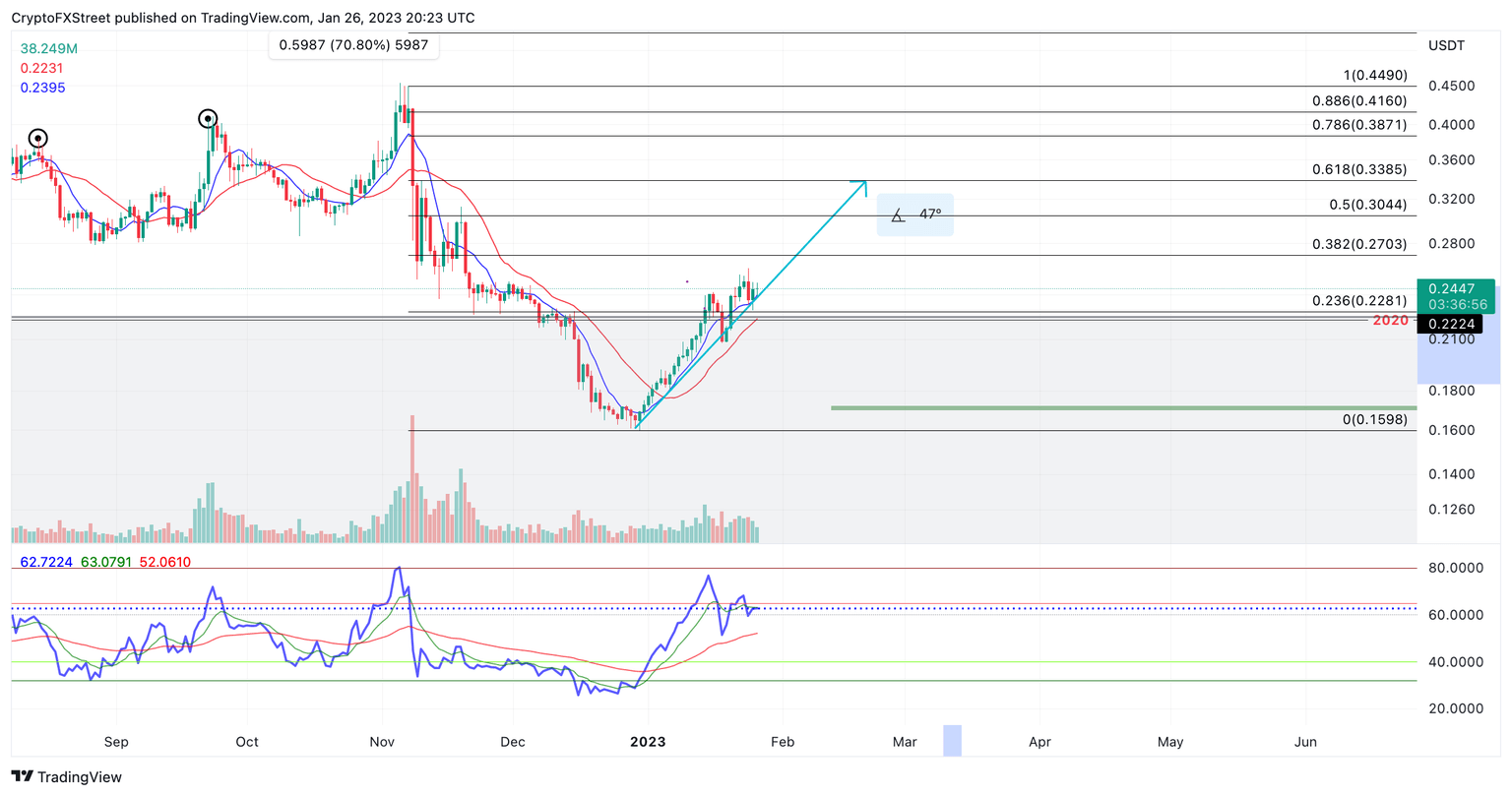

Algorand price is maintaining its' stance as the bulls have stair-stepped their way back into the mid-$0.20 zone. Since January 1, the scalable blockchain token has rallied by 43%. During the rise, the bulls have maintained support above an ascending trend line establishing higher pivot lows on January 11 through January 26. As the price consolidates above the trend, the ALGO technicals suggests another spike up is on the horizon.

Algorand price currently auctions at $0.243, showing sustained support above the 8-day exponential moving average. The consolidation is also occurring just above November's low at $0.22. So long as the bulls maintain support above the level, the possibility of rallying toward the midpoint of November's trading range near $0.30 stands a fair chance of occurring. Such a move would create a 27% increase from ALGO's current market value.

ALGO/USDT 1-day chart

For traders looking to join the bulls, Invalidation of the uptrend could occur if the bears tag the candlestick low that initially pierced November's trading range at $0.217. A breach of the level will likely induce a larger downswing targeting liquidity levels at the $0.18 barrier. The Algorand price would decline 18% from its' current market value if the bears were successful.

This video details how Bitcoin price moves could affect Algorand price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.