AAVE price: What to expect from Aave with upcoming deployment on zkSync 2.0 testnet

- Aave could be deployed into the zkSync 2.0 testnet if an off-campus web3 student organization, FranklinDAO’s proposal gets voted in.

- Aave recently announced that alongside Uniswap, the open-source DeFi protocol could be deployed on Polygon’s zkEVM testnet.

- Analysts believe Aave price is likely to decline until November 5 as the sentiment among traders remains bearish.

Aave is a decentralized finance (DeFi) protocol that lets users lend and borrow cryptocurrencies and real-world assets without the hassle of a centralized intermediary. Aave’s deployment on zkSync 2.0 testnet and zkEVM testnet on Polygon is making headlines, as analysts evaluate the impact on the DeFi token’s price.

Also read: Chiliz price up 15% as FIFA World Cup 2022 draws close, here’s what to expect

Aave could arrive on zkSync 2.0 testnet soon

Aave, a leading DeFi protocol that powers lending and borrowing of cryptocurrencies and real-world assets for users could deploy on zkSync 2.0 testnet if a new proposal gets voted in. zkSync 2.0 is a zero-knowledge rollup layer-2 network that bundles up transactions and passes them down to Ethereum so they can be written to its ledger.

The current version of zkSync 2.0 solves the needs of most applications on Ethereum. It is expected to provide developers with a design space to experiment with applications not possible on Ethereum today.

The proposal was put forward by Franklin DAO, previously Penn DAO, an off-campus web3 organization of University of Pennsylvania students. The proposal is presented in partnership with Matter Labs and the objective is to expand the cross-chain experience of Aave V3.

Aave v3 deployment on zkSync 2.0 testnet

Once the decentralized exchange (DEX) liquidity requirements are met, a snapshot will be submitted to zkSync V2 testnet as next steps. In the second week of October, Aave announced its deployment on Polygon’s zkEVM testnet, alongside DeFi protocol Uniswap. Typically, an expansion of Aave’s cross-chain capabilities boosts the sentiment among Aave token holders.

Aave price could continue to decline

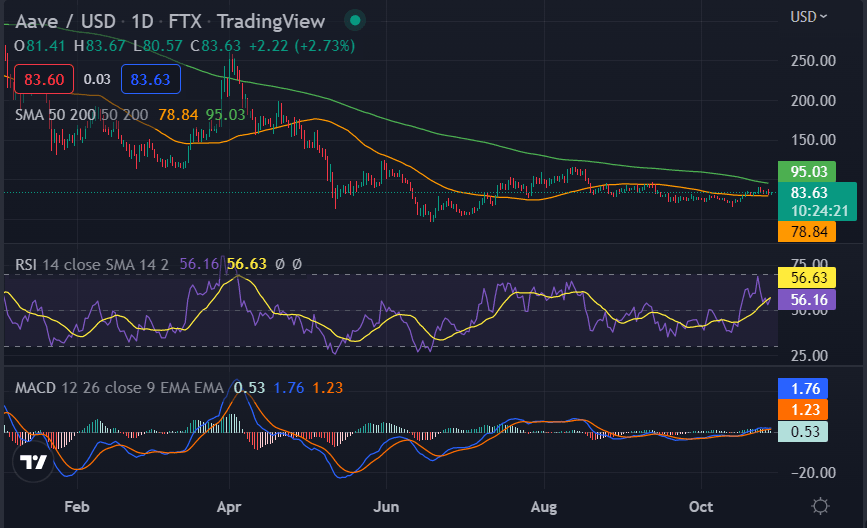

Analysts evaluating the Aave price trend, predict a decline in AAVE till November 5. The sentiment among Aave holders is currently bearish, unless there is a shift in sentiment and increase in on-chain activity, analysts believe AAVE could continue its downtrend.

Ann Mugoiri, crypto analyst evaluated the daily price chart and argued that bears are defining the price movement today. AAVE/USD is correcting after a strong bullish move and the pair is exchanging hands at $86.03 today. Aave yielded 13.4% gains for holders over the past two weeks. Mugoiri argues that the selling pressure has returned and the trend remains bearish as Aave price steadily declines.

Aave/USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.