US CRUDE OIL

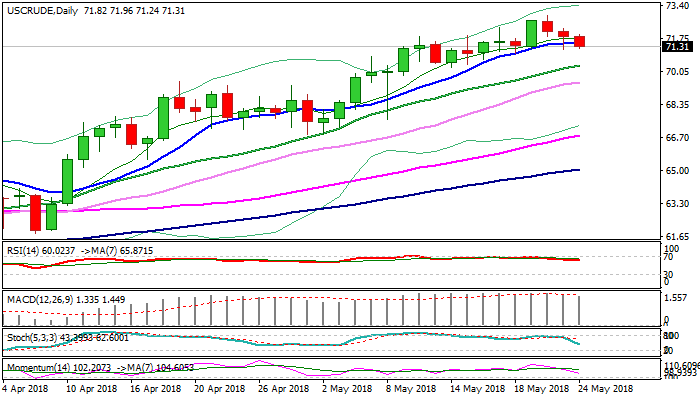

WTI oil remains in red for the third straight day and pressures Wednesday’s spike low at $71.18.

Concerns over strong rise in weekly oil inventories (US crude stocks rose 5.77 million barrels vs forecasted draw of 1.56 million barrels) and US production holding at all-time high, weigh on oil prices, helped by weaker dollar.

Pullback from new multi-year recovery high at $72.89 penetrated thick 4-hr cloud (spanned between $71.37 and $69.95) could extend towards strong supports at $70.61 (Fibo 38.2% of $66.91/$72.89) and 70.37$ (rising 20SMA).

Break below 10SMA ($71.50) was initial bearish signal, with further easing supported by south-heading 14-d momentum and slow stochastic).

Res: 71.37; 71.50; 71.96; 72.24

Sup: 71.18; 70.98; 70.61; 70.37

Interested in OIL technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.